- United Kingdom

- /

- Consumer Services

- /

- LSE:DTY

If You Had Bought Dignity (LON:DTY) Stock Three Years Ago, You'd Be Sitting On A 82% Loss, Today

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Dignity plc (LON:DTY); the share price is down a whopping 82% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And more recent buyers are having a tough time too, with a drop of 50% in the last year. The falls have accelerated recently, with the share price down 22% in the last three months.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Dignity

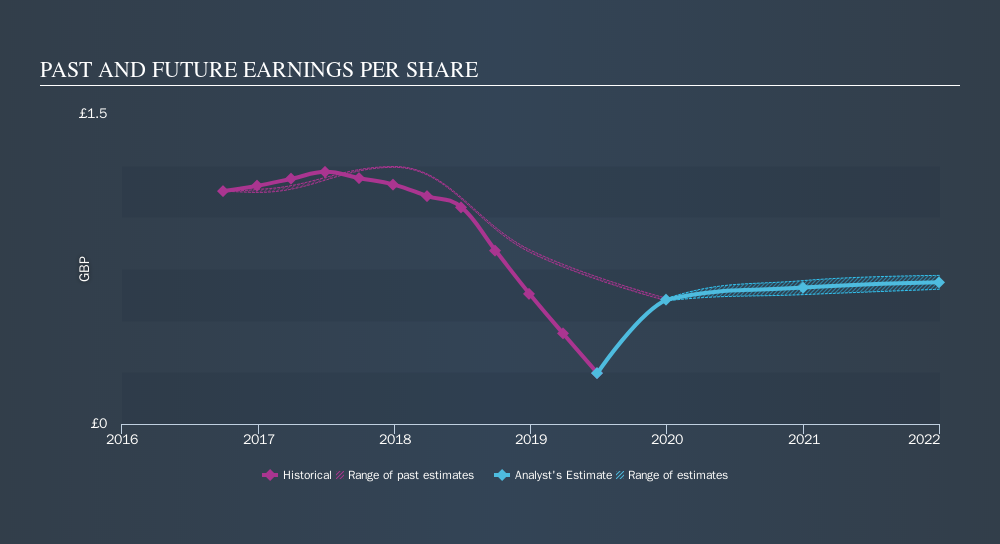

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Dignity saw its EPS decline at a compound rate of 39% per year, over the last three years. This change in EPS is reasonably close to the 43% average annual decrease in the share price. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We've already covered Dignity's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Dignity's TSR, which was a 81% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Dignity shareholders are down 49% for the year, but the market itself is up 1.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 19% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Is Dignity cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:DTY

Dignity

Dignity plc, together with its subsidiaries, provides funeral services in the United Kingdom.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives