- United Kingdom

- /

- Hospitality

- /

- LSE:PTEC

3 UK Stocks That May Be Undervalued In October 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces challenges amid weak trade data from China, investors are closely watching for opportunities in a market influenced by global economic shifts. In such an environment, identifying potentially undervalued stocks can be crucial for those looking to capitalize on discrepancies between a company's intrinsic value and its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.374 | £12.23 | 47.9% |

| On the Beach Group (LSE:OTB) | £2.225 | £4.40 | 49.5% |

| Norcros (LSE:NXR) | £2.90 | £5.50 | 47.3% |

| Fintel (AIM:FNTL) | £2.18 | £3.85 | 43.4% |

| Fevertree Drinks (AIM:FEVR) | £8.71 | £15.72 | 44.6% |

| Essentra (LSE:ESNT) | £1.086 | £1.99 | 45.3% |

| DFS Furniture (LSE:DFS) | £1.56 | £2.78 | 43.9% |

| Begbies Traynor Group (AIM:BEG) | £1.115 | £2.23 | 50% |

| AstraZeneca (LSE:AZN) | £125.58 | £238.80 | 47.4% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.245 | £4.37 | 48.7% |

Let's dive into some prime choices out of the screener.

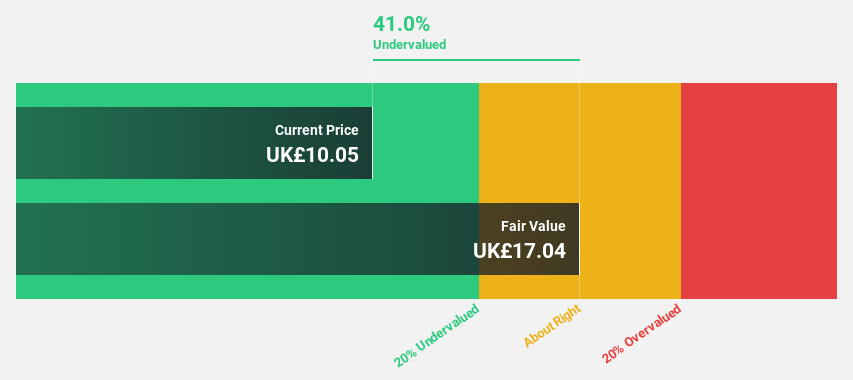

Nichols (AIM:NICL)

Overview: Nichols plc, with a market cap of £396.78 million, supplies soft drinks to the retail, wholesale, catering, licensed, and leisure industries across the United Kingdom, the Middle East, Africa, and internationally.

Operations: The company's revenue is derived from two main segments: Packaged, contributing £133.97 million, and Out of Home, generating £40.35 million.

Estimated Discount To Fair Value: 41.9%

Nichols PLC is trading at a significant discount, 41.9% below estimated fair value and more than 20% undervalued based on discounted cash flow analysis. Despite a slight dip in recent earnings, the company forecasts robust annual profit growth of 16.4%, outpacing the UK market average. Analysts predict a potential stock price increase of 34.8%. However, Nichols has an unstable dividend track record and recent executive changes could impact future performance stability.

- Our comprehensive growth report raises the possibility that Nichols is poised for substantial financial growth.

- Dive into the specifics of Nichols here with our thorough financial health report.

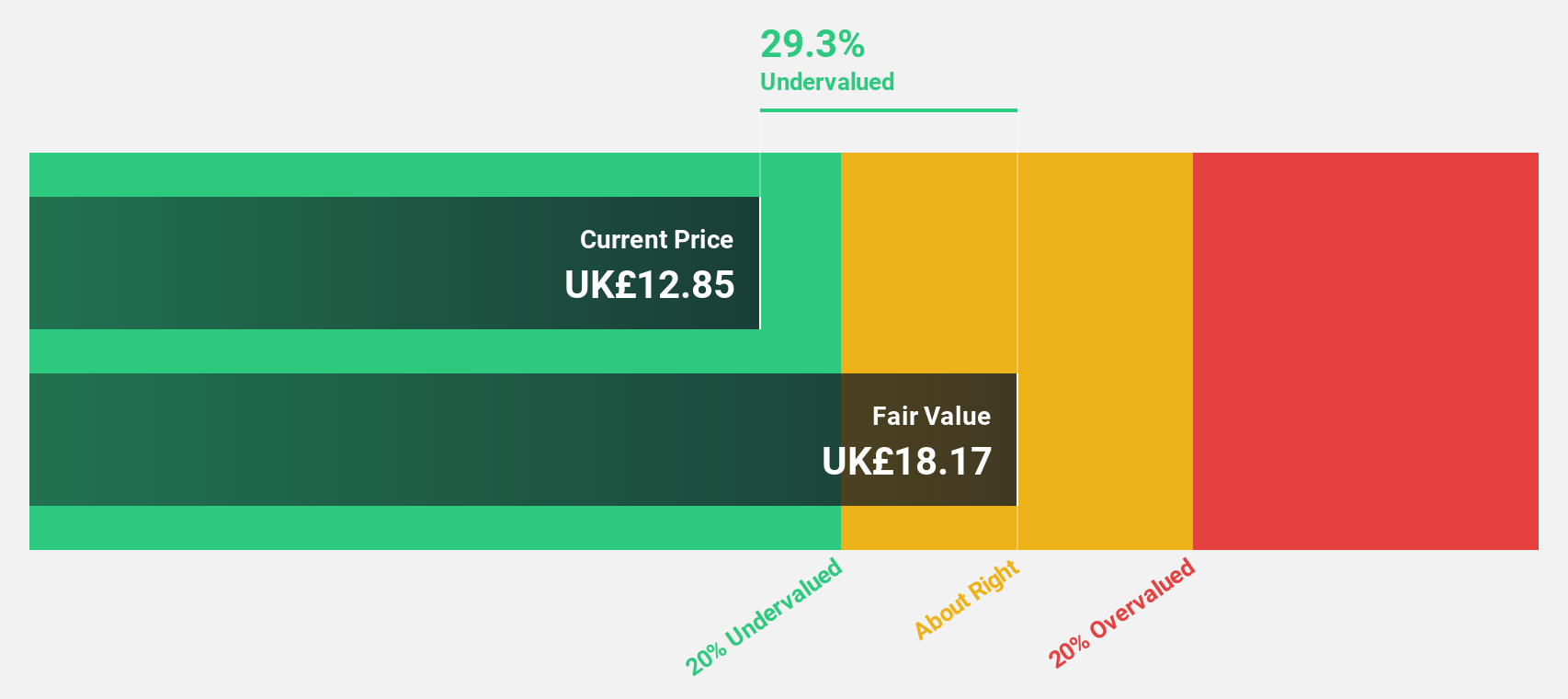

Burberry Group (LSE:BRBY)

Overview: Burberry Group plc, with a market cap of £4.37 billion, operates in the manufacturing, retail, and wholesale of luxury goods under the Burberry brand across regions including Asia Pacific, Europe, the Middle East, India, Africa, and the Americas.

Operations: The company's revenue is primarily derived from its Retail/Wholesale segment, which accounts for £2.40 billion, and its Licensing segment, contributing £67 million.

Estimated Discount To Fair Value: 42.4%

Burberry Group is trading at £12.15, significantly below its estimated fair value of £21.09, indicating it is over 20% undervalued based on discounted cash flow analysis. The company has been added to the FTSE 100 Index, reflecting its market significance. Despite a forecasted low return on equity of 17.4%, Burberry's earnings are expected to grow by nearly 50% annually, surpassing the UK market average and becoming profitable within three years.

- According our earnings growth report, there's an indication that Burberry Group might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Burberry Group.

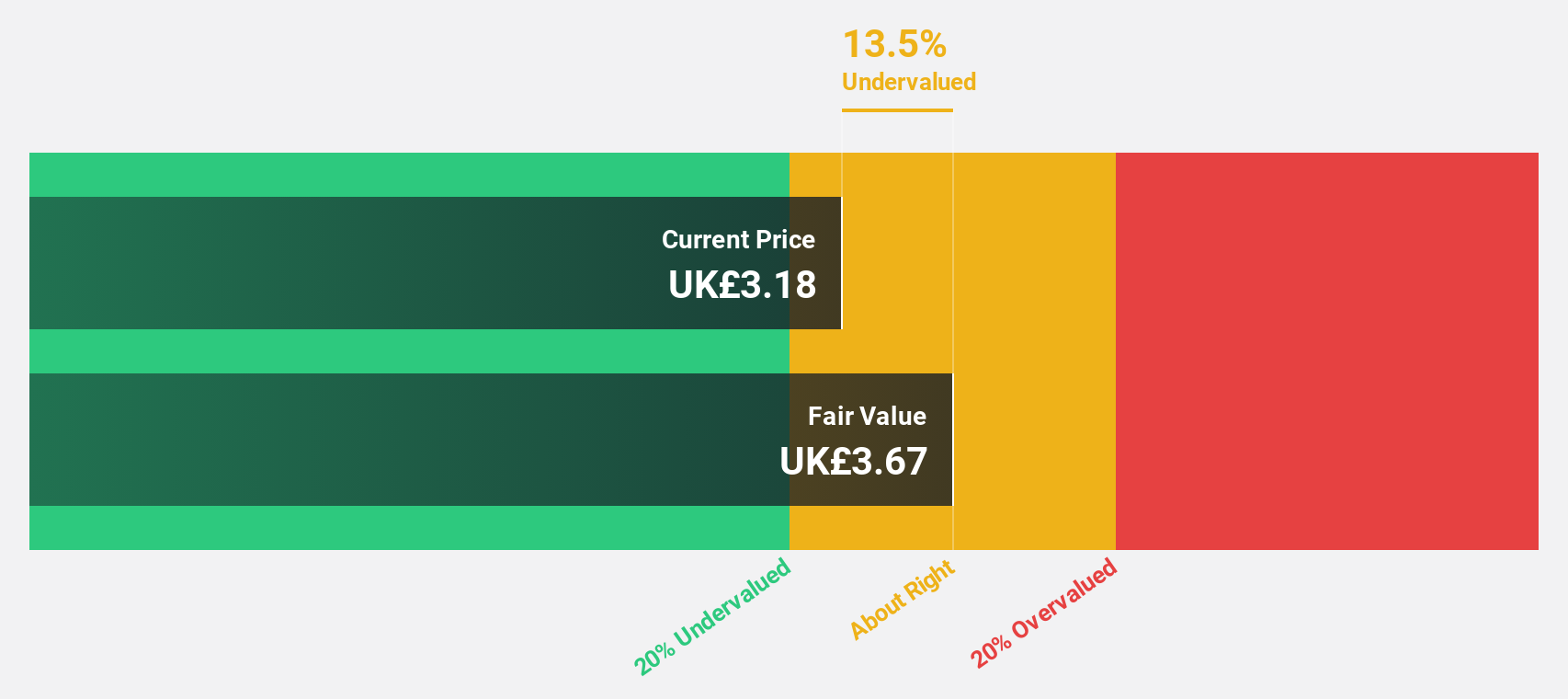

Playtech (LSE:PTEC)

Overview: Playtech plc is a technology company that provides gambling software, services, content, and platform technologies across various regions including Italy, Mexico, the UK, Europe, and Latin America with a market cap of £1.03 billion.

Operations: The company's revenue segments include B2B at €719.70 million, HAPPYBET at €17.10 million, and Sun Bingo and Other B2C at €72.20 million.

Estimated Discount To Fair Value: 15.6%

Playtech is trading at £3.36, below its estimated fair value of £3.98, suggesting it is undervalued on a cash flow basis. Forecasts indicate earnings growth of 62.56% annually with profitability expected in three years, outpacing the UK market average. Recent share buybacks totaling £43.7 million may enhance shareholder value while their disciplined M&A strategy targets accretive acquisitions to strengthen Playtech's B2B technology focus amidst evolving regulatory landscapes.

- The analysis detailed in our Playtech growth report hints at robust future financial performance.

- Navigate through the intricacies of Playtech with our comprehensive financial health report here.

Make It Happen

- Discover the full array of 50 Undervalued UK Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PTEC

Playtech

A technology company, operates as a gambling software, services, content, and platform technologies provider in Italy, Mexico, the United Kingdom, rest of Europe, Latin America, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives