- United Kingdom

- /

- Leisure

- /

- LSE:GAW

Is Now The Time To Put Games Workshop Group (LON:GAW) On Your Watchlist?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Games Workshop Group (LON:GAW). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Games Workshop Group

Games Workshop Group's Improving Profits

Over the last three years, Games Workshop Group has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Games Workshop Group's EPS have grown from UK£1.58 to UK£1.90 over twelve months. I doubt many would complain about that 20% gain.

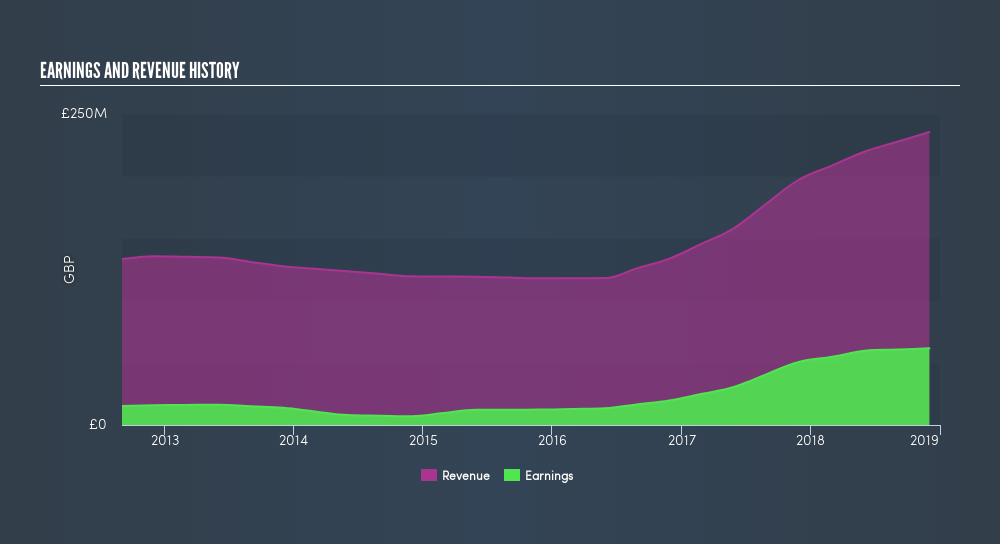

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Games Workshop Group maintained stable EBIT margins over the last year, all while growing revenue 19% to UK£236m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Games Workshop Group's forecast profits?

Are Games Workshop Group Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Games Workshop Group insiders have a significant amount of capital invested in the stock. Given insiders own a small fortune of shares, currently valued at UK£75m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Games Workshop Group with market caps between UK£787m and UK£2.5b is about UK£1.4m.

The Games Workshop Group CEO received total compensation of just UK£438k in the year to June 2018. That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Games Workshop Group To Your Watchlist?

As I already mentioned, Games Workshop Group is a growing business, which is what I like to see. The fact that EPS is growing is a genuine positive for Games Workshop Group, but the pretty picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Of course, just because Games Workshop Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:GAW

Games Workshop Group

Engages in the design, manufacture, distribution, and sale of fantasy miniature figures and games in the United Kingdom, Continental Europe, North America, Australia, New Zealand, Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives