3 Undervalued European Small Caps With Recent Insider Action

Reviewed by Simply Wall St

As the European market experiences a resurgence, with the STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns and stronger-than-expected economic growth in the eurozone, small-cap stocks are drawing renewed interest from investors looking for potential opportunities. In this environment, identifying small-cap companies with strong fundamentals and recent insider activity can be particularly appealing to those seeking to capitalize on market momentum while navigating broader economic trends.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.0x | 0.5x | 39.42% | ★★★★★☆ |

| Tristel | 29.1x | 4.1x | 22.28% | ★★★★★☆ |

| J D Wetherspoon | 12.4x | 0.4x | 30.05% | ★★★★★☆ |

| Eastnine | 17.3x | 8.4x | 40.91% | ★★★★★☆ |

| Savills | 24.4x | 0.5x | 41.28% | ★★★★☆☆ |

| NOTE | 18.6x | 1.2x | -17.47% | ★★★☆☆☆ |

| FRP Advisory Group | 12.9x | 2.3x | 11.92% | ★★★☆☆☆ |

| Italmobiliare | 11.0x | 1.5x | -270.69% | ★★★☆☆☆ |

| FastPartner | 18.8x | 4.8x | -49.49% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.6x | 42.17% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

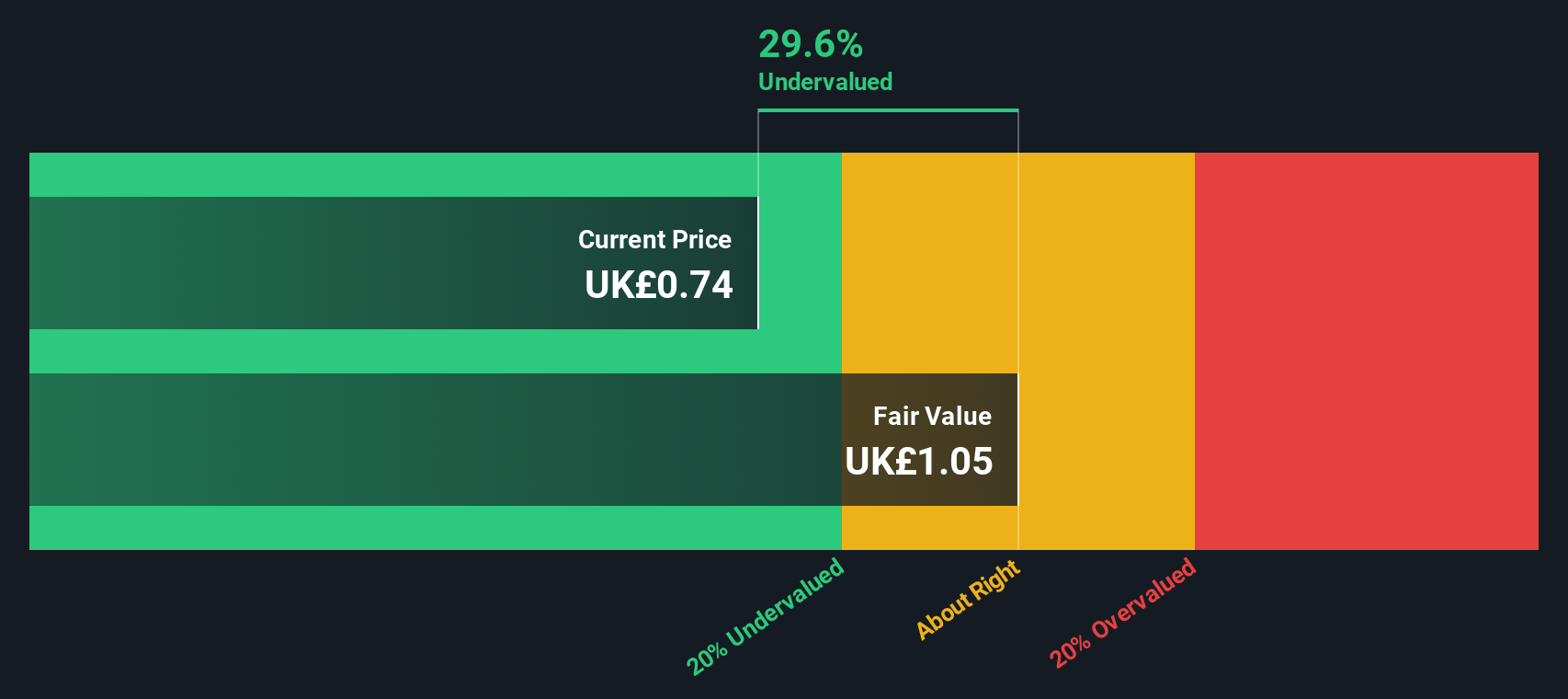

Dr. Martens (LSE:DOCS)

Simply Wall St Value Rating: ★★★★★★

Overview: Dr. Martens is a renowned footwear company specializing in the design, manufacturing, and sale of iconic boots and shoes with a market capitalization of approximately £2.5 billion.

Operations: The primary revenue stream for the company is derived from footwear sales amounting to £805.9 million. The gross profit margin has shown an upward trend, reaching 65.52% by September 2024, while operating expenses have consistently increased over time, impacting net income margins.

PE: 18.4x

Dr. Martens, a company with a rich heritage in footwear, is capturing attention as an undervalued stock in Europe. Despite profit margins dropping from 10.6% to 3.6%, earnings are projected to grow by 39.72% annually, indicating potential for future improvement. Recent insider confidence is evident through share purchases over the past year, signaling belief in the company's prospects. The addition of experienced directors like Robert Hanson could bolster strategic growth initiatives and enhance market positioning going forward.

- Dive into the specifics of Dr. Martens here with our thorough valuation report.

Evaluate Dr. Martens' historical performance by accessing our past performance report.

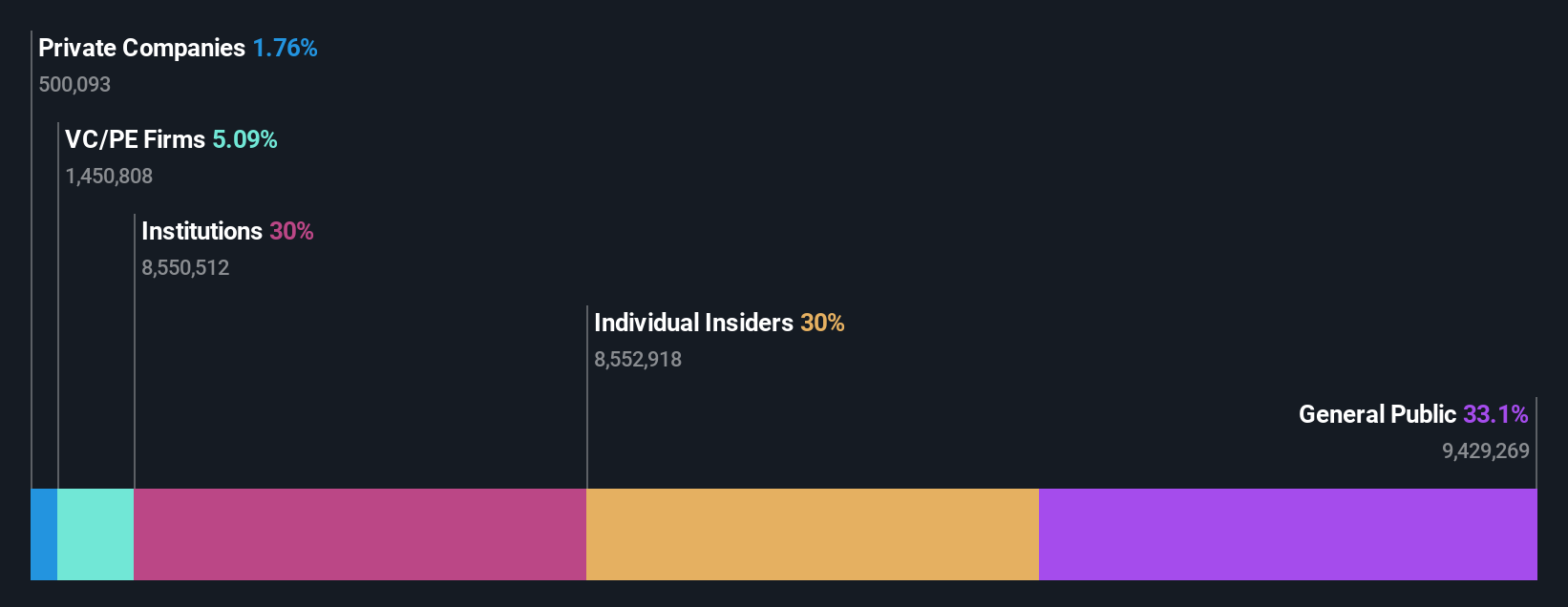

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wilmington is a company engaged in providing information, education, and networking services across sectors such as legal, finance, and health, safety and environment (HSE), with a market cap of £0.29 billion.

Operations: The company's revenue primarily stems from its Finance segment, followed by contributions from Legal and Health, Safety and Environment (HSE) sectors. Over the observed periods, gross profit margin has shown variability, peaking at 22.30% in December 2024. Operating expenses have generally decreased over time, with a significant drop noted in recent years. Non-operating expenses have also fluctuated significantly across different periods.

PE: 23.4x

Wilmington, a smaller European company, is drawing attention for its potential value. Despite a dip in net income to £2.59 million for the half year ending December 2024, sales increased to £46.57 million from the previous year. Insider confidence is evident with share repurchases beginning February 2025 under a shareholder-approved program. The company maintains its dividend at 3 pence per share and forecasts earnings growth of nearly 17% annually, suggesting promising prospects amid executive changes slated for June 2025.

- Navigate through the intricacies of Wilmington with our comprehensive valuation report here.

Examine Wilmington's past performance report to understand how it has performed in the past.

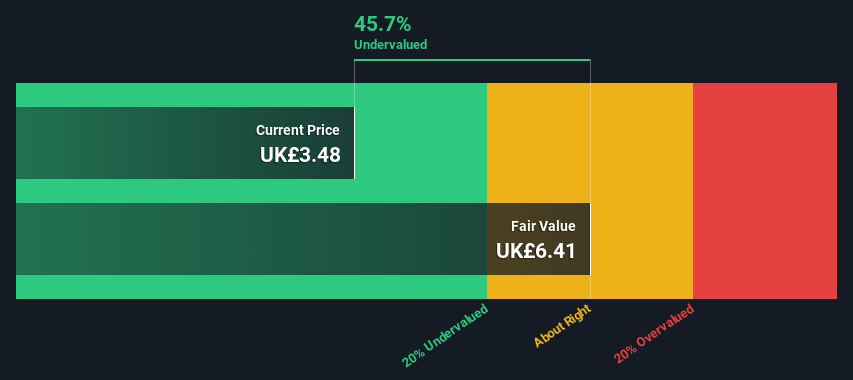

NOTE (OM:NOTE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NOTE is a technology-focused company specializing in manufacturing and delivering high-quality electronics, with a market cap of SEK 4.68 billion.

Operations: The company generates revenue primarily from Western Europe, with significant contributions also coming from the Rest of World segment. Over recent periods, gross profit margin has shown an upward trend, reaching 13.54% by early 2025. Operating expenses have fluctuated but remain a key component affecting net income margins, which stand at approximately 6.47%.

PE: 18.6x

NOTE AB, a European small-cap, recently reported Q1 2025 sales of SEK 1,003 million with net income at SEK 65 million. Despite a slight dip in sales from the previous year, earnings per share increased to SEK 2.27. Insider confidence is evident as Director Johan Hagberg acquired 4,047 shares for approximately US$600K between March and April 2025. The company expects Q2 sales between SEK 950-1,050 million and proposed a dividend of SEK 7 per share at their AGM on April 24th. Earnings are projected to grow annually by over 16%.

- Delve into the full analysis valuation report here for a deeper understanding of NOTE.

Understand NOTE's track record by examining our Past report.

Seize The Opportunity

- Click here to access our complete index of 61 Undervalued European Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOTE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOTE

NOTE

Provides electronics manufacturing services in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives