- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:VINO

Virgin Wines UK PLC's (LON:VINO) Shares Climb 31% But Its Business Is Yet to Catch Up

Virgin Wines UK PLC (LON:VINO) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 6.7% isn't as attractive.

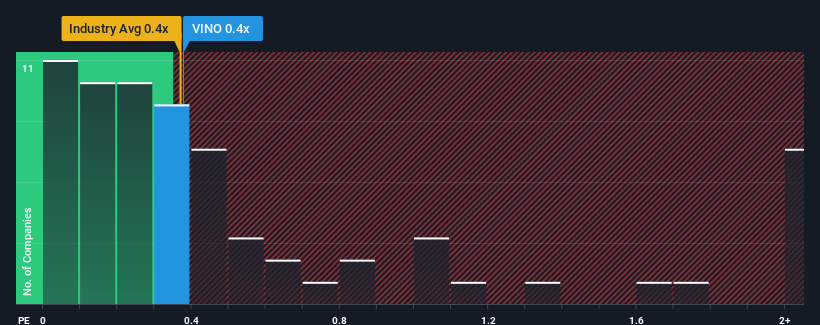

Although its price has surged higher, there still wouldn't be many who think Virgin Wines UK's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when it essentially matches the median P/S in the United Kingdom's Consumer Retailing industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Virgin Wines UK

How Virgin Wines UK Has Been Performing

While the industry has experienced revenue growth lately, Virgin Wines UK's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Virgin Wines UK will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Virgin Wines UK?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Virgin Wines UK's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 20% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 3.6% each year during the coming three years according to the sole analyst following the company. With the industry predicted to deliver 6.4% growth per year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Virgin Wines UK's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Its shares have lifted substantially and now Virgin Wines UK's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Virgin Wines UK's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

It is also worth noting that we have found 2 warning signs for Virgin Wines UK (1 is significant!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:VINO

Virgin Wines UK

Operates as a direct-to-consumer online wine retailer in the United Kingdom.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives