- United Kingdom

- /

- Building

- /

- AIM:ALU

3 UK Dividend Stocks To Consider With Up To 5.1% Yield

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such uncertain times, dividend stocks can offer a degree of stability and income potential, making them an attractive option for investors seeking to navigate these turbulent market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.26% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 8.11% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.22% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.70% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.20% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.38% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.85% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.07% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.76% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Alumasc Group (AIM:ALU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc, with a market cap of £112.02 million, manufactures and sells building products, systems, and solutions across the United Kingdom, Europe, North America, the Middle East, the Far East, and internationally.

Operations: The Alumasc Group plc generates its revenue through three primary segments: Water Management (£48.32 million), Building Envelope (£37.60 million), and Housebuilding Products (£14.81 million).

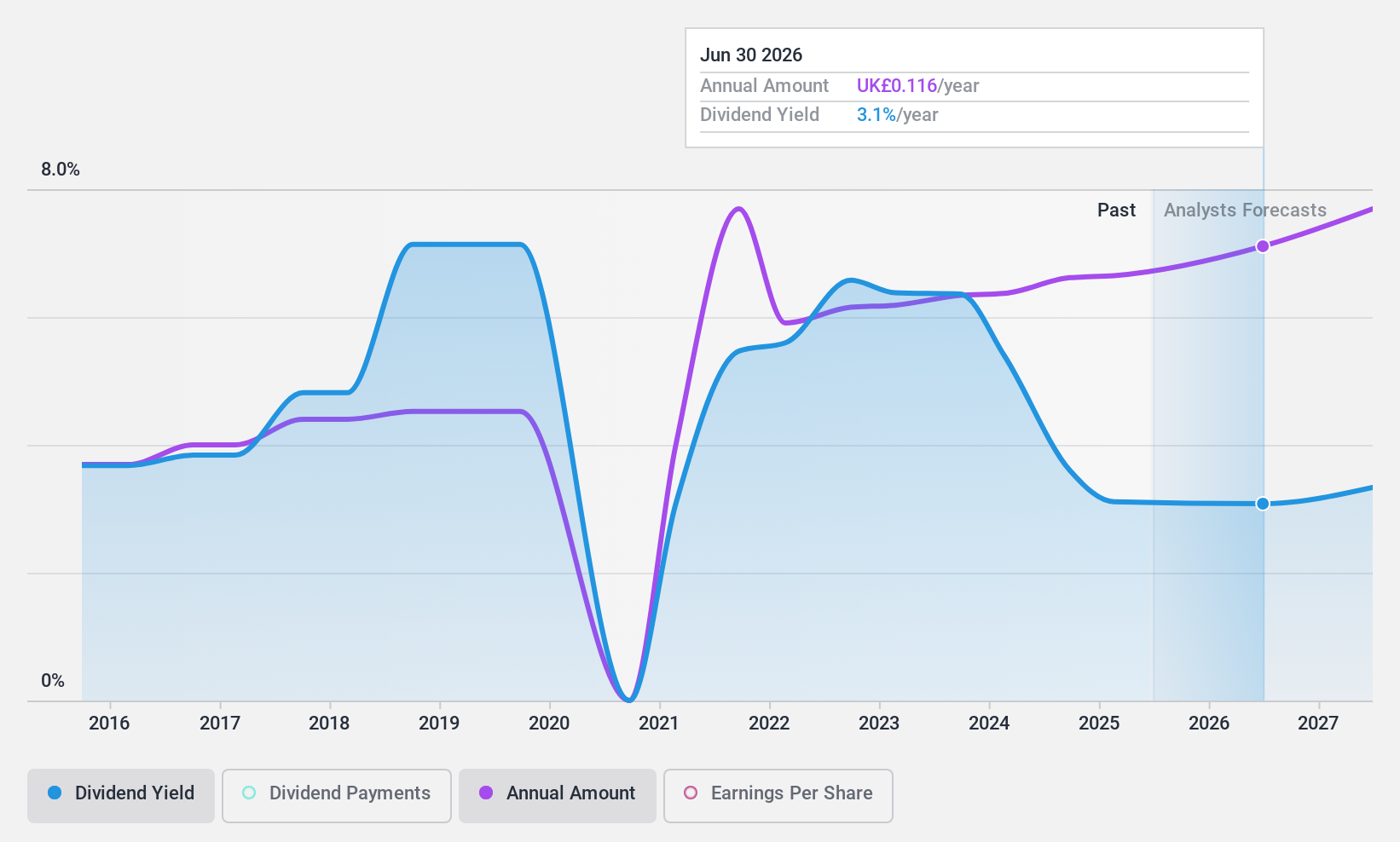

Dividend Yield: 3.5%

Alumasc Group has recently increased its dividend to 7.3 pence per share, reflecting a commitment to shareholder returns. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 44.2% and 36.9%, respectively, indicating sustainability despite a historically volatile dividend track record over the past decade. Trading at a significant discount to estimated fair value, Alumasc offers potential value for investors seeking income amidst its strategic management changes aimed at enhancing operational performance.

- Dive into the specifics of Alumasc Group here with our thorough dividend report.

- Our valuation report unveils the possibility Alumasc Group's shares may be trading at a discount.

Brooks Macdonald Group (AIM:BRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brooks Macdonald Group plc offers investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees in the UK and Channel Islands, with a market cap of £273.46 million.

Operations: Brooks Macdonald Group's revenue is primarily derived from its UK Investment Management segment, which includes financial planning and accounts for £113.71 million, complemented by its International segment generating £19.91 million.

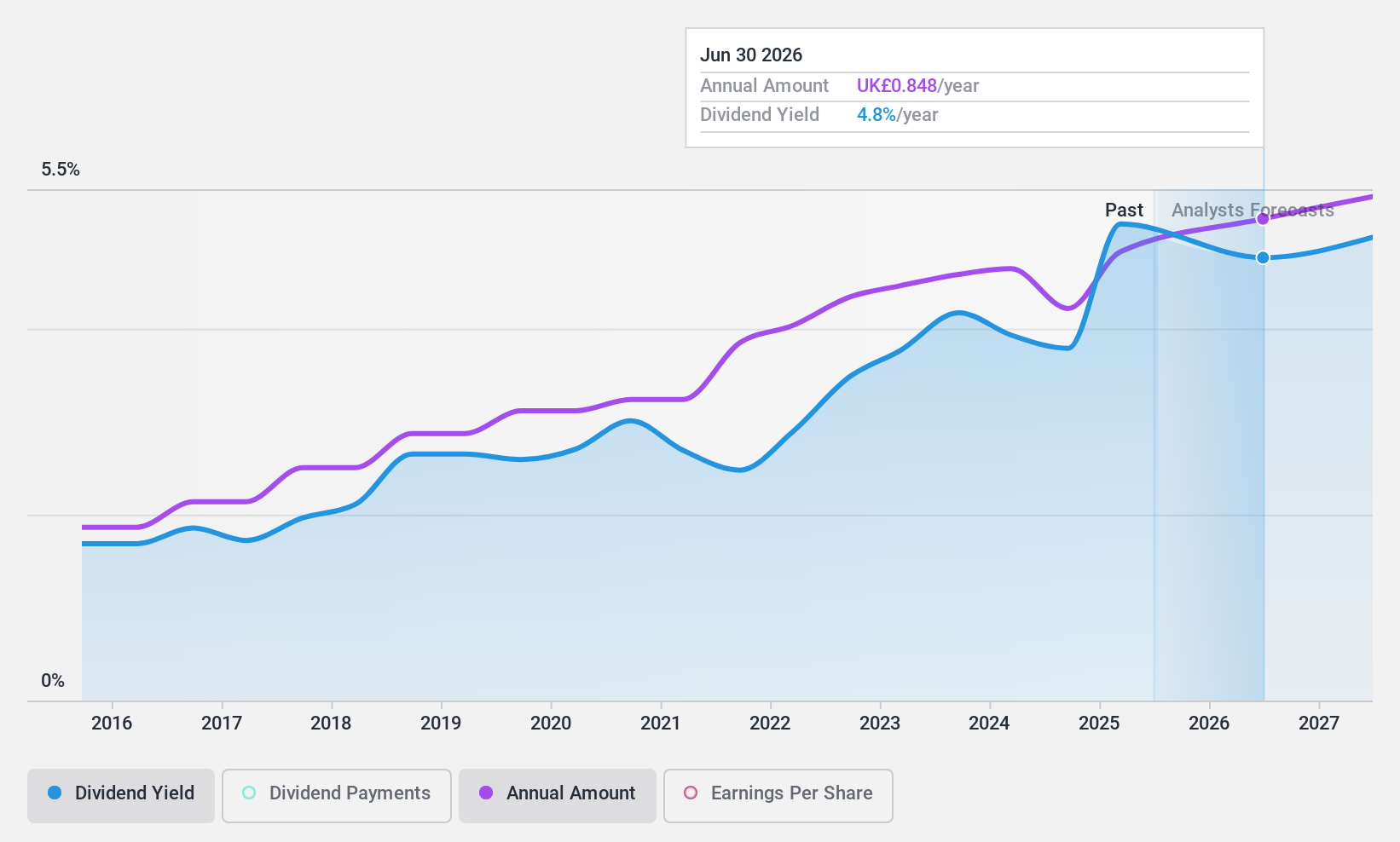

Dividend Yield: 4.6%

Brooks Macdonald Group has increased its total annual dividend to 78 pence, a 4% rise from the previous year, signaling confidence despite financial challenges. However, with a high payout ratio of 194.5%, dividends are not well covered by earnings, though cash flows sufficiently cover them with a cash payout ratio of 35.8%. Recent executive changes include Katherine Jones as CFO and Director, potentially impacting future financial strategies and dividend sustainability.

- Get an in-depth perspective on Brooks Macdonald Group's performance by reading our dividend report here.

- Our expertly prepared valuation report Brooks Macdonald Group implies its share price may be too high.

Lloyds Banking Group (LSE:LLOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lloyds Banking Group plc, along with its subsidiaries, offers a variety of banking and financial services both in the United Kingdom and internationally, with a market cap of £34.19 billion.

Operations: Lloyds Banking Group plc generates revenue through its diverse portfolio of banking and financial services provided in the UK and abroad.

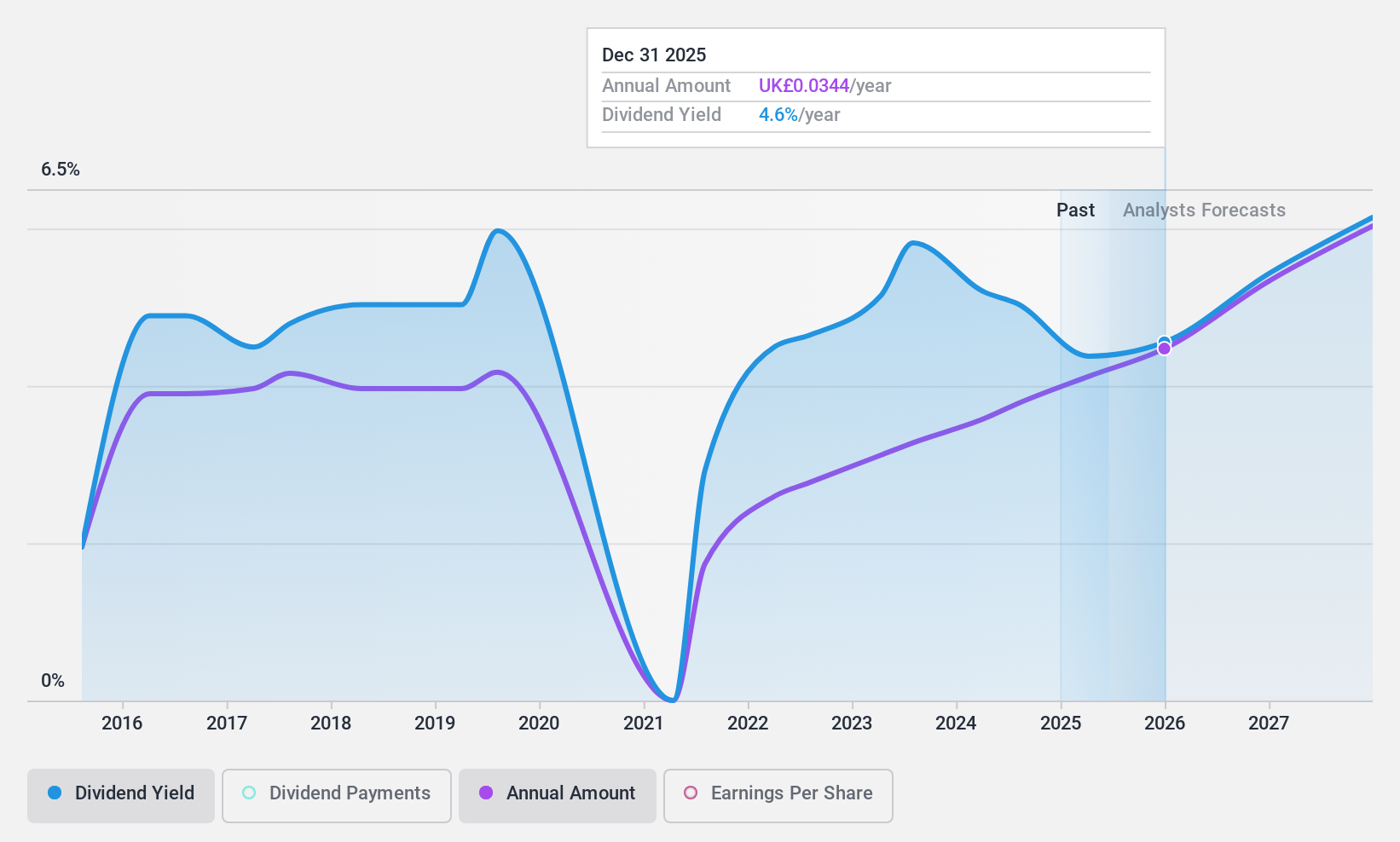

Dividend Yield: 5.1%

Lloyds Banking Group's dividend payments are well covered by earnings with a payout ratio of 41.5%, though their dividend track record has been unstable over the past decade. Recent share buybacks, totaling £1.52 billion, indicate a focus on shareholder returns despite net income slightly declining to £3.73 billion for the nine months ending September 2024. The group is trading significantly below its estimated fair value, suggesting potential undervaluation in the market context.

- Take a closer look at Lloyds Banking Group's potential here in our dividend report.

- Our valuation report unveils the possibility Lloyds Banking Group's shares may be trading at a premium.

Where To Now?

- Embark on your investment journey to our 64 Top UK Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALU

Alumasc Group

Manufactures and sells building products, systems, and solutions in the United Kingdom, Europe, North America, the Middle East, the Far East, and internationally.

Flawless balance sheet, undervalued and pays a dividend.