- United Kingdom

- /

- Leisure

- /

- LSE:GAW

Those Who Purchased Games Workshop Group (LON:GAW) Shares Three Years Ago Have A -499% Loss To Show For It

For us, stock picking is in large part the hunt for the truly magnificent stocks. You won't get it right every time, but when you do, the returns can be truly splendid. For example, the Games Workshop Group PLC (LON:GAW) share price is up a whopping 499% in the last three years, a handsome return for long term holders. We note the stock price is up 1.6% in the last seven days.

View our latest analysis for Games Workshop Group

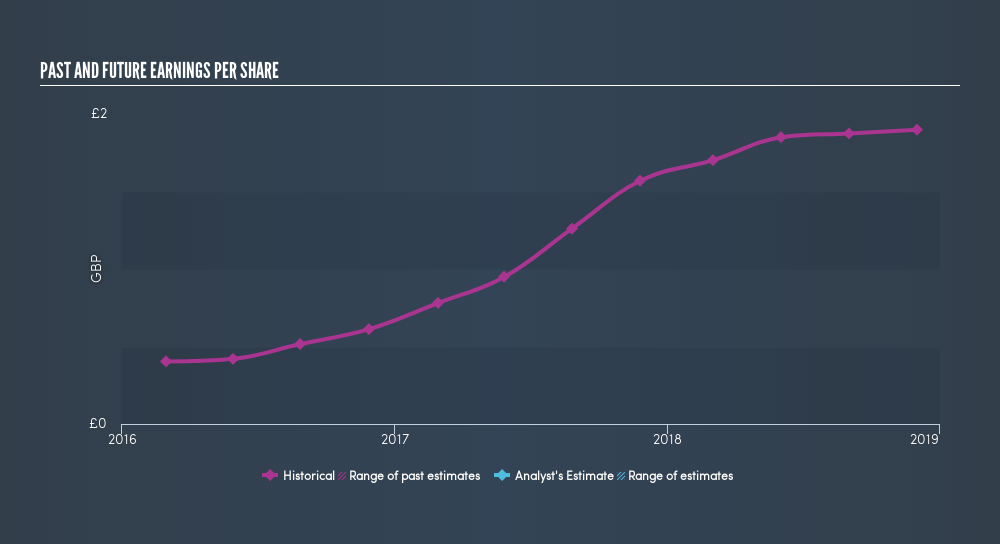

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, Games Workshop Group achieved compound earnings per share growth of 70% per year. We note that the 82% yearly (average) share price gain isn't too far from the EPS growth rate. Coincidence? Probably not. This observation indicates that the market's attitude to the business hasn't changed all that much. Rather, the share price has approximately tracked EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Games Workshop Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Games Workshop Group's TSR for the last 3 years was 667%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Games Workshop Group shareholders have received a total shareholder return of 40% over one year. And that does include the dividend. However, the TSR over five years, coming in at 54% per year, is even more impressive. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Games Workshop Group is not the only stock that insiders are buying. For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:GAW

Games Workshop Group

Engages in the design, manufacture, distribution, and sale of fantasy miniature figures and games in the United Kingdom, Continental Europe, North America, Australia, New Zealand, Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives