- United Kingdom

- /

- Hospitality

- /

- LSE:ROO

UK's June 2025 Stocks That May Be Trading Below Fair Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both closing lower amid concerns over weak trade data from China and its impact on global economic recovery. In this environment, identifying stocks that may be trading below their fair value can offer potential opportunities for investors seeking to navigate these uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.482 | £11.90 | 45.5% |

| Van Elle Holdings (AIM:VANL) | £0.385 | £0.69 | 44.1% |

| LSL Property Services (LSE:LSL) | £3.01 | £5.65 | 46.7% |

| Jubilee Metals Group (AIM:JLP) | £0.0355 | £0.066 | 46.3% |

| Informa (LSE:INF) | £7.91 | £14.56 | 45.7% |

| Huddled Group (AIM:HUD) | £0.0335 | £0.06 | 44% |

| Greatland Gold (AIM:GGP) | £0.164 | £0.30 | 45.4% |

| Gooch & Housego (AIM:GHH) | £5.88 | £10.56 | 44.3% |

| Duke Capital (AIM:DUKE) | £0.285 | £0.53 | 46.4% |

| Deliveroo (LSE:ROO) | £1.756 | £3.09 | 43.1% |

Here we highlight a subset of our preferred stocks from the screener.

AO World (LSE:AO.)

Overview: AO World plc, along with its subsidiaries, operates as an online retailer specializing in domestic appliances and ancillary services in the United Kingdom and Germany, with a market capitalization of approximately £561.36 million.

Operations: AO World plc generates revenue through its online retail operations, focusing on domestic appliances and ancillary services across the UK and Germany.

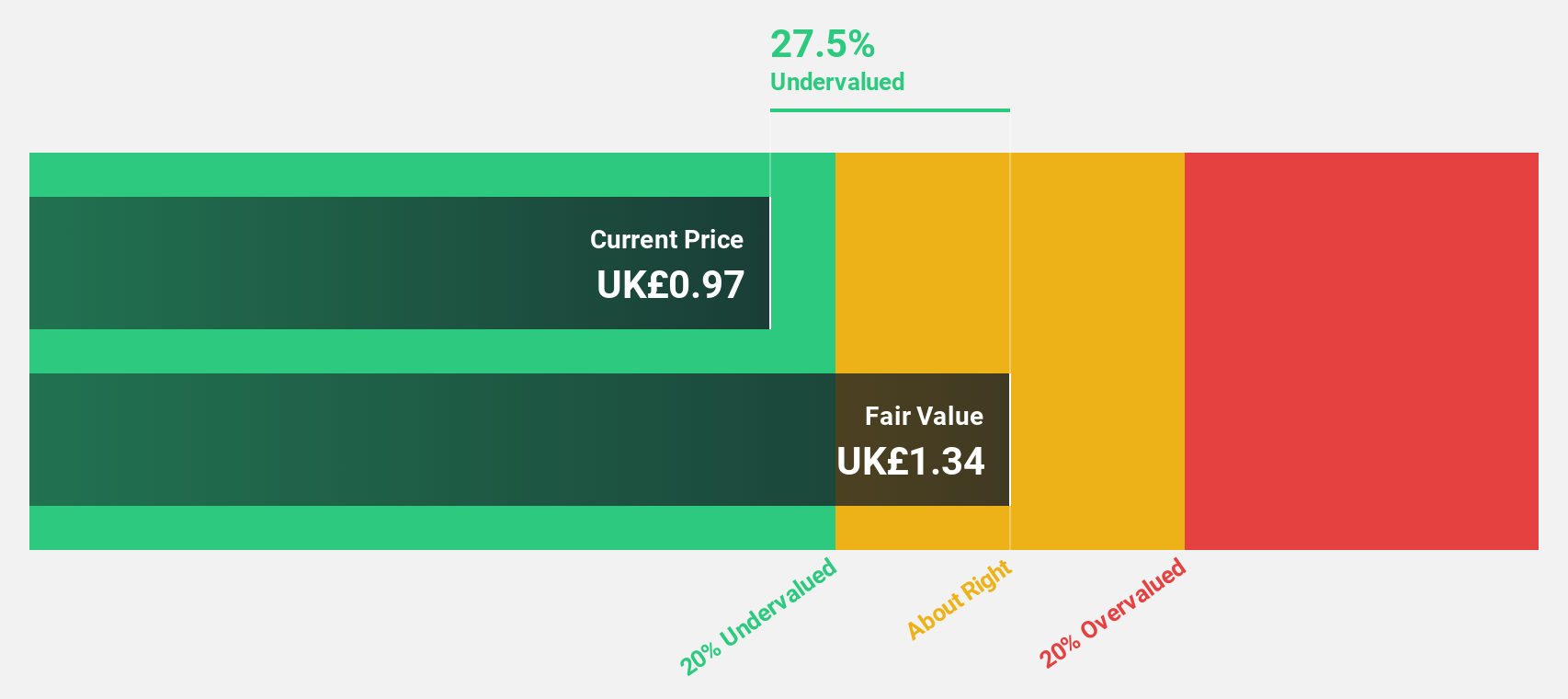

Estimated Discount To Fair Value: 27.5%

AO World is trading at £0.97, 27.5% below its estimated fair value of £1.34, suggesting it may be undervalued based on cash flows. Despite a drop in net income to £10.5 million from £24.7 million, earnings are forecast to grow significantly at 39.1% annually over the next three years, outpacing the UK market's growth rate of 14.5%. However, profit margins have declined and there has been significant insider selling recently.

- Our growth report here indicates AO World may be poised for an improving outlook.

- Get an in-depth perspective on AO World's balance sheet by reading our health report here.

Phoenix Group Holdings (LSE:PHNX)

Overview: Phoenix Group Holdings plc operates in the long-term savings and retirement sector across Europe, with a market capitalization of approximately £6.60 billion.

Operations: The company generates revenue through its segments, including Retirement Solutions at £4.46 billion and Pensions & Savings at -£562 million, while the Europe and Other segment contributes -£785 million and With-profits accounts for -£711 million.

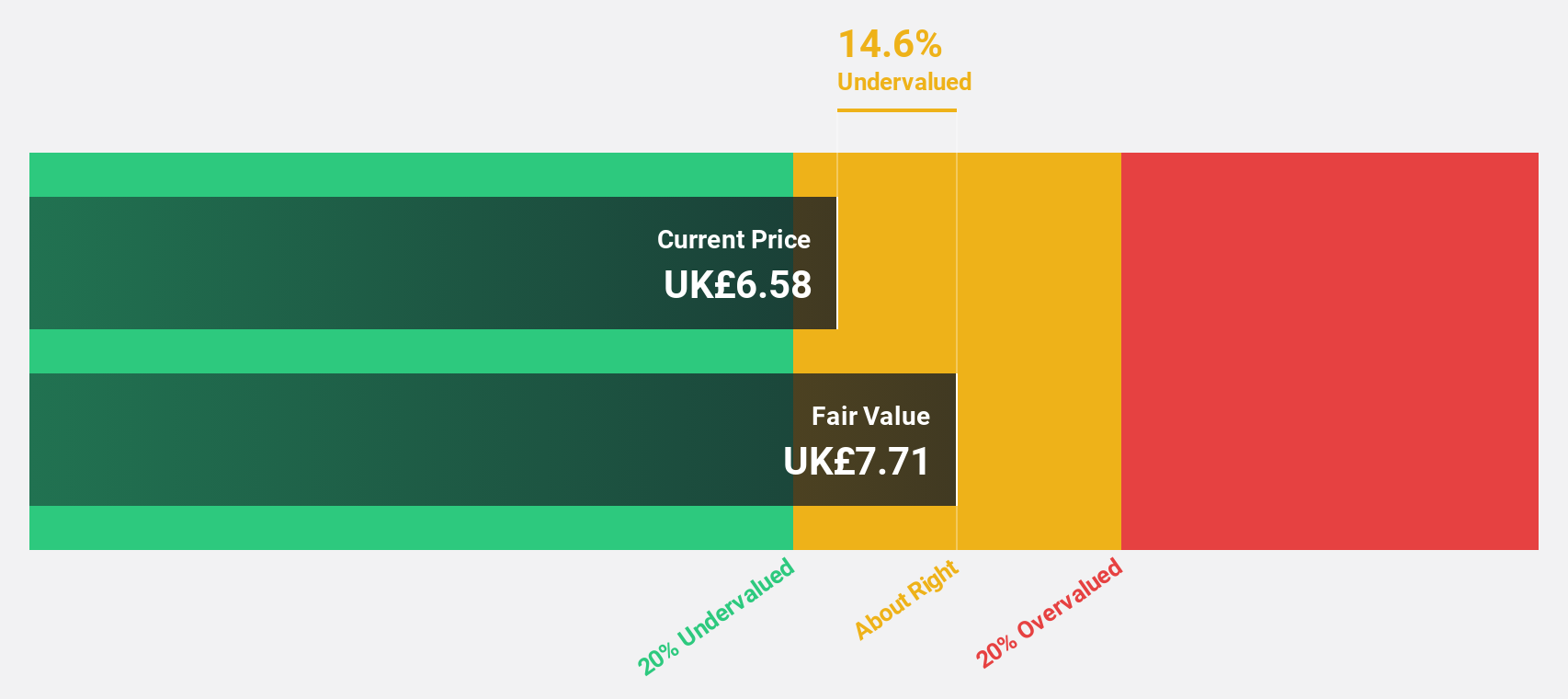

Estimated Discount To Fair Value: 14.4%

Phoenix Group Holdings is trading at £6.62, below its estimated fair value of £7.72, highlighting potential undervaluation based on cash flows. Despite a forecasted revenue decline of 23.9% annually over the next three years, earnings are expected to grow significantly at 95.09% per year, surpassing market averages. The dividend yield stands at 8.27%, though it's not well covered by earnings, and return on equity is projected to be very high at 71.7% in three years' time.

- The growth report we've compiled suggests that Phoenix Group Holdings' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Phoenix Group Holdings.

Deliveroo (LSE:ROO)

Overview: Deliveroo plc operates an online food delivery platform across several countries including the United Kingdom, Ireland, and France, with a market cap of £2.55 billion.

Operations: The company's revenue is primarily derived from the operation of its on-demand food delivery platform, amounting to £2.07 billion.

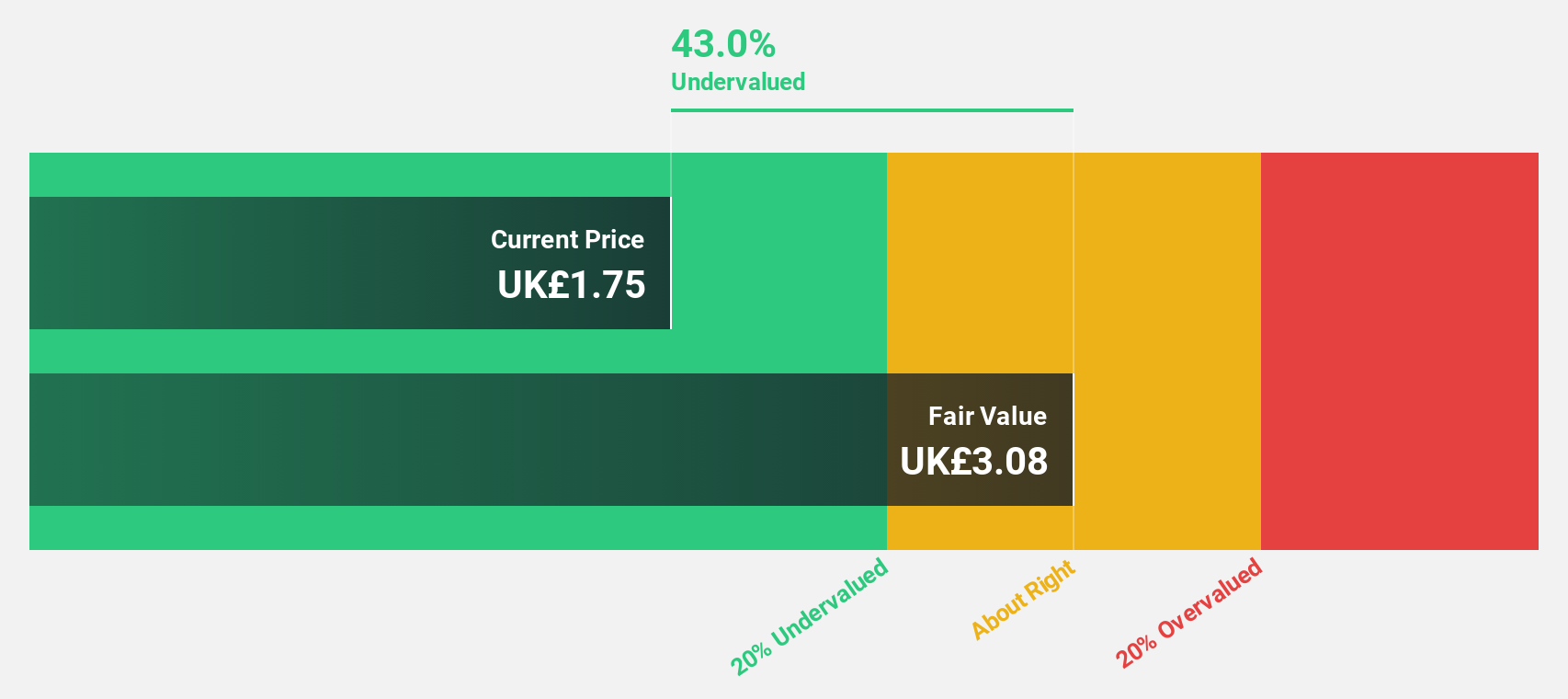

Estimated Discount To Fair Value: 43.1%

Deliveroo is trading at £1.76, significantly below its estimated fair value of £3.09, suggesting potential undervaluation based on cash flows. The company is forecasted to achieve profitability within three years, with earnings expected to grow 67.37% annually and revenue projected to increase by 8.5% per year, outpacing the UK market average of 3.6%. Recent developments include DoorDash's proposed acquisition valued at approximately £2.7 billion, which could impact future valuations and shareholder decisions.

- The analysis detailed in our Deliveroo growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Deliveroo's balance sheet health report.

Seize The Opportunity

- Navigate through the entire inventory of 59 Undervalued UK Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ROO

Deliveroo

A holding company, operates an online on-demand food and non-food delivery platform in the United Kingdom, Ireland, France, Italy, Belgium, Hong Kong, Singapore, the United Arab Emirates, Kuwait, and Qatar.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives