- United Kingdom

- /

- Hospitality

- /

- AIM:NXQ

The Market Doesn't Like What It Sees From Nexteq plc's (LON:NXQ) Earnings Yet As Shares Tumble 41%

The Nexteq plc (LON:NXQ) share price has fared very poorly over the last month, falling by a substantial 41%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

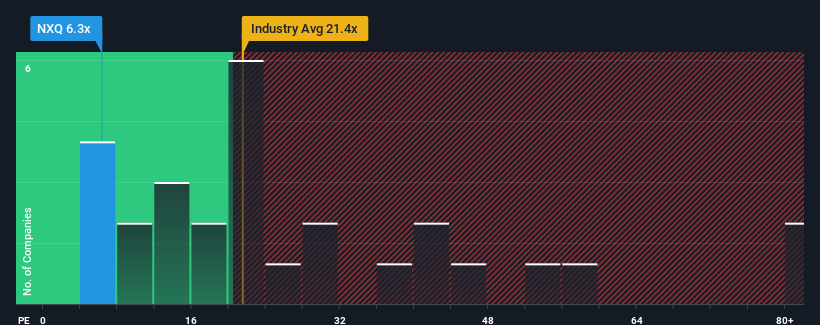

Although its price has dipped substantially, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 17x, you may still consider Nexteq as a highly attractive investment with its 6.3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Nexteq hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Nexteq

How Is Nexteq's Growth Trending?

Nexteq's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings growth is heading into negative territory, declining 44% over the next year. Meanwhile, the broader market is forecast to expand by 18%, which paints a poor picture.

With this information, we are not surprised that Nexteq is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Shares in Nexteq have plummeted and its P/E is now low enough to touch the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nexteq maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Nexteq has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might also be able to find a better stock than Nexteq. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nexteq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NXQ

Nexteq

Operates as a technology solution provider to customers in industrial markets in North America, Asia, Australia, the United Kingdom, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives