- United Kingdom

- /

- Consumer Durables

- /

- LSE:CSP

Countryside Properties (LON:CSP) Has A Somewhat Strained Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Countryside Properties PLC (LON:CSP) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Countryside Properties

What Is Countryside Properties's Net Debt?

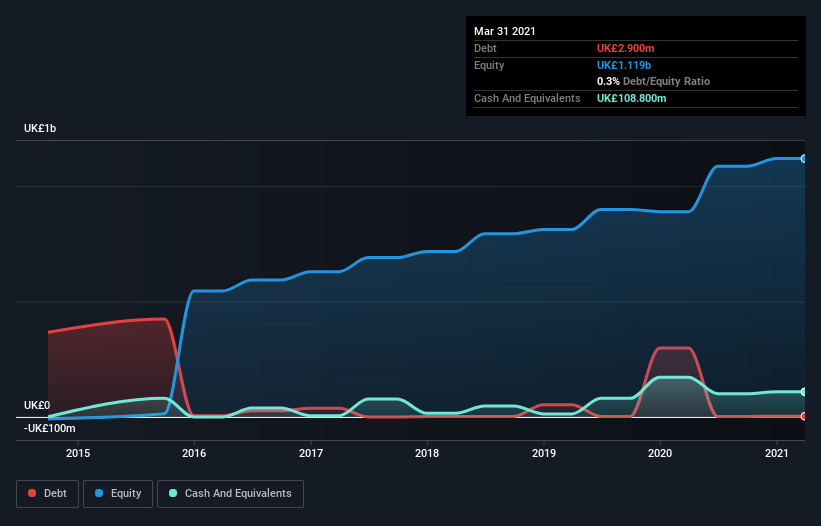

The image below, which you can click on for greater detail, shows that Countryside Properties had debt of UK£2.90m at the end of March 2021, a reduction from UK£298.2m over a year. However, it does have UK£108.8m in cash offsetting this, leading to net cash of UK£105.9m.

How Healthy Is Countryside Properties' Balance Sheet?

The latest balance sheet data shows that Countryside Properties had liabilities of UK£354.0m due within a year, and liabilities of UK£217.4m falling due after that. Offsetting this, it had UK£108.8m in cash and UK£166.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£296.2m.

Of course, Countryside Properties has a market capitalization of UK£2.63b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Countryside Properties also has more cash than debt, so we're pretty confident it can manage its debt safely.

Importantly, Countryside Properties's EBIT fell a jaw-dropping 83% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Countryside Properties's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Countryside Properties may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Considering the last three years, Countryside Properties actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Summing up

While Countryside Properties does have more liabilities than liquid assets, it also has net cash of UK£105.9m. Despite its cash we think that Countryside Properties seems to struggle to grow its EBIT, so we are wary of the stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Countryside Properties has 1 warning sign we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Countryside Properties or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CSP

Countryside Partnerships

Countryside Partnerships PLC operates as a home builder and urban regeneration partner in the United Kingdom.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives