- United Kingdom

- /

- Trade Distributors

- /

- LSE:BNZL

Top UK Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with challenges from weak trade data out of China, investors are keenly observing how global economic shifts impact domestic markets. In these uncertain times, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to navigate the current market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.22% | ★★★★★☆ |

| RS Group (LSE:RS1) | 4.05% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.03% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.23% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.64% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.53% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.38% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.40% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.59% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.79% | ★★★★★★ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

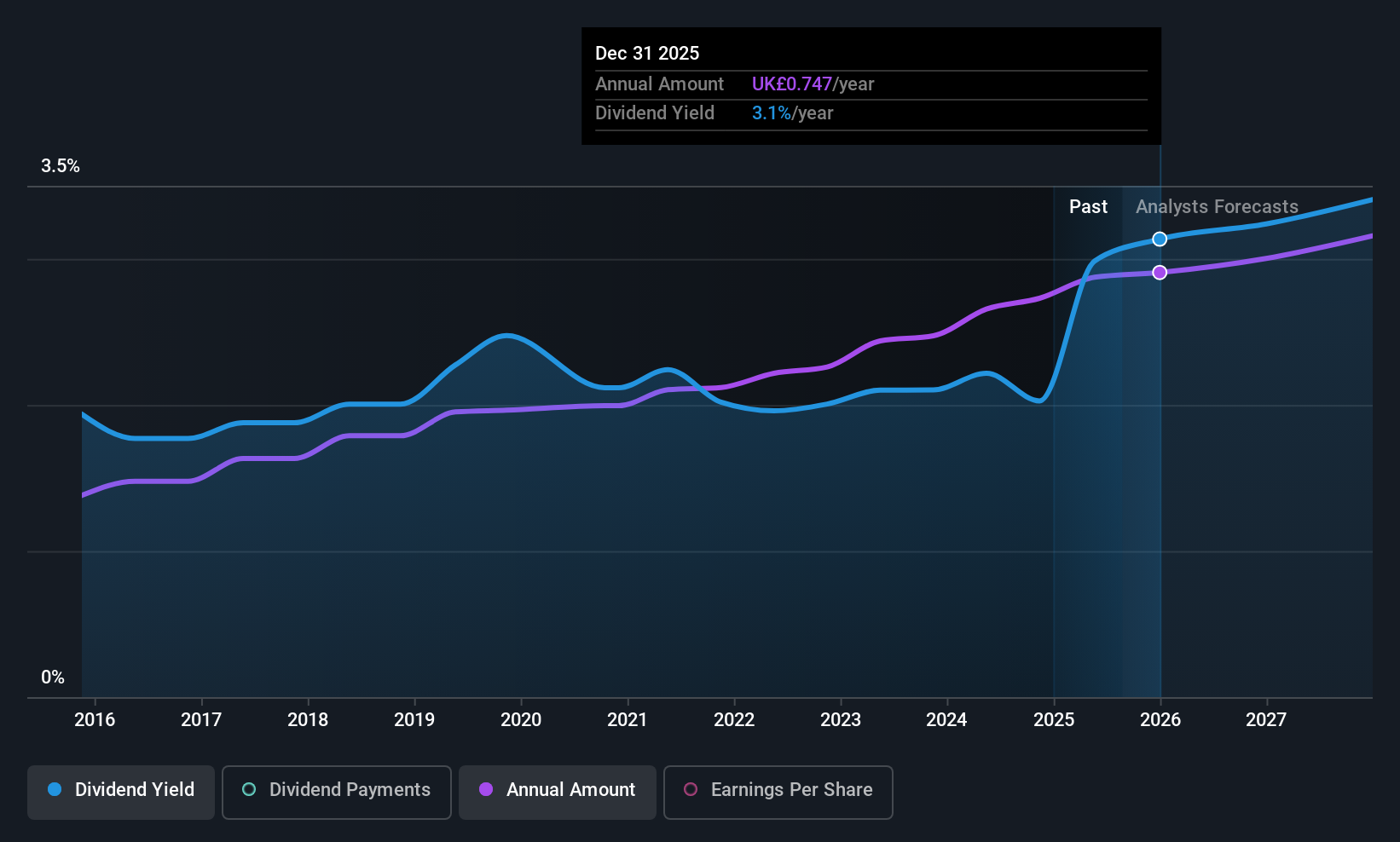

Bunzl (LSE:BNZL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bunzl plc is a distribution and services company operating in North America, Continental Europe, the United Kingdom, Ireland, and internationally with a market cap of £7.91 billion.

Operations: Bunzl plc generates revenue primarily from its Packaging & Containers segment, amounting to £11.82 billion.

Dividend Yield: 3%

Bunzl's dividend payments are supported by a manageable payout ratio of 50.5% and a cash payout ratio of 29%, indicating solid coverage by earnings and cash flows. Despite an increase in the interim dividend to 20.2 pence per share, Bunzl's yield remains modest at 3.02%, below the UK's top quartile payers. Recent buybacks totaling £364 million reflect shareholder returns, yet its high debt level and historically volatile dividends suggest caution for those prioritizing stability.

- Dive into the specifics of Bunzl here with our thorough dividend report.

- Our valuation report here indicates Bunzl may be undervalued.

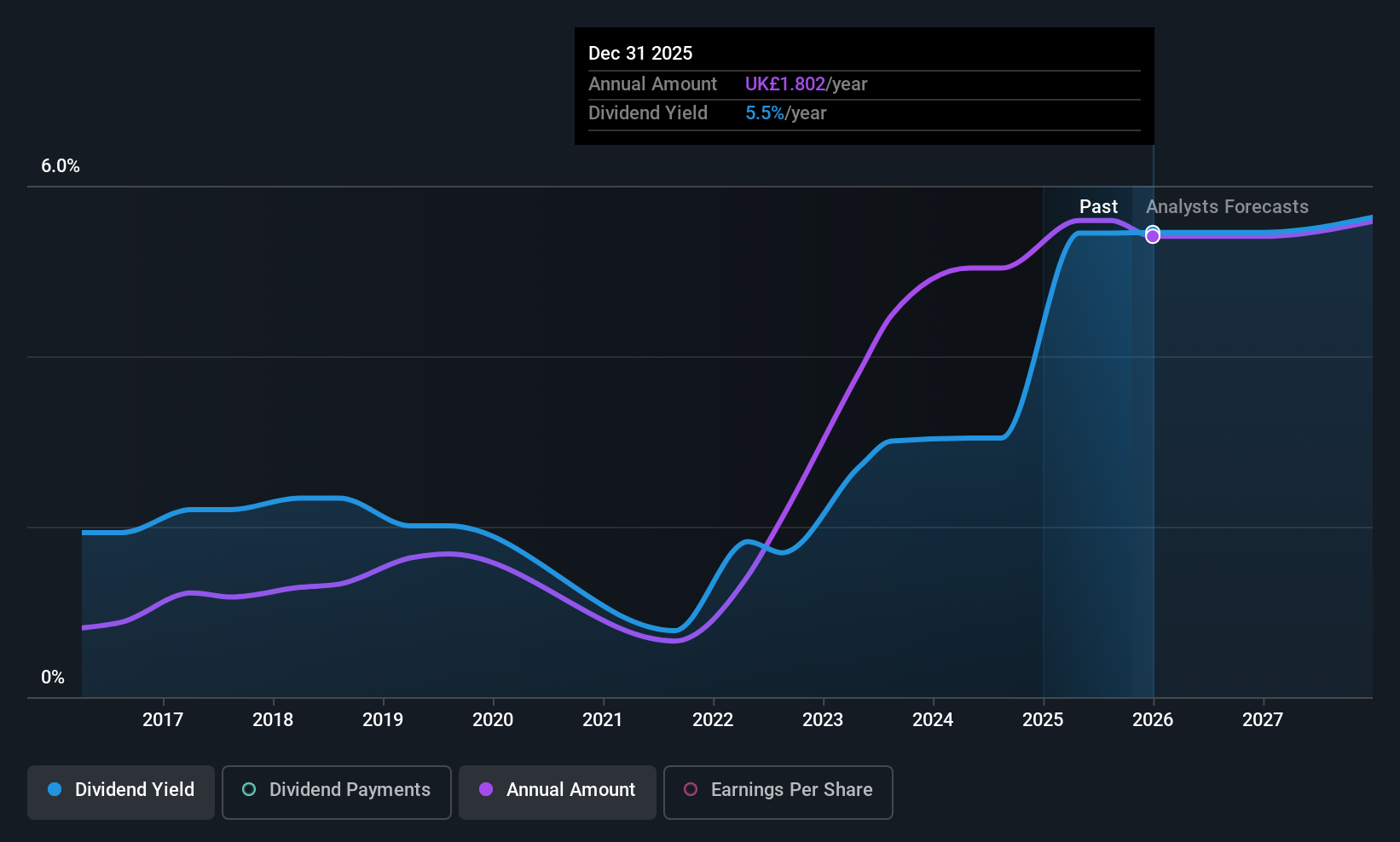

4imprint Group (LSE:FOUR)

Simply Wall St Dividend Rating: ★★★★★★

Overview: 4imprint Group plc is a direct marketer of promotional products operating in North America, the United Kingdom, and Ireland, with a market cap of £857.93 million.

Operations: The company's revenue is primarily generated from its operations in North America, which account for $1.33 billion, with additional contributions of $25 million from the UK and Ireland.

Dividend Yield: 5.8%

4imprint Group offers a compelling dividend profile, with stable and growing dividends over the past decade. A high yield of 5.79% places it in the top 25% of UK dividend payers, supported by sustainable payout ratios—57.2% for earnings and 54.2% for cash flows. Despite recent earnings growth and good relative value compared to peers, future earnings are expected to decline by 9.1% annually over the next three years, warranting careful consideration from investors focused on long-term income stability.

- Click here and access our complete dividend analysis report to understand the dynamics of 4imprint Group.

- Insights from our recent valuation report point to the potential undervaluation of 4imprint Group shares in the market.

Games Workshop Group (LSE:GAW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Games Workshop Group PLC designs, manufactures, distributes, and sells fantasy miniature figures and games globally, with a market cap of approximately £4.90 billion.

Operations: Games Workshop Group PLC generates revenue primarily from its Core segment, which accounts for £565 million, and its Licensing segment, contributing £52.50 million.

Dividend Yield: 3.5%

Games Workshop Group has maintained stable and reliable dividend payments over the past decade, with recent increases aligning with its policy. The current yield of 3.5% is below the top UK dividend payers but remains attractive due to consistent growth in payouts. Dividends are covered by earnings and cash flows at payout ratios of 87.4% and 83%, respectively, though future earnings are projected to decline slightly by an average of 2% annually over three years.

- Unlock comprehensive insights into our analysis of Games Workshop Group stock in this dividend report.

- In light of our recent valuation report, it seems possible that Games Workshop Group is trading beyond its estimated value.

Taking Advantage

- Click through to start exploring the rest of the 47 Top UK Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bunzl might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BNZL

Bunzl

Operates as a distribution and services company in the North America, Continental Europe, the United Kingdom, Ireland, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives