- United Kingdom

- /

- Hospitality

- /

- LSE:SSPG

SSP Group (LON:SSPG shareholders incur further losses as stock declines 7.8% this week, taking five-year losses to 14%

While not a mind-blowing move, it is good to see that the SSP Group plc (LON:SSPG) share price has gained 23% in the last three months. But over the last half decade, the stock has not performed well. After all, the share price is down 32% in that time, significantly under-performing the market.

With the stock having lost 7.8% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Because SSP Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, SSP Group saw its revenue increase by 23% per year. That's better than most loss-making companies. Shareholders are no doubt disappointed with the loss of 6%, each year, in that time. You could say that the market has been harsh, given the top line growth. If that's the case, now might be the smart time to take a close look at it.

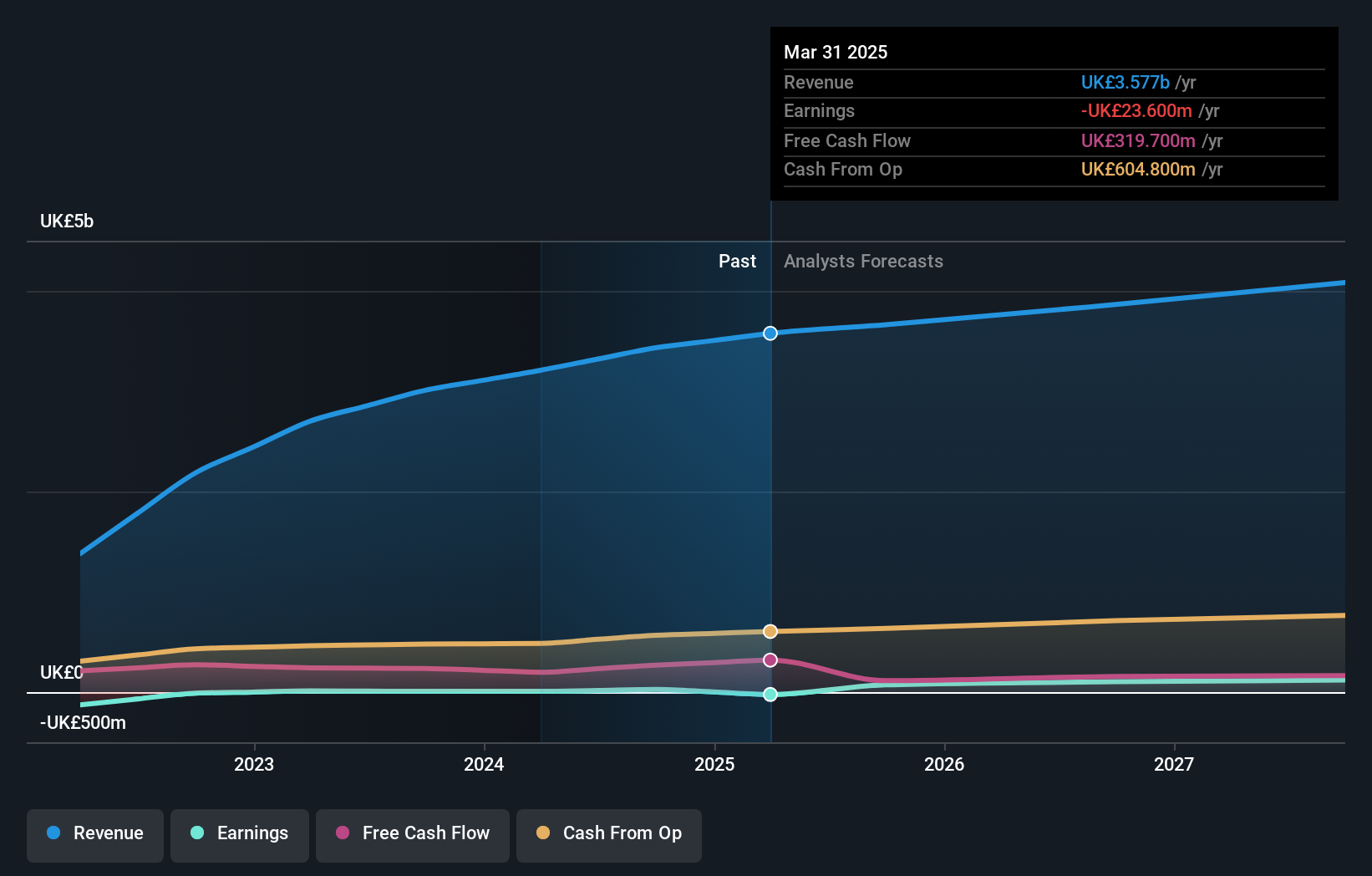

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SSP Group is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling SSP Group stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of SSP Group, it has a TSR of -14% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

SSP Group shareholders are down 1.5% for the year (even including dividends), but the market itself is up 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 3% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand SSP Group better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with SSP Group .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SSPG

SSP Group

Operates food and beverage outlets in North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives