- United Kingdom

- /

- Diversified Financial

- /

- AIM:BUR

3 UK Stocks Estimated To Trade At Discounts Of Up To 40.8%

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and broader global economic concerns. In this environment, investors may seek opportunities in undervalued stocks that could potentially offer value despite current market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gooch & Housego (AIM:GHH) | £3.90 | £7.28 | 46.4% |

| Applied Nutrition (LSE:APN) | £1.08 | £2.00 | 45.9% |

| Trainline (LSE:TRN) | £2.644 | £5.24 | 49.6% |

| Franchise Brands (AIM:FRAN) | £1.325 | £2.47 | 46.4% |

| Deliveroo (LSE:ROO) | £1.202 | £2.25 | 46.5% |

| Vanquis Banking Group (LSE:VANQ) | £0.551 | £1.02 | 45.8% |

| Kromek Group (AIM:KMK) | £0.051 | £0.10 | 49.6% |

| CVS Group (AIM:CVSG) | £9.36 | £18.35 | 49% |

| Fintel (AIM:FNTL) | £2.17 | £4.24 | 48.8% |

| Optima Health (AIM:OPT) | £1.66 | £3.08 | 46% |

Let's uncover some gems from our specialized screener.

Burford Capital (AIM:BUR)

Overview: Burford Capital Limited offers legal finance products and services globally, with a market cap of approximately £1.99 billion.

Operations: Burford Capital's revenue segments include Principal Finance generating $24.58 million and Asset Management and Other Services contributing $47.68 million.

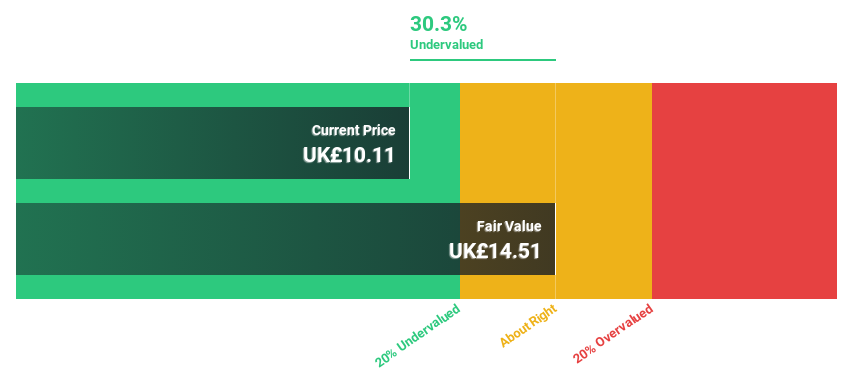

Estimated Discount To Fair Value: 40.8%

Burford Capital is trading at £9.08, significantly below its estimated fair value of £15.35, suggesting it may be undervalued based on cash flows. Despite a challenging year with revenue falling to $546.09 million and net income dropping to $146.48 million, earnings are forecasted to grow 32% annually, outpacing the UK market's growth rate of 14%. However, profit margins remain negative and return on equity is expected to be modest at 8.1%.

- According our earnings growth report, there's an indication that Burford Capital might be ready to expand.

- Dive into the specifics of Burford Capital here with our thorough financial health report.

Entain (LSE:ENT)

Overview: Entain Plc operates as a sports-betting and gaming company with a market cap of £3.30 billion.

Operations: The company's revenue is segmented into CEE (£488 million), UK&I (£2.05 billion), and International (£2.57 billion).

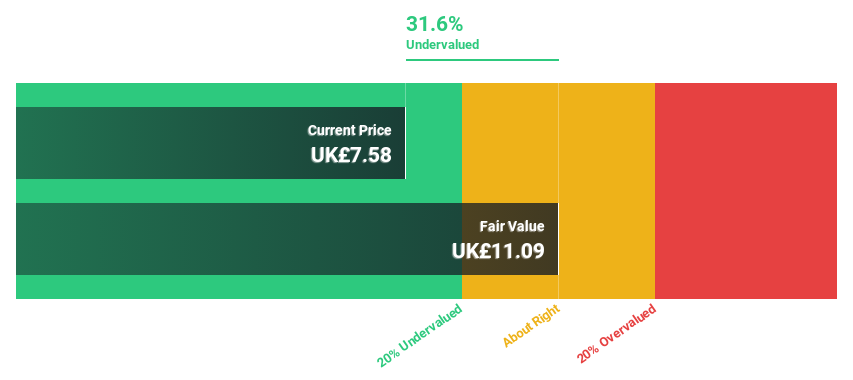

Estimated Discount To Fair Value: 32.1%

Entain is trading at £5.16, below its estimated fair value of £7.61, indicating potential undervaluation based on cash flows. Despite reporting a net loss of £452.7 million for 2024, the company's earnings are expected to grow significantly by 101.76% annually over the next three years, surpassing market averages and leading to profitability. However, recent leadership changes may introduce some uncertainty in strategic direction and governance stability moving forward.

- Insights from our recent growth report point to a promising forecast for Entain's business outlook.

- Unlock comprehensive insights into our analysis of Entain stock in this financial health report.

Mondi (LSE:MNDI)

Overview: Mondi plc, with a market cap of £4.49 billion, operates globally in the manufacture and sale of packaging and paper solutions across Africa, Western Europe, Emerging Europe, Russia, North America, South America, Asia, and Australia.

Operations: The company's revenue segments include Flexible Packaging (€3.96 billion), Uncoated Fine Paper (€1.32 billion), and Corrugated Packaging (€2.25 billion).

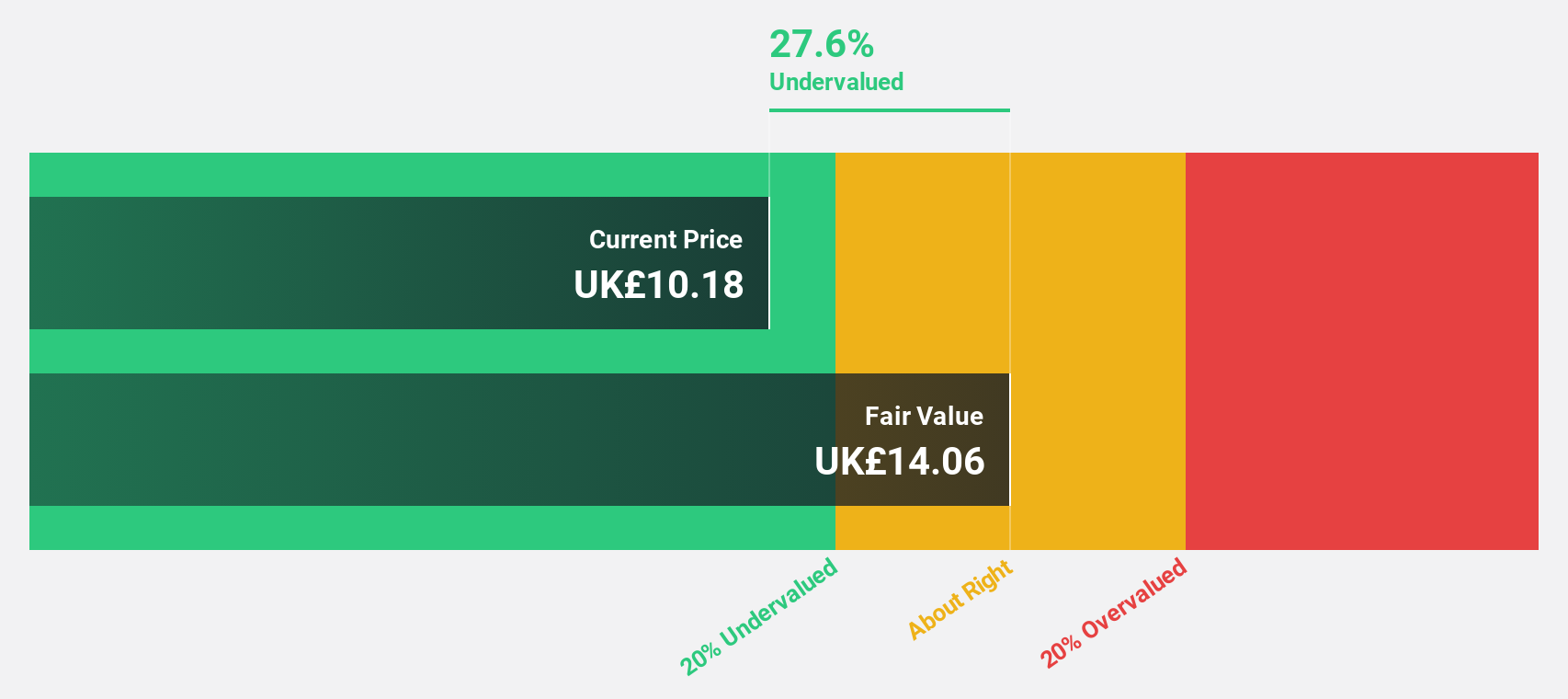

Estimated Discount To Fair Value: 11.8%

Mondi is trading at £10.19, slightly below its estimated fair value of £11.55, reflecting potential undervaluation based on cash flows. The company reported a net income of €218 million for 2024, recovering from a previous loss. Despite lower profit margins this year, earnings are forecast to grow significantly by 34.72% annually over the next three years, outpacing the UK market growth rate of 14%. However, its dividend sustainability remains questionable due to insufficient coverage by earnings or free cash flows.

- The growth report we've compiled suggests that Mondi's future prospects could be on the up.

- Take a closer look at Mondi's balance sheet health here in our report.

Make It Happen

- Click this link to deep-dive into the 55 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burford Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BUR

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives