- United Kingdom

- /

- Capital Markets

- /

- AIM:TAVI

3 Promising UK Penny Stocks With Market Caps Under £80M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting companies tied to global commodity prices. Despite these broader market pressures, investors might find intriguing opportunities in penny stocks—smaller or newer companies that can offer unexpected potential. Although the term "penny stocks" may seem outdated, these investments remain relevant for those seeking value and growth outside of larger firms.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.76M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £178.93M | ★★★★★☆ |

| Foresight Group Holdings (LSE:FSG) | £3.72 | £426.51M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.46 | £88.11M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.595 | £358.04M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.0575 | £92.27M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £155.53M | ★★★★★☆ |

| QinetiQ Group (LSE:QQ.) | £3.824 | £2.16B | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cake Box Holdings (AIM:CBOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cake Box Holdings Plc, with a market cap of £73 million, operates in the United Kingdom retailing fresh cream celebration cakes through its subsidiaries.

Operations: The company generates revenue of £38.62 million from its food processing segment.

Market Cap: £73M

Cake Box Holdings, with a market cap of £73 million, showcases strong financial health, evidenced by its short-term assets (£13.6M) exceeding both short and long-term liabilities. The company has demonstrated consistent earnings growth over the past five years at 8.7% annually, with recent acceleration to 9.3%. Its Return on Equity stands high at 26%, and debt levels are well-managed with more cash than total debt and operating cash flow covering debt significantly. Recent board appointments aim to strengthen governance while an increased interim dividend reflects confidence in future profitability despite dividends not being fully covered by free cash flows.

- Navigate through the intricacies of Cake Box Holdings with our comprehensive balance sheet health report here.

- Gain insights into Cake Box Holdings' future direction by reviewing our growth report.

Tavistock Investments (AIM:TAVI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tavistock Investments Plc, along with its subsidiaries, offers financial advisory and investment management services in the United Kingdom, with a market cap of £22.56 million.

Operations: The company's revenue is derived entirely from its operations in the United Kingdom, amounting to £38.55 million.

Market Cap: £22.56M

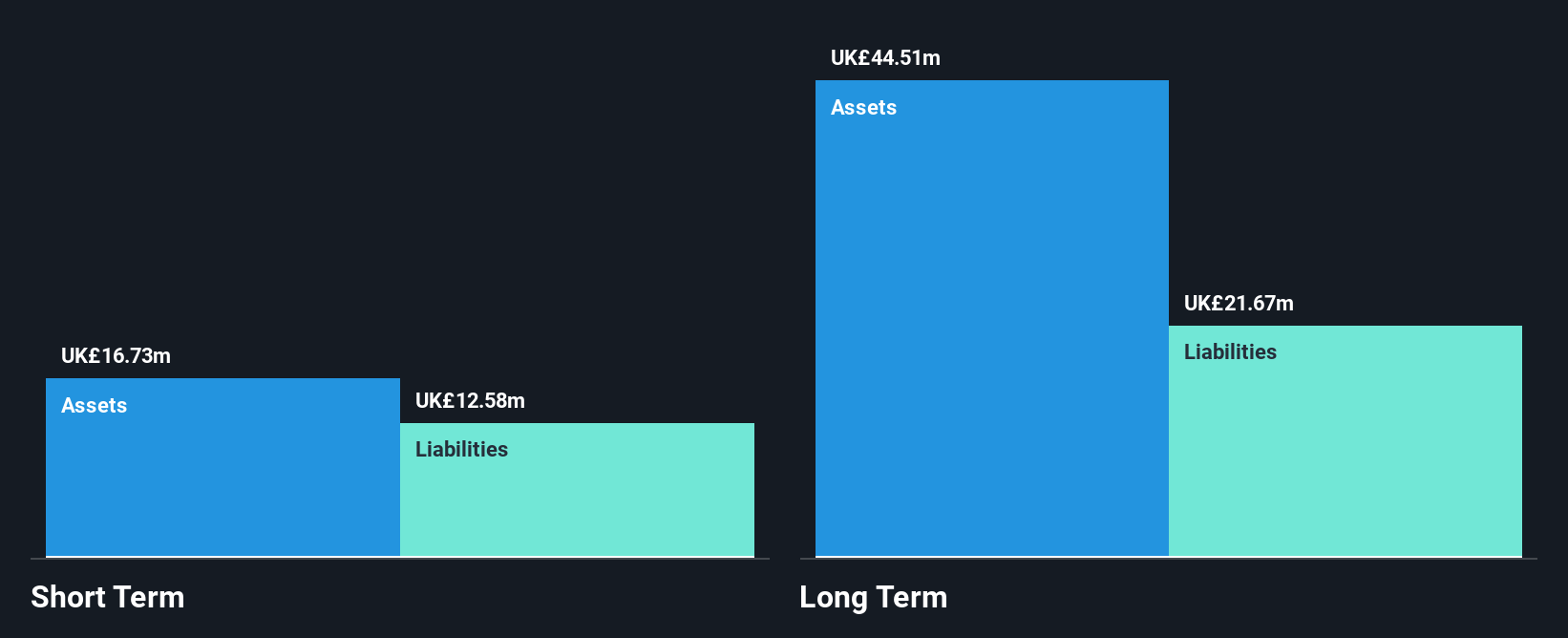

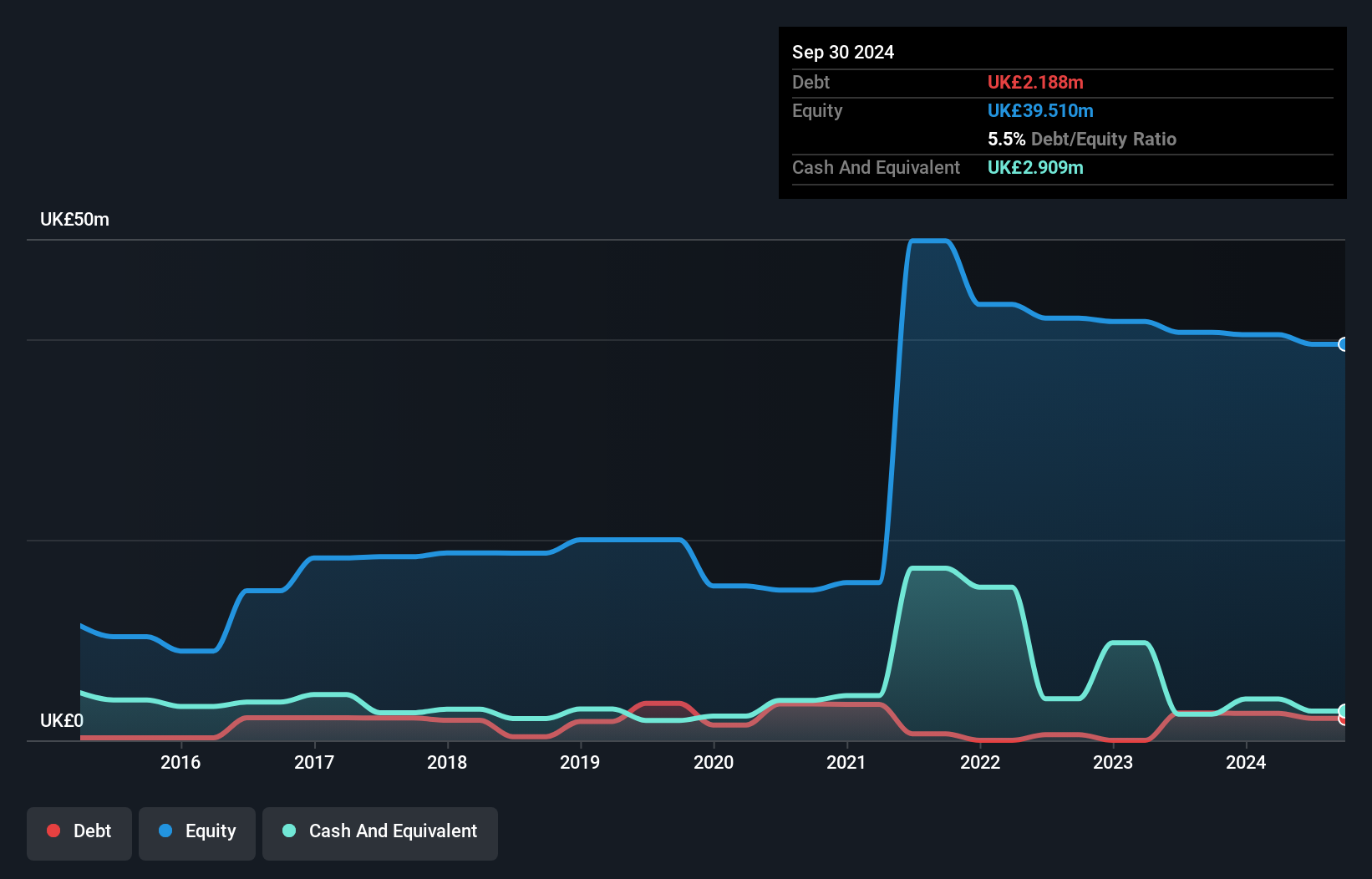

Tavistock Investments, with a market cap of £22.56 million, faces challenges as it remains unprofitable despite generating £38.55 million in revenue from UK operations. The company's short-term assets (£14.2M) surpass both its short and long-term liabilities, indicating solid liquidity management. Although Tavistock's debt to equity ratio has improved significantly over five years, its negative Return on Equity (-6.34%) and increasing losses highlight profitability issues. Recent earnings reported a net loss of £0.989 million for the half-year ended September 2024, compared to net income the previous year, reflecting ongoing financial struggles amidst stable weekly volatility (7%).

- Click to explore a detailed breakdown of our findings in Tavistock Investments' financial health report.

- Review our historical performance report to gain insights into Tavistock Investments' track record.

Topps Tiles (LSE:TPT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Topps Tiles Plc operates in the United Kingdom, focusing on the retail and wholesale distribution of ceramic and porcelain tiles, natural stone, and related products for both residential and commercial markets, with a market cap of £68.34 million.

Operations: The company generates £251.76 million in revenue from its retail segment focused on building products.

Market Cap: £68.34M

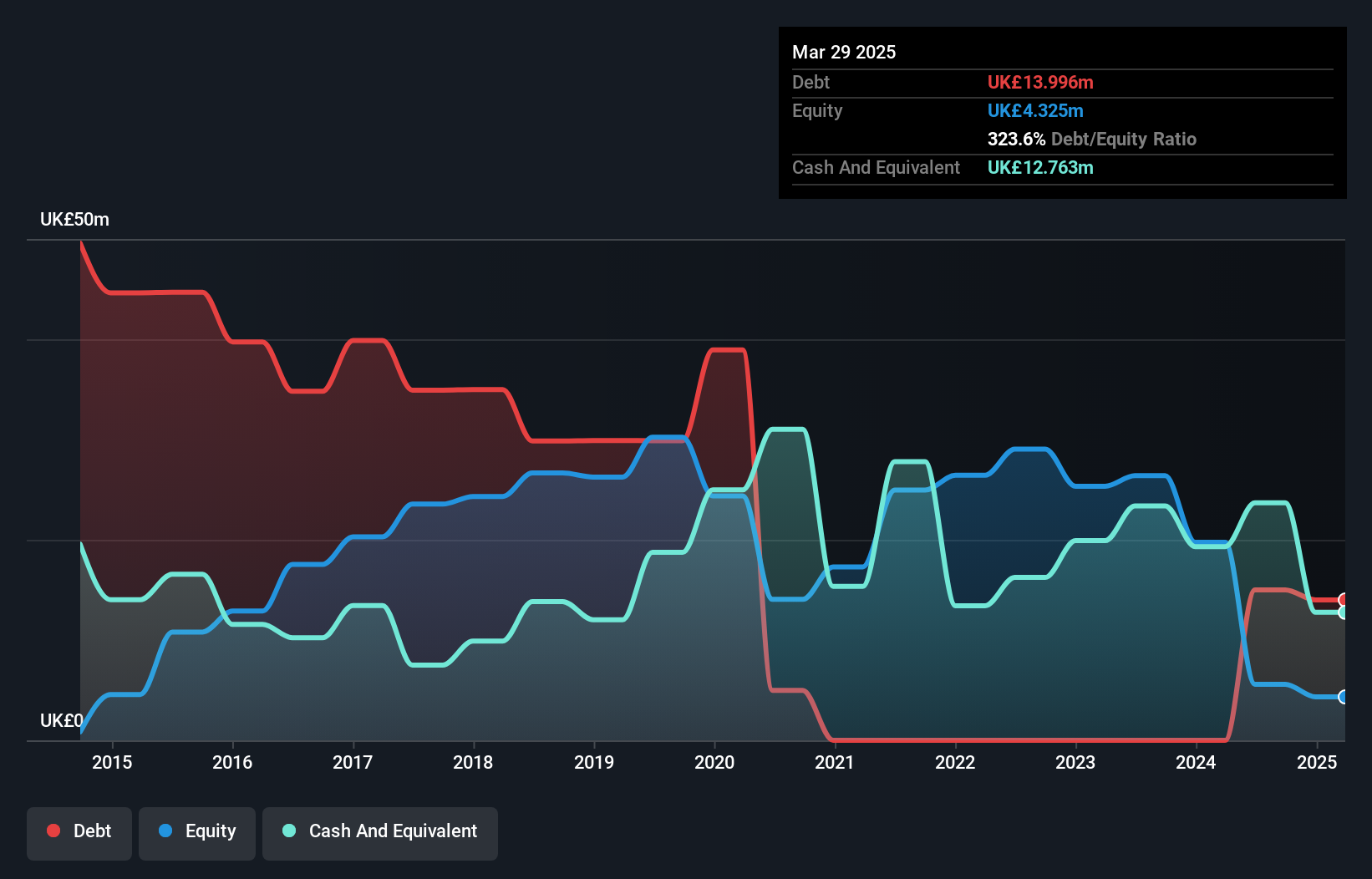

Topps Tiles, with a market cap of £68.34 million, remains unprofitable despite generating £251.76 million in revenue from its retail segment. The company faces challenges as its short-term assets (£76.1M) exceed short-term liabilities but fall short of covering long-term liabilities (£88.7M). Trading at 64.7% below fair value suggests potential undervaluation relative to peers and industry, yet the negative Return on Equity (-229.54%) underscores profitability concerns. Recent sales figures indicate positive momentum with a 4.6% year-on-year increase for the latest quarter, although leadership changes loom as CEO Rob Parker plans to retire by late 2025.

- Dive into the specifics of Topps Tiles here with our thorough balance sheet health report.

- Explore Topps Tiles' analyst forecasts in our growth report.

Make It Happen

- Navigate through the entire inventory of 444 UK Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tavistock Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TAVI

Tavistock Investments

Provides financial advisory and investment management services in the United Kingdom.

Adequate balance sheet slight.

Market Insights

Community Narratives