- United Kingdom

- /

- Retail REITs

- /

- LSE:SUPR

European Small Caps With Insider Buying Undervalued And Ready For Attention

Reviewed by Simply Wall St

Amid a backdrop of mixed performances in European markets, with the pan-European STOXX Europe 600 Index slightly down and major indexes showing varied results, investors are closely watching economic indicators such as inflation and labor market resilience. In this environment, small-cap stocks often present unique opportunities due to their potential for growth and sensitivity to economic shifts. Identifying promising small-cap stocks involves looking at factors like insider buying trends, which can signal confidence in a company's prospects despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Boozt | 15.2x | 0.7x | 45.37% | ★★★★★☆ |

| Foxtons Group | 10.6x | 1.0x | 39.42% | ★★★★★☆ |

| Bytes Technology Group | 18.3x | 4.6x | 8.30% | ★★★★☆☆ |

| Kitwave Group | 12.4x | 0.3x | 39.53% | ★★★★☆☆ |

| Hoist Finance | 9.7x | 2.0x | 21.20% | ★★★★☆☆ |

| Sabre Insurance Group | 8.7x | 1.6x | -6.51% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 3.09% | ★★★★☆☆ |

| Oxford Instruments | 40.4x | 2.1x | 16.52% | ★★★☆☆☆ |

| NCC Group | NA | 1.4x | 7.91% | ★★★☆☆☆ |

| CVS Group | 45.3x | 1.3x | 37.76% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

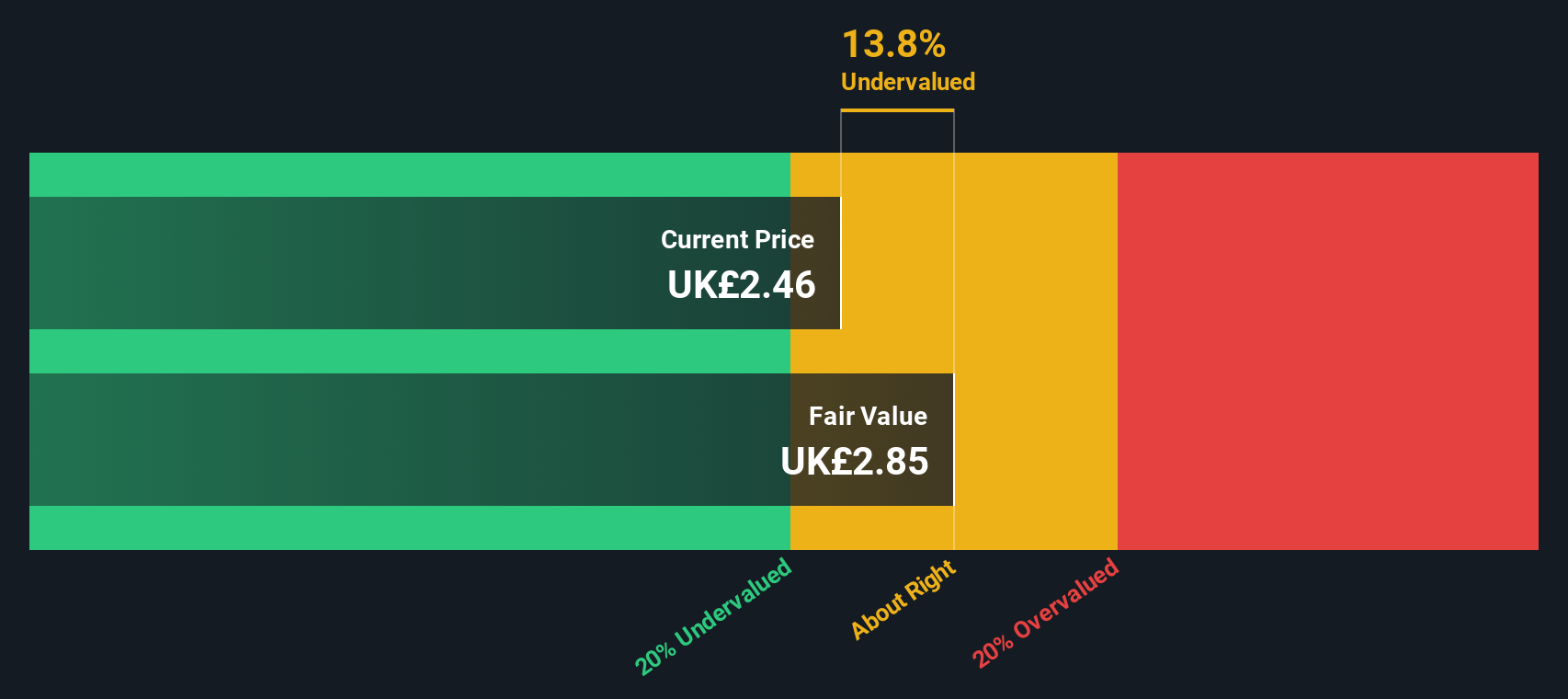

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Value Rating: ★★★★★★

Overview: Hollywood Bowl Group operates a chain of ten-pin bowling centers in the UK, focusing on providing family-friendly entertainment, and has a market capitalization of approximately £0.55 billion.

Operations: The company generates revenue primarily from recreational activities, with recent figures showing a revenue of £240.46 million. The cost of goods sold (COGS) amounts to £89.63 million, resulting in a gross profit margin of 62.73%. Operating expenses are significant, comprising general and administrative costs as well as depreciation and amortization expenses. Net income stands at £28.60 million, translating to a net income margin of 11.89%.

PE: 14.7x

Hollywood Bowl Group, a notable player in the leisure industry, is being recognized for its potential value. Despite relying on external borrowing for funding, which carries inherent risk, the company anticipates a 14% annual earnings growth. Recent insider confidence is evident with share purchases from January to August 2025. The appointment of Asheeka Hyde as an independent Non-Executive Director brings nearly two decades of experience in data and analytics, potentially enhancing strategic oversight and positioning the company for future growth opportunities.

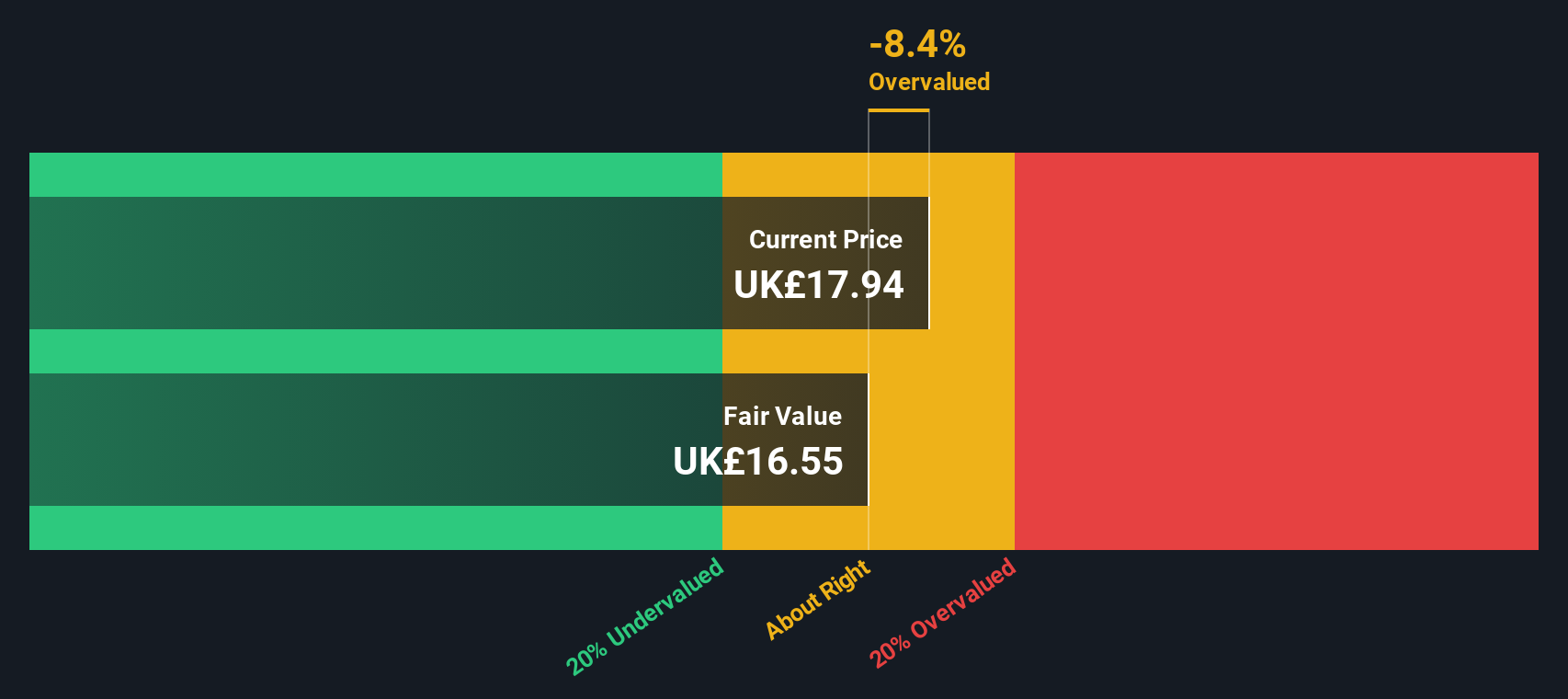

Oxford Instruments (LSE:OXIG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Oxford Instruments is a company specializing in the development and provision of high-technology tools and systems for industry and research, with a market cap of approximately £1.43 billion.

Operations: The company's revenue is primarily derived from Imaging & Analysis (£330.5 million) and Advanced Technologies (£171.1 million). Operating expenses, including sales and marketing, R&D, and general administrative costs, are significant factors in the cost structure. The net profit margin showed a varied trend over time but reached 13.22% as of June 2023 before declining to 5.19% by March 2025.

PE: 40.4x

Oxford Instruments, a key player in scientific instrumentation, is capturing attention as an undervalued stock with significant potential. Despite a dip in net profit margin from 10.8% to 5.2%, the company anticipates a promising earnings growth of 26% annually. Their £50 million share repurchase program, funded by selling their NanoScience business, signals strong insider confidence and commitment to shareholder value. Recent participation in international symposiums underscores their active engagement with cutting-edge technology sectors across Europe and Asia.

- Get an in-depth perspective on Oxford Instruments' performance by reading our valuation report here.

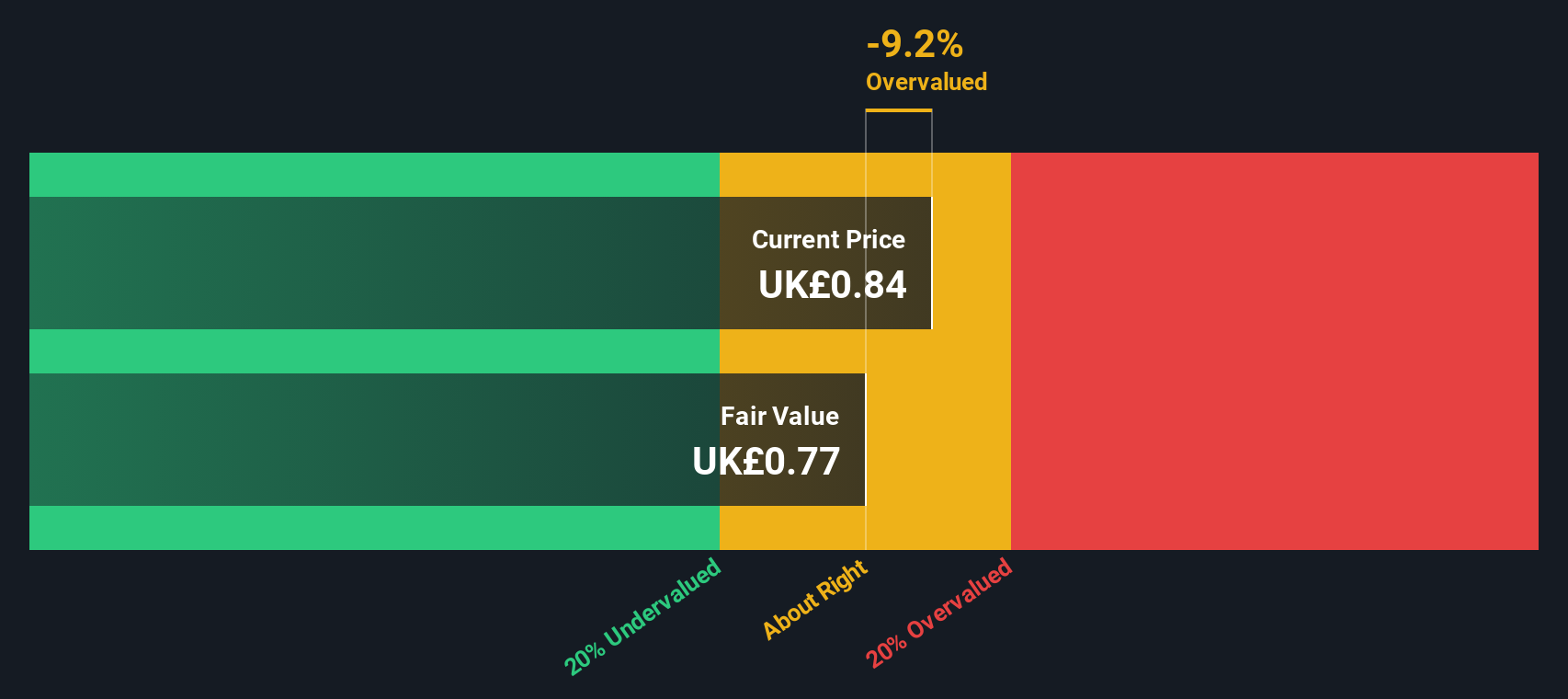

Supermarket Income REIT (LSE:SUPR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Supermarket Income REIT focuses on investing in supermarket property assets, with a market cap of approximately £1.21 billion.

Operations: The primary revenue stream is derived from investments in supermarket property assets, with a recent revenue figure of £112.5 million. Operating expenses have varied over time, with a notable increase to £15.035 million as of December 2023, impacting net income margins which have fluctuated significantly from highs above 1% to lows below -1%. The gross profit margin consistently stands at 100%, indicating that cost of goods sold is not applicable or negligible for this business model.

PE: 14.2x

Supermarket Income REIT, a smaller player in the European market, recently completed a £250 million fixed-income offering and secured a £215 million loan with Blue Owl Capital. Their financial strategy includes hedging to manage risk, while maintaining a 31% loan-to-value ratio. Insider confidence is evident from recent share purchases. With earnings projected to grow at 11.54% annually, this company demonstrates potential for future growth amidst its strategic financial maneuvers and consistent dividend payouts.

- Unlock comprehensive insights into our analysis of Supermarket Income REIT stock in this valuation report.

Assess Supermarket Income REIT's past performance with our detailed historical performance reports.

Summing It All Up

- Explore the 42 names from our Undervalued European Small Caps With Insider Buying screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SUPR

Supermarket Income REIT

Supermarket Income REIT plc (LSE: SUPR, JSE: SRI) is a real estate investment trust dedicated to investing in grocery properties which are an essential part of the feed the nation infrastructure.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives