- United Kingdom

- /

- Consumer Services

- /

- AIM:CODE

Northcoders Group PLC (LON:CODE) Soars 32% But It's A Story Of Risk Vs Reward

Those holding Northcoders Group PLC (LON:CODE) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 59% share price decline over the last year.

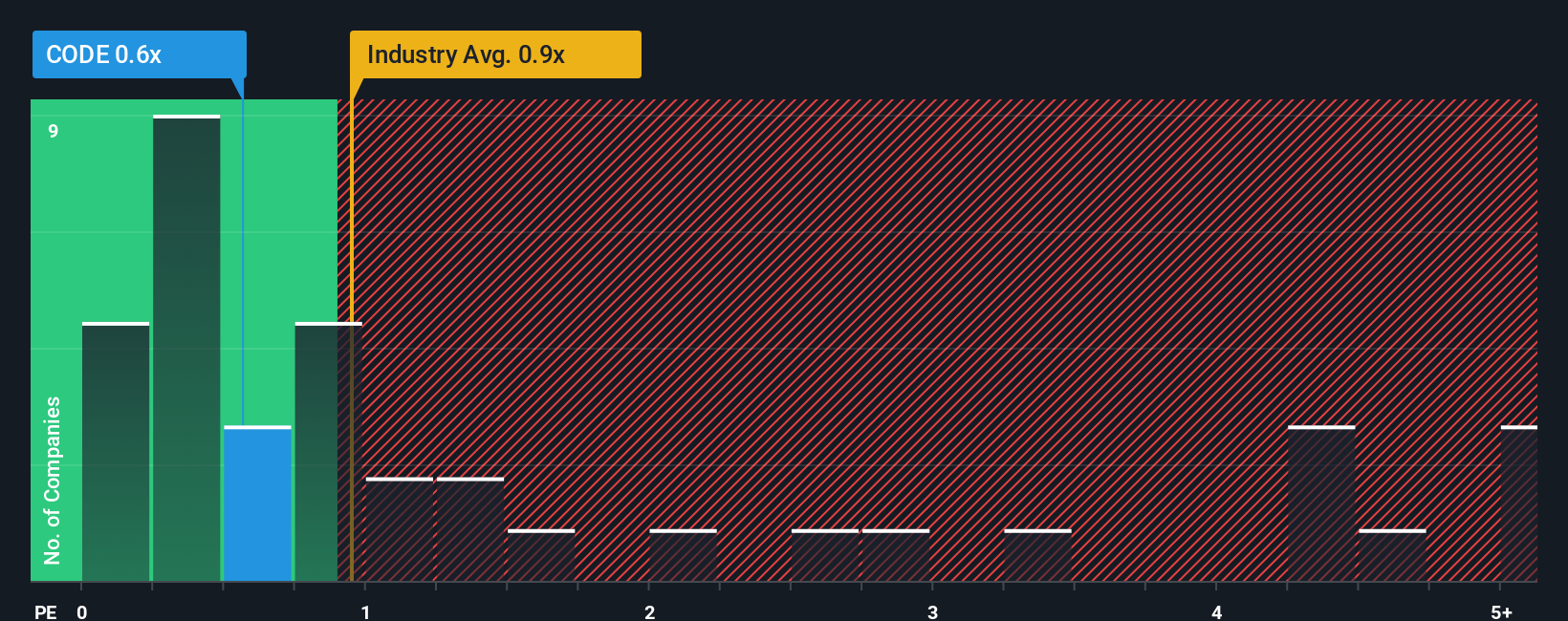

Even after such a large jump in price, it would still be understandable if you think Northcoders Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.6x, considering almost half the companies in the United Kingdom's Consumer Services industry have P/S ratios above 2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Northcoders Group

How Northcoders Group Has Been Performing

Recent times have been pleasing for Northcoders Group as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on Northcoders Group will be hoping that this isn't the case and the company continues to beat out the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Northcoders Group.Do Revenue Forecasts Match The Low P/S Ratio?

Northcoders Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen an excellent 193% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 7.7% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 2.9%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Northcoders Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite Northcoders Group's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Northcoders Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Northcoders Group you should be aware of.

If you're unsure about the strength of Northcoders Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Northcoders Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CODE

Northcoders Group

Provides training programs for software coding to individual and corporate customers in the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Community Narratives