- United Kingdom

- /

- Consumer Durables

- /

- LSE:TW.

Taylor Wimpey (LSE:TW.): Exploring the Valuation Narrative After Recent Share Performance

Reviewed by Simply Wall St

See our latest analysis for Taylor Wimpey.

After a rocky start to the year, recent months have seen Taylor Wimpey’s share price return drift modestly lower, contributing to a year-to-date decline of 16.6%. Still, when you take a step back, the 3-year total shareholder return stands at a much stronger 27.5%, reminding investors that momentum can ebb and flow as sentiment shifts with market cycles and sector outlook.

If you’re keeping an eye on how other companies are weathering these market moves, this could be the right time to discover fast growing stocks with high insider ownership.

With the share price lagging and analysts projecting upside, is Taylor Wimpey trading below its true value? Or has the market already factored in future growth expectations, leaving limited room for a rebound?

Most Popular Narrative: 22.6% Undervalued

Taylor Wimpey’s most followed valuation narrative points to a fair value of £1.32 per share, notably above the last close price of £1.02. This gap is driving speculation over what could trigger a re-rating if market expectations and forecasts play out.

“Anticipated improvements in the planning environment, including the implementation of the new NPPF and expected streamlining of decision-making via upcoming legislation, will unlock more outlet openings and support increased completions from 2026 onward. This is likely to lift revenue and operating profit.”

Curious what assumptions could justify a valuation premium like this? The boldest projections center on profit margins and revenue leaps. The analysts behind this narrative are betting on a turnaround driven by changing regulation and surprising financial shifts. Are you ready to see the numbers that underpin this ambitious target?

Result: Fair Value of £1.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability challenges and rising build cost inflation could cast doubt on these projections. These factors may potentially stall revenue and margin recovery.Find out about the key risks to this Taylor Wimpey narrative.

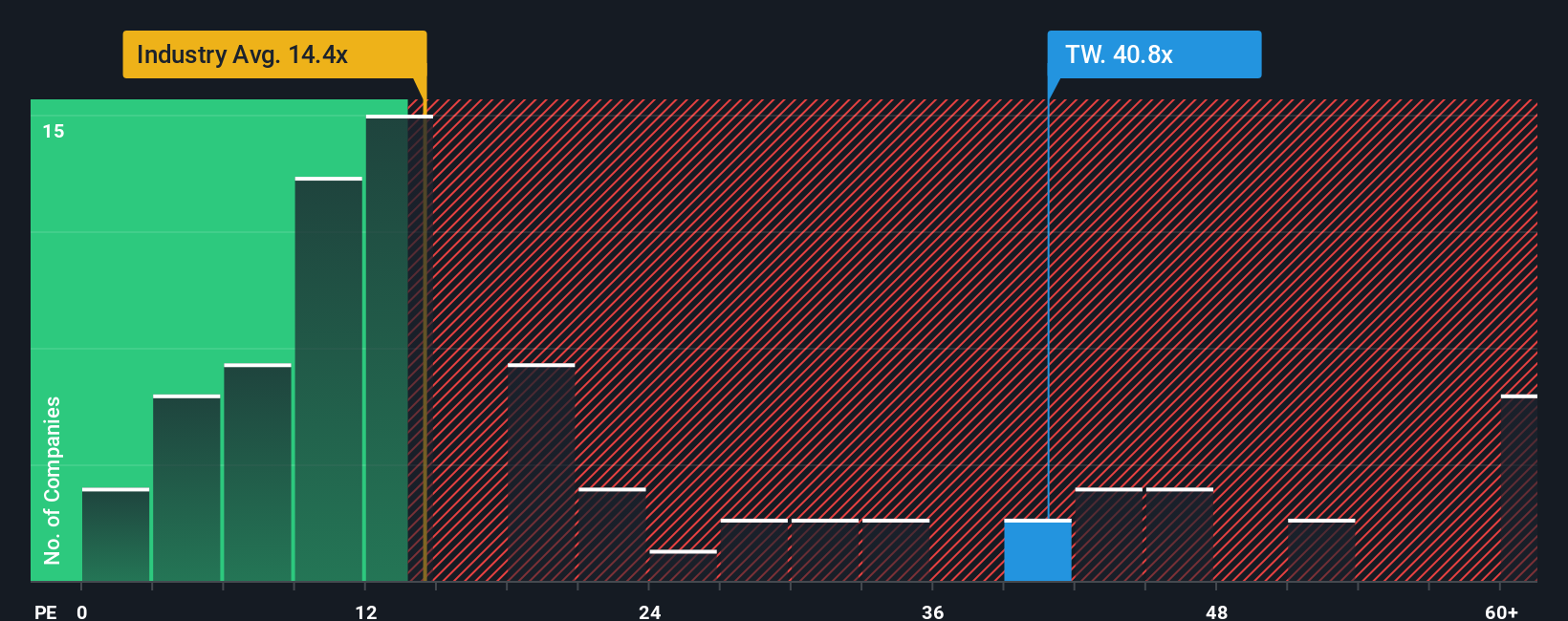

Another View: Price-to-Earnings Tells a Different Story

Looking at valuation through the lens of price-to-earnings, Taylor Wimpey appears pricey. Its P/E ratio of 42.6x stands well above both peer (18.9x) and industry (15.2x) averages, and is also higher than the fair ratio of 31.7x. This gap could spell a valuation risk if market sentiment turns. Does this hint at a reality check ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Taylor Wimpey Narrative

If the story above doesn’t line up with your take or you’d rather crunch the numbers your way, it only takes a few minutes to build your own outlook and draw your own conclusions. Do it your way.

A great starting point for your Taylor Wimpey research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit your portfolio. There’s a world of compelling stocks just waiting to be found across breakthrough tech, future-focused innovation, and reliable dividend growth.

- Unlock potential gains by targeting companies with robust cash flows using these 870 undervalued stocks based on cash flows, and see which undervalued opportunities are flying under the radar.

- Capture reliable income with these 15 dividend stocks with yields > 3% that showcase strong yields above 3%, a smart move for anyone seeking steady returns.

- Position yourself ahead of the curve and track disruption in medical technology through these 31 healthcare AI stocks, featuring pioneers at the forefront of healthcare’s AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Wimpey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TW.

Taylor Wimpey

Operates as a homebuilder company in the United Kingdom and Spain.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives