- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRST

How Many Crest Nicholson Holdings plc (LON:CRST) Shares Did Insiders Buy, In The Last Year?

We often see insiders buying up shares in companies that perform well over the long term. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in Crest Nicholson Holdings plc (LON:CRST).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, most countries require that the company discloses such transactions to the market.

We don't think shareholders should simply follow insider transactions. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

See our latest analysis for Crest Nicholson Holdings

The Last 12 Months Of Insider Transactions At Crest Nicholson Holdings

The CEO & Director Peter Truscott made the biggest insider purchase in the last 12 months. That single transaction was for UK£182k worth of shares at a price of UK£2.02 each. Even though the purchase was made at a significantly lower price than the recent price (UK£4.15), we still think insider buying is a positive. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

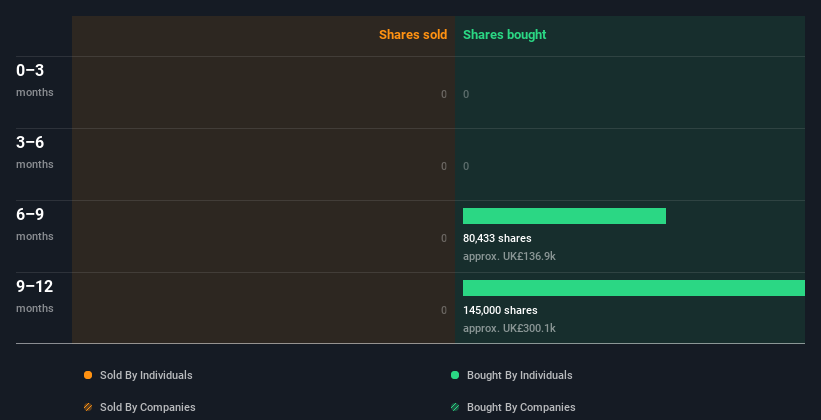

Crest Nicholson Holdings insiders may have bought shares in the last year, but they didn't sell any. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Crest Nicholson Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does Crest Nicholson Holdings Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 0.7% of Crest Nicholson Holdings shares, worth about UK£7.5m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Do The Crest Nicholson Holdings Insider Transactions Indicate?

There haven't been any insider transactions in the last three months -- that doesn't mean much. On a brighter note, the transactions over the last year are encouraging. While we have no worries about the insider transactions, we'd be more comfortable if they owned more Crest Nicholson Holdings stock. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Crest Nicholson Holdings. While conducting our analysis, we found that Crest Nicholson Holdings has 1 warning sign and it would be unwise to ignore this.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Crest Nicholson Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CRST

Crest Nicholson Holdings

Engages in building residential homes in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026