- United Kingdom

- /

- Hospitality

- /

- LSE:RNK

Investors Appear Satisfied With The Rank Group Plc's (LON:RNK) Prospects As Shares Rocket 27%

The Rank Group Plc (LON:RNK) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

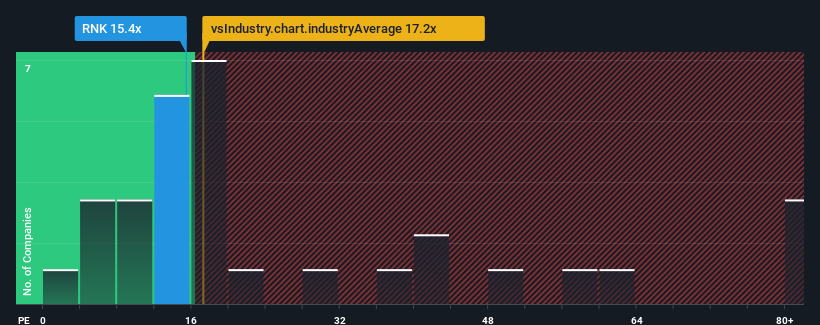

Although its price has surged higher, there still wouldn't be many who think Rank Group's price-to-earnings (or "P/E") ratio of 15.4x is worth a mention when the median P/E in the United Kingdom is similar at about 16x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We check all companies for important risks. See what we found for Rank Group in our free report.Rank Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Rank Group

What Are Growth Metrics Telling Us About The P/E?

Rank Group's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 109%. Still, incredibly EPS has fallen 3.6% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 15% per year during the coming three years according to the four analysts following the company. With the market predicted to deliver 15% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Rank Group's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Rank Group's P/E?

Rank Group appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Rank Group maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Rank Group with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RNK

Rank Group

Engages in provision of gaming services in the United Kingdom, Europe, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives