- United Kingdom

- /

- Hospitality

- /

- LSE:JDW

Here's Why J D Wetherspoon (LON:JDW) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like J D Wetherspoon (LON:JDW), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide J D Wetherspoon with the means to add long-term value to shareholders.

How Fast Is J D Wetherspoon Growing Its Earnings Per Share?

Over the last three years, J D Wetherspoon has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. J D Wetherspoon's EPS shot up from UK£0.41 to UK£0.62; a result that's bound to keep shareholders happy. That's a commendable gain of 53%.

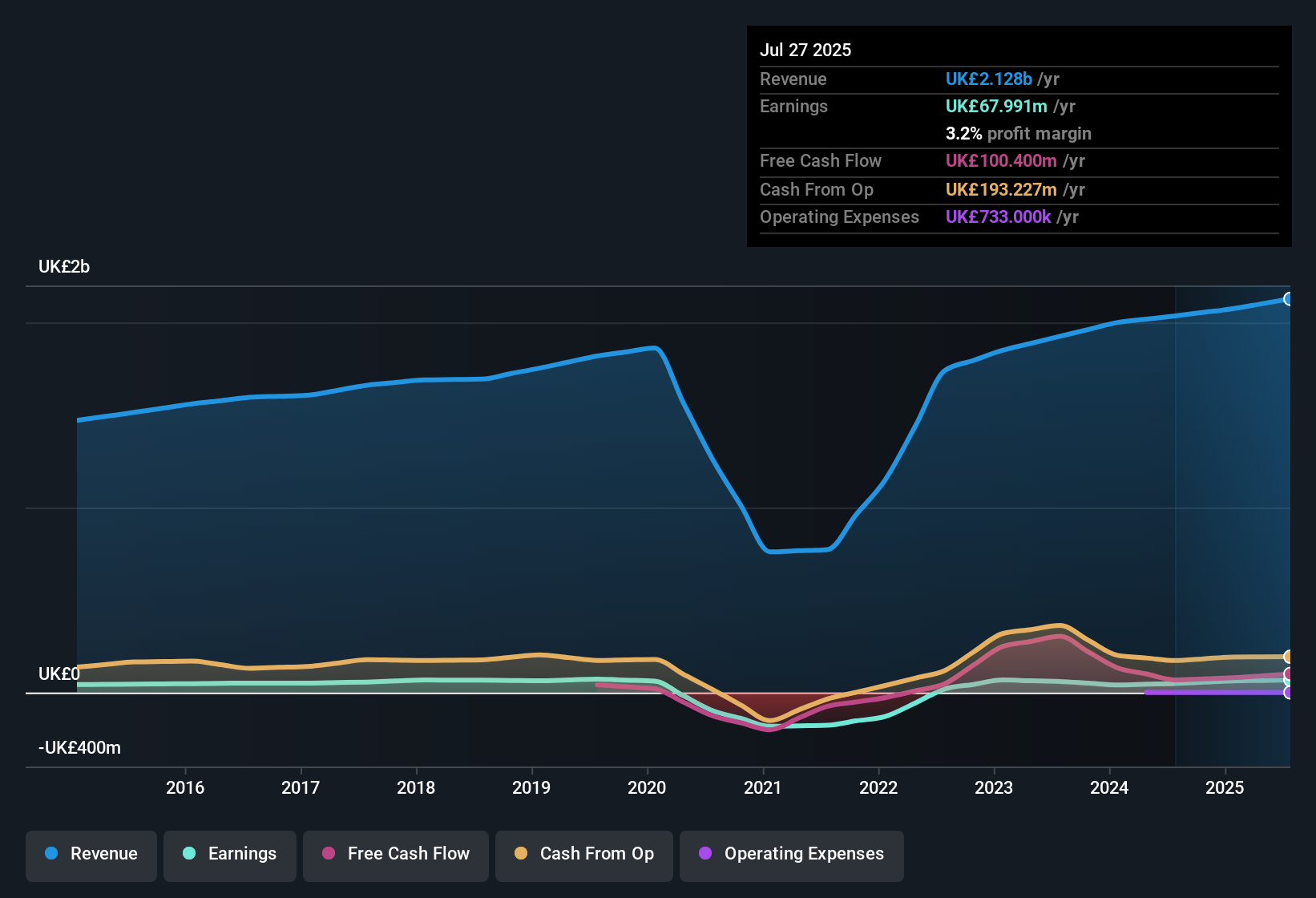

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. J D Wetherspoon maintained stable EBIT margins over the last year, all while growing revenue 4.5% to UK£2.1b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

View our latest analysis for J D Wetherspoon

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for J D Wetherspoon?

Are J D Wetherspoon Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at J D Wetherspoon were both selling and buying shares; but happily, as a group they spent UK£48k more on stock, than they netted from selling it. Shareholders who may have questioned insiders selling will find some reassurance in this fact.

The good news, alongside the insider buying, for J D Wetherspoon bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth UK£200m. This totals to 27% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Very encouraging.

Does J D Wetherspoon Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into J D Wetherspoon's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. Astute investors will want to keep this stock on watch. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with J D Wetherspoon , and understanding this should be part of your investment process.

Keen growth investors love to see insider activity. Thankfully, J D Wetherspoon isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:JDW

J D Wetherspoon

Owns and operates pubs and hotels in the United Kingdom and the Republic of Ireland.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success