- United Kingdom

- /

- Capital Markets

- /

- AIM:AGFX

Do Argentex Group's (LON:AGFX) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Argentex Group (LON:AGFX), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Argentex Group

Argentex Group's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. Argentex Group's EPS shot up from UK£0.057 to UK£0.081; a result that's bound to keep shareholders happy. That's a impressive gain of 42%.

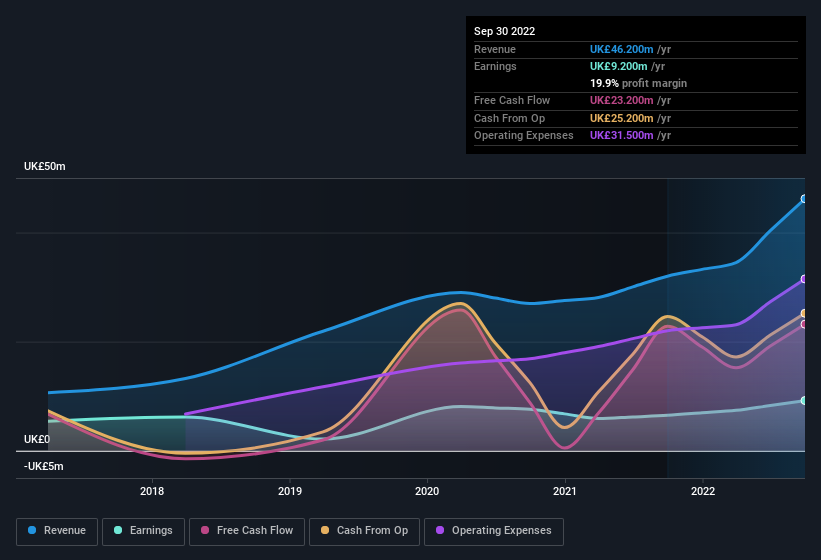

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Argentex Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 44% to UK£46m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Argentex Group?

Are Argentex Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Argentex Group shareholders is that no insiders reported selling shares in the last year. Add in the fact that Nigel Railton, the Independent Non-Executive Director of the company, paid UK£30k for shares at around UK£1.04 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Argentex Group.

The good news, alongside the insider buying, for Argentex Group bulls is that insiders (collectively) have a meaningful investment in the stock. Holding UK£50m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. Amounting to 34% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

Should You Add Argentex Group To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Argentex Group's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. These things considered, this is one stock worth watching. What about risks? Every company has them, and we've spotted 1 warning sign for Argentex Group you should know about.

The good news is that Argentex Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AGFX

Argentex Group

Provides currency risk management, payment, and alternative banking solutions in the United Kingdom, the Netherlands, the United Arab Emirates, and Australia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives