- United Kingdom

- /

- Consumer Durables

- /

- LSE:TW.

Taylor Wimpey (LSE:TW.)—Is the Current Share Price Creating a Compelling Value Opportunity?

Reviewed by Simply Wall St

Taylor Wimpey (LSE:TW.) has been turning heads lately as the stock’s share price has shifted noticeably, catching the eye of both long-term holders and newcomers alike. While there is no single headline event driving the recent moves, this kind of price activity often prompts investors to wonder if something under the surface is changing or if broader market factors are at play.

In the bigger picture, Taylor Wimpey’s shares have trended lower through the past year, slipping around 33% from this time last year and remaining under pressure in recent months. Although there have been some short-lived recoveries, such as a 3% gain in the past week, these bursts have mostly been overshadowed by a longer decline that contrasts sharply with the company’s growth in annual revenue and net income.

With this blend of sliding share price and improving fundamentals, the question stands: has the market created a buying opportunity here, or is it simply baking future challenges into the price?

Most Popular Narrative: 25.2% Undervalued

According to the most widely followed narrative, Taylor Wimpey shares are trading at a meaningful discount to their estimated fair value. This view is based on forecasts of future earnings, margin improvement, and industry catalysts that may drive the stock higher over time.

Anticipated improvements in the planning environment, including the implementation of the new NPPF and expected streamlining of decision-making via upcoming legislation, will unlock more outlet openings and support increased completions from 2026 onward. This is likely to lift revenue and operating profit.

Wondering what really powers this bullish outlook? The narrative hints at ambitious multi-year growth, profitability improvements, and valuation multiples not typically seen in this sector. What hidden drivers are behind this jump in fair value? Hungry for the surprising details of these analyst forecasts? Find out how forward-thinking assumptions could shape Taylor Wimpey’s future.

Result: Fair Value of £1.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent affordability challenges and evolving safety costs could still limit Taylor Wimpey’s earnings recovery. This may present challenges even for the most optimistic forecasts.

Find out about the key risks to this Taylor Wimpey narrative.Another View: Market Valuation Tells a Different Story

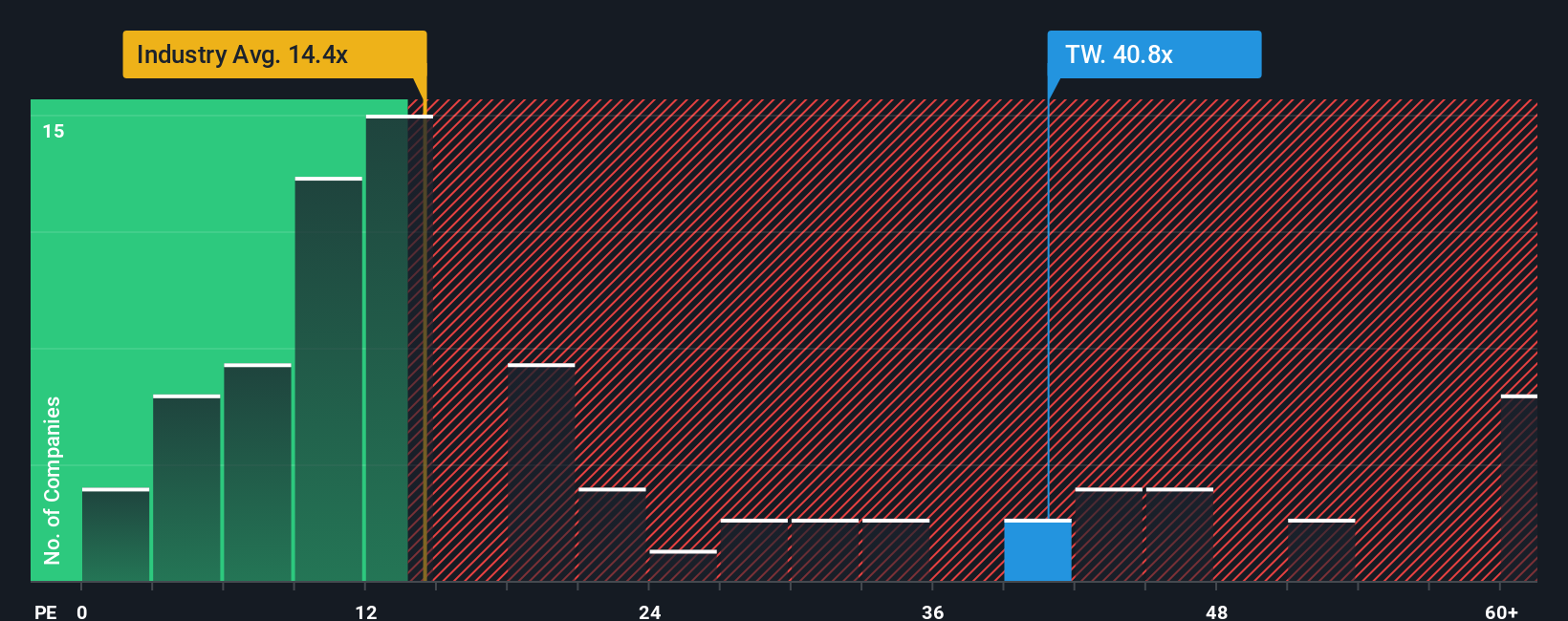

Looking from a market perspective, Taylor Wimpey’s current valuation appears high compared to similar industry names when considering its price-to-earnings ratio. Could this signal the market sees lingering risks despite strong growth forecasts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Taylor Wimpey Narrative

If you see things differently or have your own perspective on Taylor Wimpey, it only takes a few minutes to dig into the numbers and develop your own outlook. Do it your way.

A great starting point for your Taylor Wimpey research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the chance to uncover fresh opportunities in today’s ever-changing market. These hand-picked screens could elevate your next big move and keep you a step ahead.

- Rocket your portfolio forward by targeting lucrative companies with strong cash flow potential using our list of undervalued stocks based on cash flows.

- Unlock portfolio stability and capital growth by focusing on reliable businesses offering consistent payouts with our screen for dividend stocks with yields > 3%.

- Fuel your investing edge by seeking the boldest breakthroughs and rapid growth stories among up-and-coming technology leaders through our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Wimpey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About LSE:TW.

Taylor Wimpey

Operates as a homebuilder company in the United Kingdom and Spain.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives