- United Kingdom

- /

- Building

- /

- AIM:ALU

UK Dividend Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with challenges stemming from weak trade data out of China, investors are keenly observing how these global economic pressures might influence domestic markets. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.95% | ★★★★★☆ |

| RS Group (LSE:RS1) | 4.04% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.30% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.38% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.28% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.59% | ★★★★★★ |

| Macfarlane Group (LSE:MACF) | 5.75% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.36% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.87% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.76% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Alumasc Group (AIM:ALU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc manufactures and sells building products and solutions across various regions including the United Kingdom, Europe, North America, the Middle East, and the Far East, with a market cap of £101.59 million.

Operations: The Alumasc Group plc generates revenue from three main segments: Water Management (£55.52 million), Building Envelope (£41.81 million), and Housebuilding Products (£16.08 million).

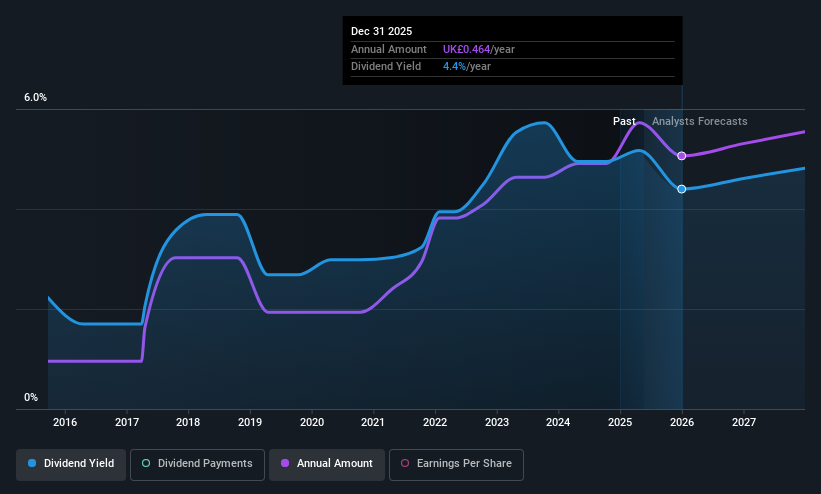

Dividend Yield: 3.9%

Alumasc Group's dividend payments have been volatile over the past decade, despite recent increases. With a payout ratio of 42.8%, dividends are well covered by earnings and cash flows, suggesting sustainability despite historical unreliability. Trading at 48% below estimated fair value, it presents good relative value compared to peers. Recent leadership changes may impact future strategy execution as CEO Paul Hooper retires in March 2026 after significant contributions to the company's growth trajectory.

- Delve into the full analysis dividend report here for a deeper understanding of Alumasc Group.

- Our valuation report here indicates Alumasc Group may be undervalued.

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC, with a market cap of £668.11 million, owns and develops oil palm plantations in Indonesia and Malaysia through its subsidiaries.

Operations: M.P. Evans Group PLC generates its revenue primarily from its plantation operations in Indonesia, amounting to $368.49 million.

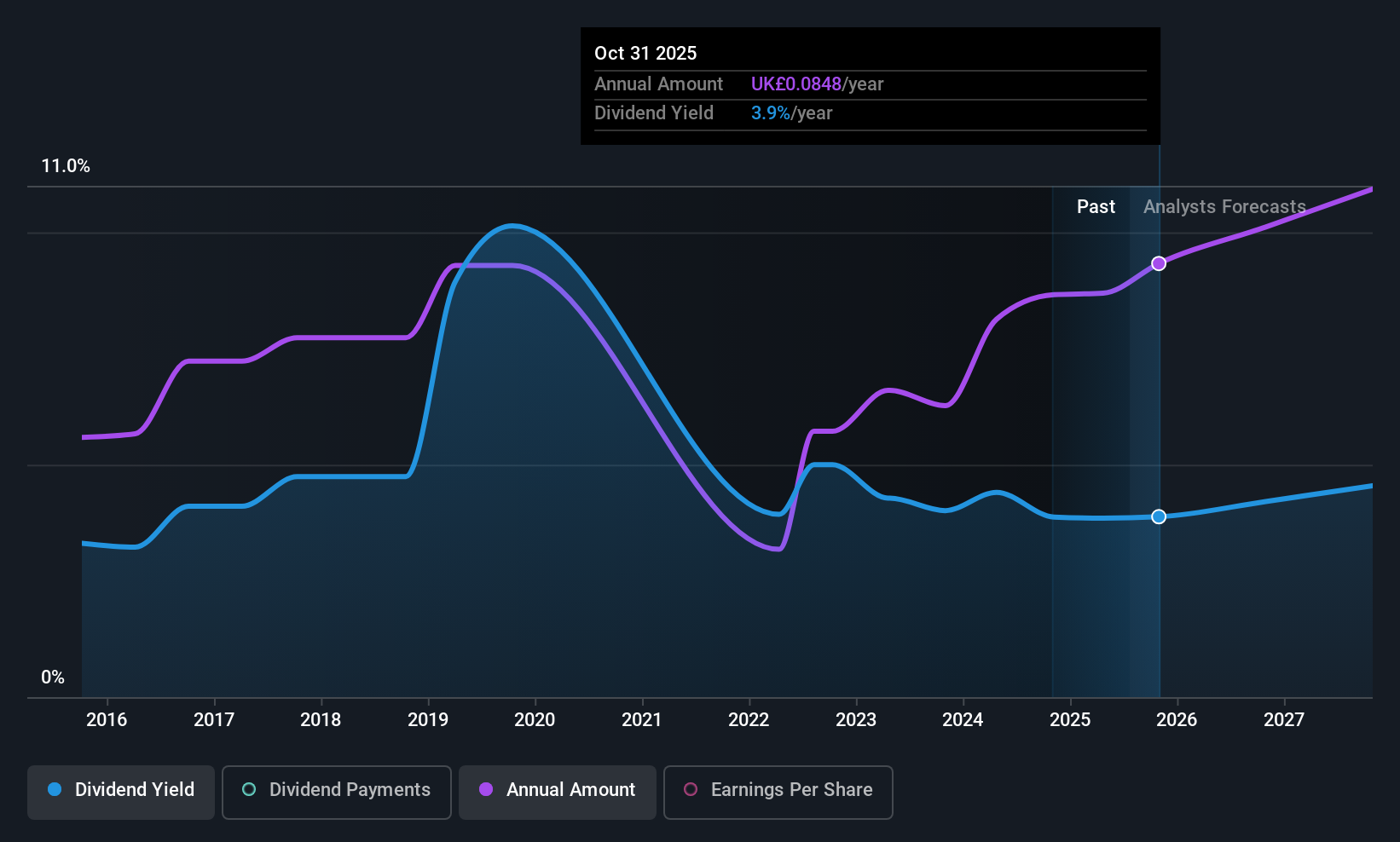

Dividend Yield: 4.3%

M.P. Evans Group's dividend payments have been volatile over the past decade but are well covered by earnings and cash flows, with payout ratios of 35.2% and 30.3%, respectively, indicating sustainability despite historical instability. Trading at a significant discount to estimated fair value, it offers good relative value in its sector. Recent financial results show strong performance with net income rising to US$48.65 million for H1 2025, supporting a recent interim dividend increase to £0.18 per share.

- Click here and access our complete dividend analysis report to understand the dynamics of M.P. Evans Group.

- Our expertly prepared valuation report M.P. Evans Group implies its share price may be lower than expected.

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a variety of instant-service equipment in the United Kingdom with a market cap of £567.34 million.

Operations: ME Group International plc generates revenue from its Personal Services segment, which amounts to £311.32 million.

Dividend Yield: 5.3%

ME Group International's dividend payments have been unreliable over the past decade, marked by volatility. However, they are covered by earnings and cash flows with payout ratios of 54.8% and 82.8%, respectively, suggesting a degree of sustainability despite historical instability. The company trades at a significant discount to its estimated fair value and expects revenue between £311 million and £318 million for FY2025, indicating potential financial stability amidst dividend challenges.

- Click to explore a detailed breakdown of our findings in ME Group International's dividend report.

- The valuation report we've compiled suggests that ME Group International's current price could be quite moderate.

Taking Advantage

- Click here to access our complete index of 53 Top UK Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALU

Alumasc Group

Manufactures and sells building products and solutions in the United Kingdom, Europe, North America, the Middle East, the Far East, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives