- United Kingdom

- /

- Commercial Services

- /

- AIM:RST

3 UK Stocks Estimated To Be Trading Below Fair Value By Up To 38.1%

Reviewed by Simply Wall St

The United Kingdom market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In this environment, identifying stocks that are trading below their fair value can be an appealing strategy for investors looking to capitalize on potential long-term gains amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victrex (LSE:VCT) | £7.86 | £15.58 | 49.6% |

| LSL Property Services (LSE:LSL) | £2.95 | £5.61 | 47.4% |

| Informa (LSE:INF) | £7.906 | £14.45 | 45.3% |

| Ibstock (LSE:IBST) | £1.628 | £3.13 | 48% |

| Huddled Group (AIM:HUD) | £0.032 | £0.06 | 46.5% |

| Greatland Gold (AIM:GGP) | £0.165 | £0.3 | 44.4% |

| Gooch & Housego (AIM:GHH) | £5.88 | £11.02 | 46.6% |

| GlobalData (AIM:DATA) | £1.545 | £3.08 | 49.9% |

| Entain (LSE:ENT) | £7.476 | £13.64 | 45.2% |

| Duke Capital (AIM:DUKE) | £0.295 | £0.53 | 44.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Restore (AIM:RST)

Overview: Restore plc, along with its subsidiaries, offers secure and sustainable business services for data, information, communications, and assets primarily in the United Kingdom with a market cap of £351.89 million.

Operations: The company's revenue segments include Datashred (£36 million), Technology (£36.10 million), Harrow Green (£35.30 million), and Information Management (£167.90 million).

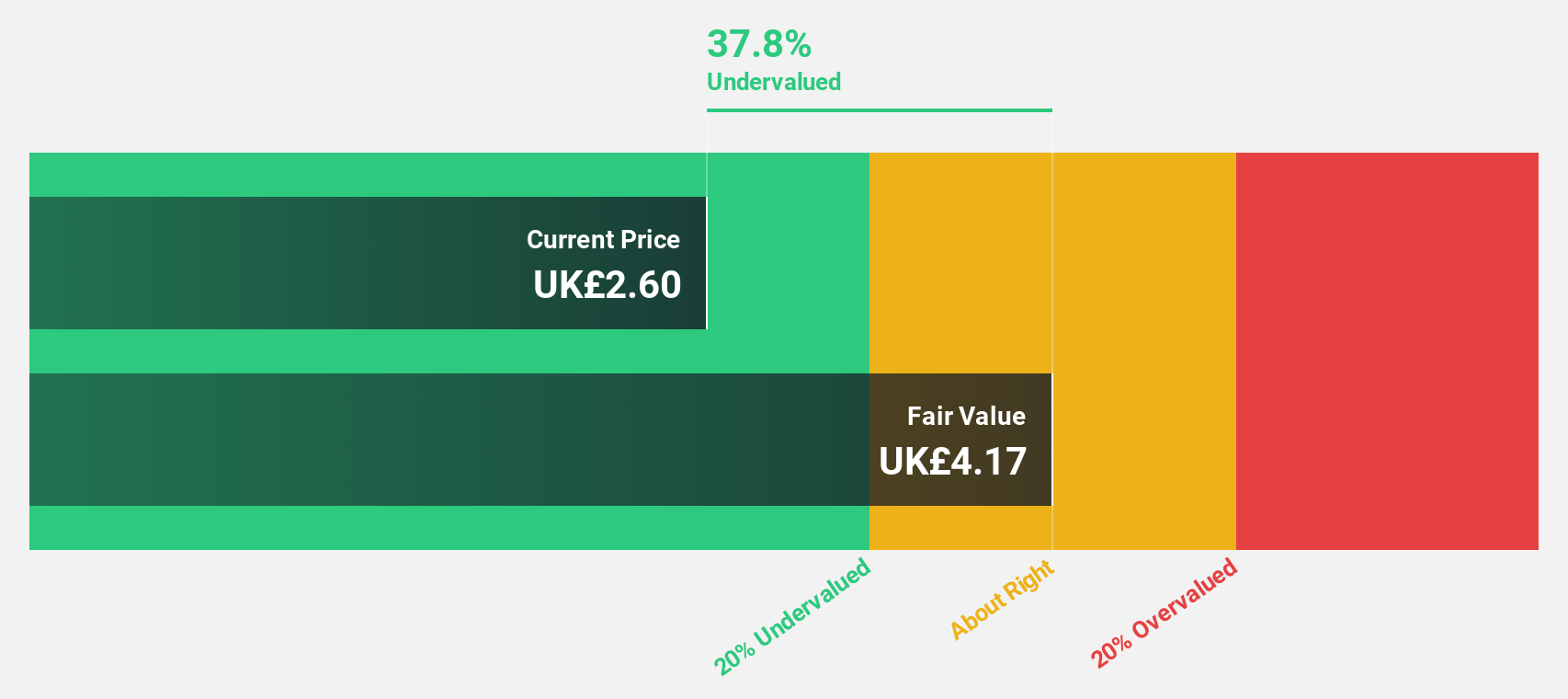

Estimated Discount To Fair Value: 38.1%

Restore is trading at £2.57, significantly below its estimated fair value of £4.15, suggesting it may be undervalued based on discounted cash flows. Despite a slower revenue growth forecast of 10.6% per year compared to the market's 3.6%, earnings are expected to grow significantly at 24.8% annually, outpacing the UK market average of 14.4%. The company recently became profitable with a net income of £12.4 million for 2024 and announced an increased dividend payout.

- Our growth report here indicates Restore may be poised for an improving outlook.

- Get an in-depth perspective on Restore's balance sheet by reading our health report here.

Dr. Martens (LSE:DOCS)

Overview: Dr. Martens plc designs, develops, procures, markets, sells, and distributes footwear under the Dr. Martens brand and has a market cap of £738.40 million.

Operations: Dr. Martens generates revenue primarily from its footwear segment, which amounts to £787.60 million.

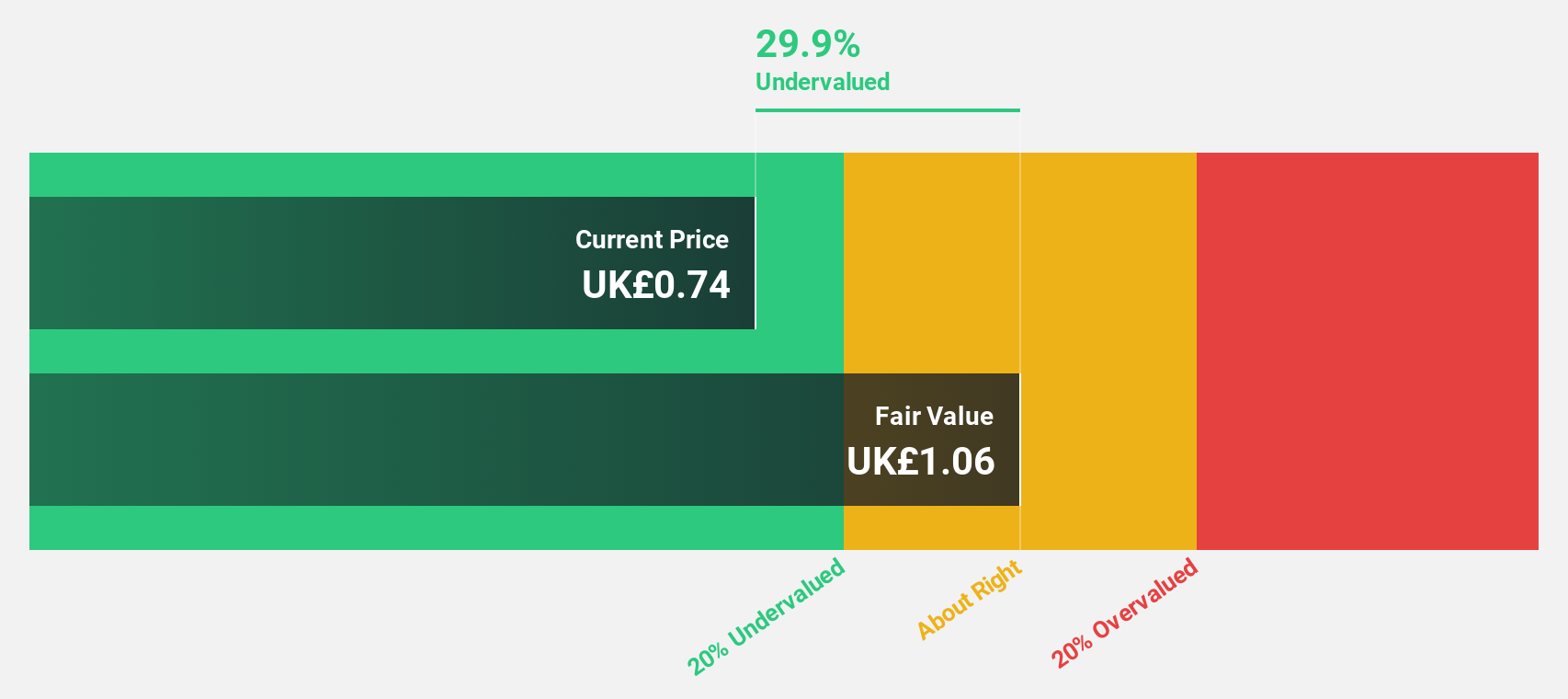

Estimated Discount To Fair Value: 27.9%

Dr. Martens is trading at £0.77, below its estimated fair value of £1.06, highlighting potential undervaluation based on cash flows. Despite a volatile share price and a recent decline in net income to £4.5 million from £69.2 million, earnings are forecast to grow significantly at 47.8% annually over the next three years, outpacing the UK market average of 14.4%. However, profit margins have decreased and dividends remain undercovered by earnings.

- Our comprehensive growth report raises the possibility that Dr. Martens is poised for substantial financial growth.

- Take a closer look at Dr. Martens' balance sheet health here in our report.

Mitie Group (LSE:MTO)

Overview: Mitie Group plc, along with its subsidiaries, offers facilities management and professional services both in the United Kingdom and internationally, with a market capitalization of £1.78 billion.

Operations: Mitie's revenue segments include Communities (£869.80 million), Business Services (£2.24 billion), and Technical Services (£1.98 billion).

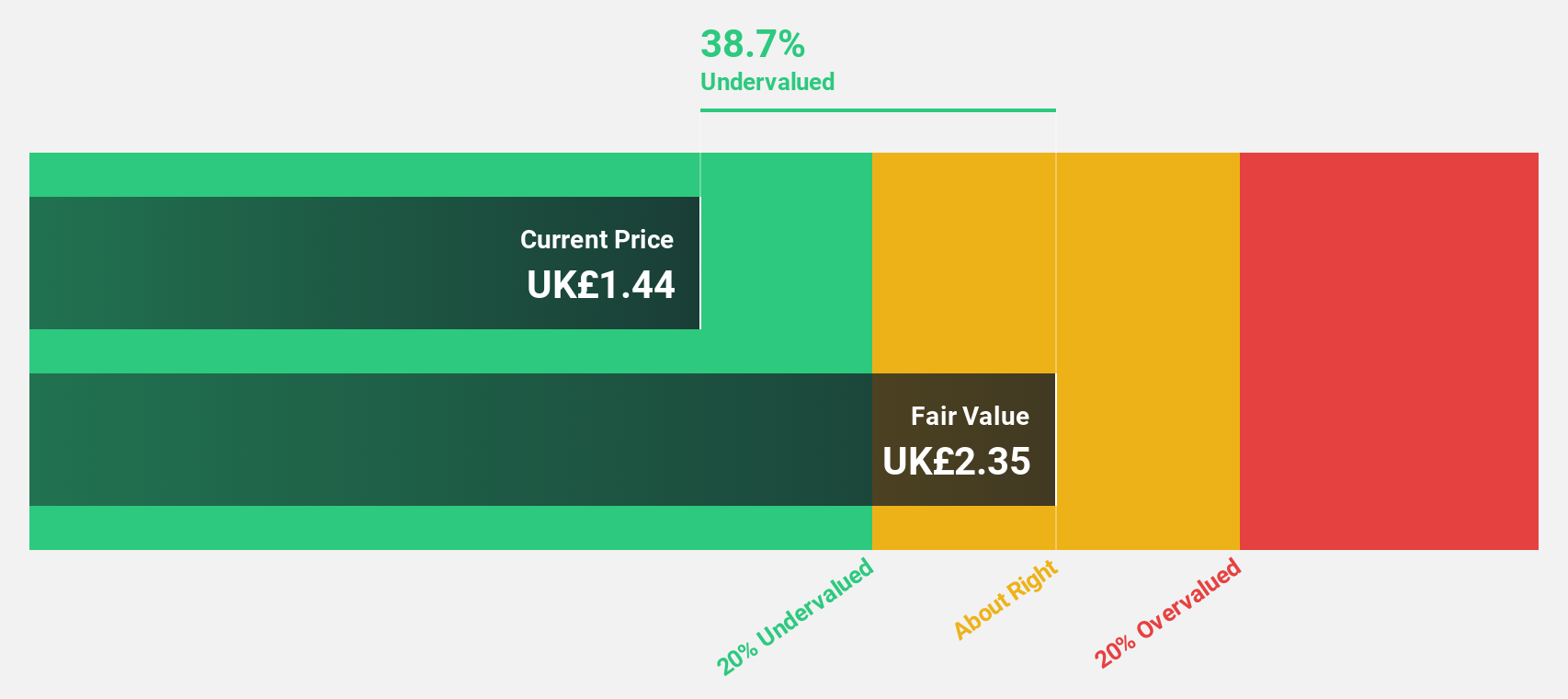

Estimated Discount To Fair Value: 37.6%

Mitie Group, trading at £1.47, is undervalued compared to its fair value estimate of £2.35, with earnings projected to grow 16.6% annually, outpacing the UK market's 14.4%. The company recently completed a share buyback worth £2.8 million and announced an 8% dividend increase for FY25 despite a dip in net income from £126.3 million to £101.4 million year-on-year amidst ongoing M&A discussions with Marlowe plc.

- Upon reviewing our latest growth report, Mitie Group's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Mitie Group's balance sheet health report.

Taking Advantage

- Unlock our comprehensive list of 55 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RST

Restore

Provides secure and sustainable business services for data, information, communications, and assets primarily in the United Kingdom.

Reasonable growth potential with proven track record and pays a dividend.

Market Insights

Community Narratives