- United Kingdom

- /

- Consumer Durables

- /

- LSE:BTRW

UK Exchange: Three Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, influenced by weak trade data from China, which continues to struggle with economic recovery post-pandemic. Amid such market volatility and global economic uncertainties, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to capitalize on long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ASA International Group (LSE:ASAI) | £0.775 | £1.46 | 46.8% |

| Fevertree Drinks (AIM:FEVR) | £6.69 | £13.12 | 49% |

| Gaming Realms (AIM:GMR) | £0.3695 | £0.72 | 48.5% |

| Brickability Group (AIM:BRCK) | £0.636 | £1.26 | 49.6% |

| Zotefoams (LSE:ZTF) | £3.07 | £5.80 | 47% |

| Informa (LSE:INF) | £8.032 | £15.88 | 49.4% |

| Duke Capital (AIM:DUKE) | £0.30 | £0.58 | 48.1% |

| Victrex (LSE:VCT) | £10.56 | £19.83 | 46.8% |

| Quartix Technologies (AIM:QTX) | £1.525 | £2.92 | 47.8% |

| St. James's Place (LSE:STJ) | £8.63 | £16.51 | 47.7% |

Here's a peek at a few of the choices from the screener.

LBG Media (AIM:LBG)

Overview: LBG Media plc is an online media publisher operating in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £278.08 million.

Operations: The company's revenue is derived entirely from its online media publishing industry segment, amounting to £82.54 million.

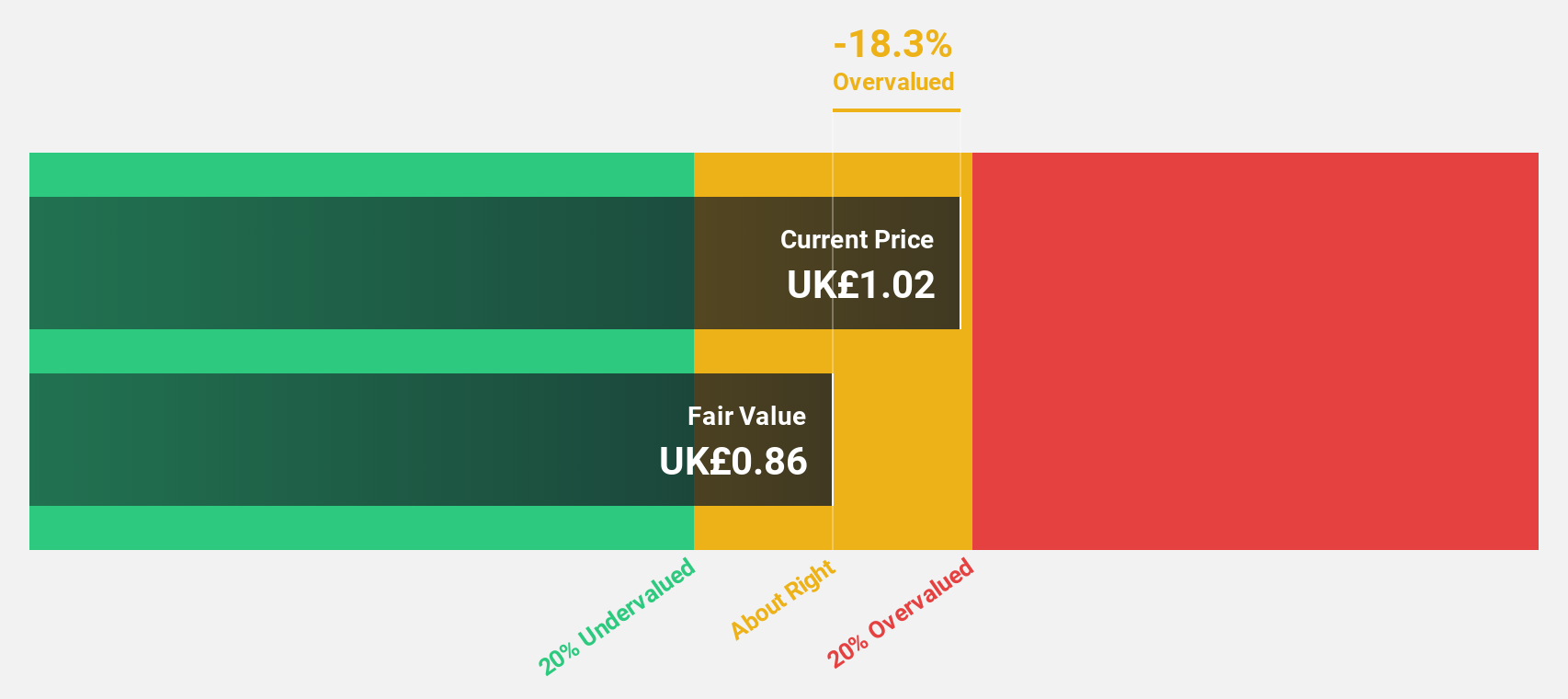

Estimated Discount To Fair Value: 26%

LBG Media is trading 26% below its estimated fair value of £1.8, with a current price of £1.33, highlighting its undervaluation based on discounted cash flows. The company's earnings are projected to grow significantly at 24.5% annually, outpacing the UK market's 14.8%. Revenue growth is expected at 9.6% per year, faster than the overall UK market rate of 3.6%, though one-off items have impacted financial results recently.

- Our earnings growth report unveils the potential for significant increases in LBG Media's future results.

- Unlock comprehensive insights into our analysis of LBG Media stock in this financial health report.

Avon Technologies (LSE:AVON)

Overview: Avon Technologies Plc, with a market cap of £423.56 million, specializes in providing respiratory and head protection products for military and first responder markets in Europe and the United States.

Operations: The company's revenue segments include Team Wendy at $129.40 million and Avon Protection at $145.60 million.

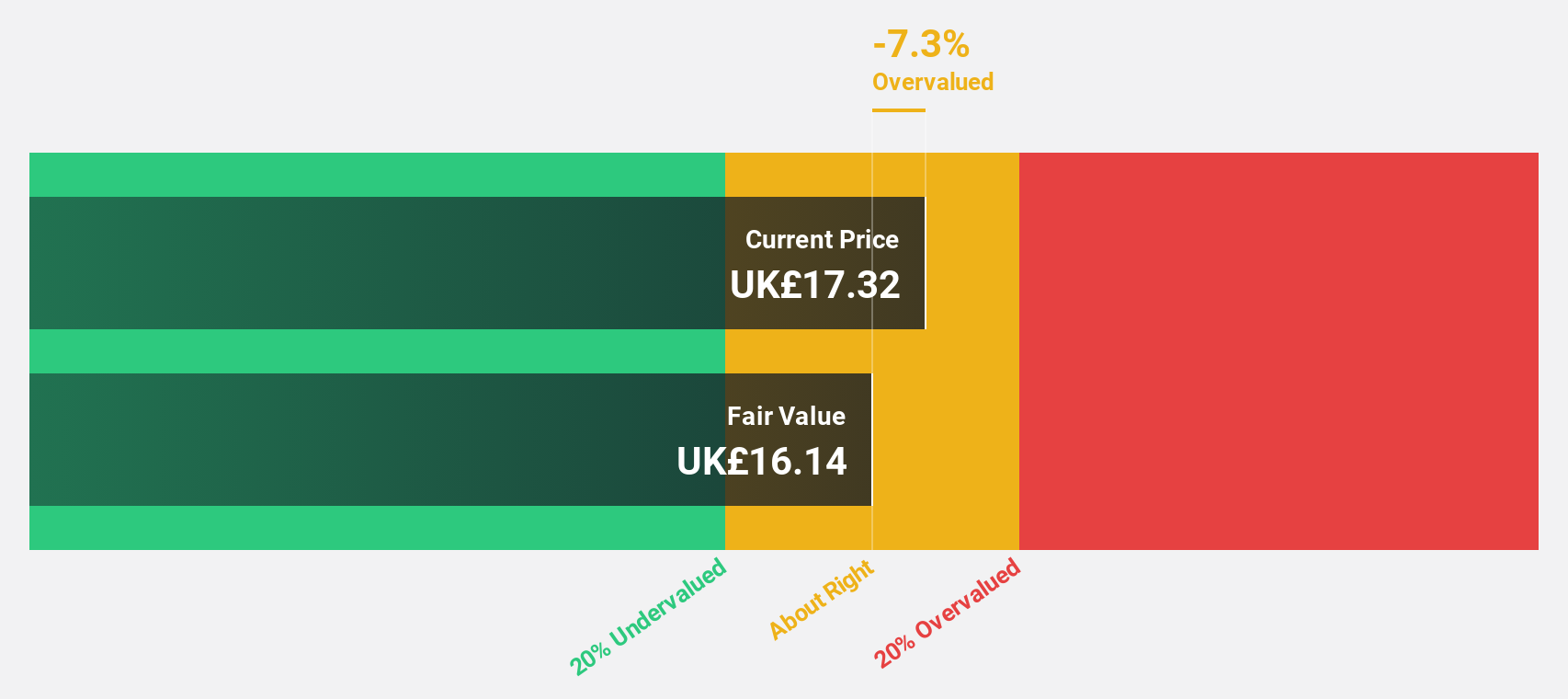

Estimated Discount To Fair Value: 29.6%

Avon Technologies, trading at £14.26, is significantly undervalued with a fair value estimate of £20.27, based on discounted cash flows. The company has turned profitable this year with net income of US$3 million and earnings per share of US$0.1, reversing last year's losses. Forecasts indicate robust annual earnings growth of 62%, well above the UK market average, while revenue growth is expected to surpass the market at 6% annually.

- Upon reviewing our latest growth report, Avon Technologies' projected financial performance appears quite optimistic.

- Get an in-depth perspective on Avon Technologies' balance sheet by reading our health report here.

Barratt Redrow (LSE:BTRW)

Overview: Barratt Redrow plc operates in the housebuilding industry within the United Kingdom and has a market capitalization of approximately £6.25 billion.

Operations: The company's revenue is primarily derived from its housebuilding segment, totaling £4.17 billion.

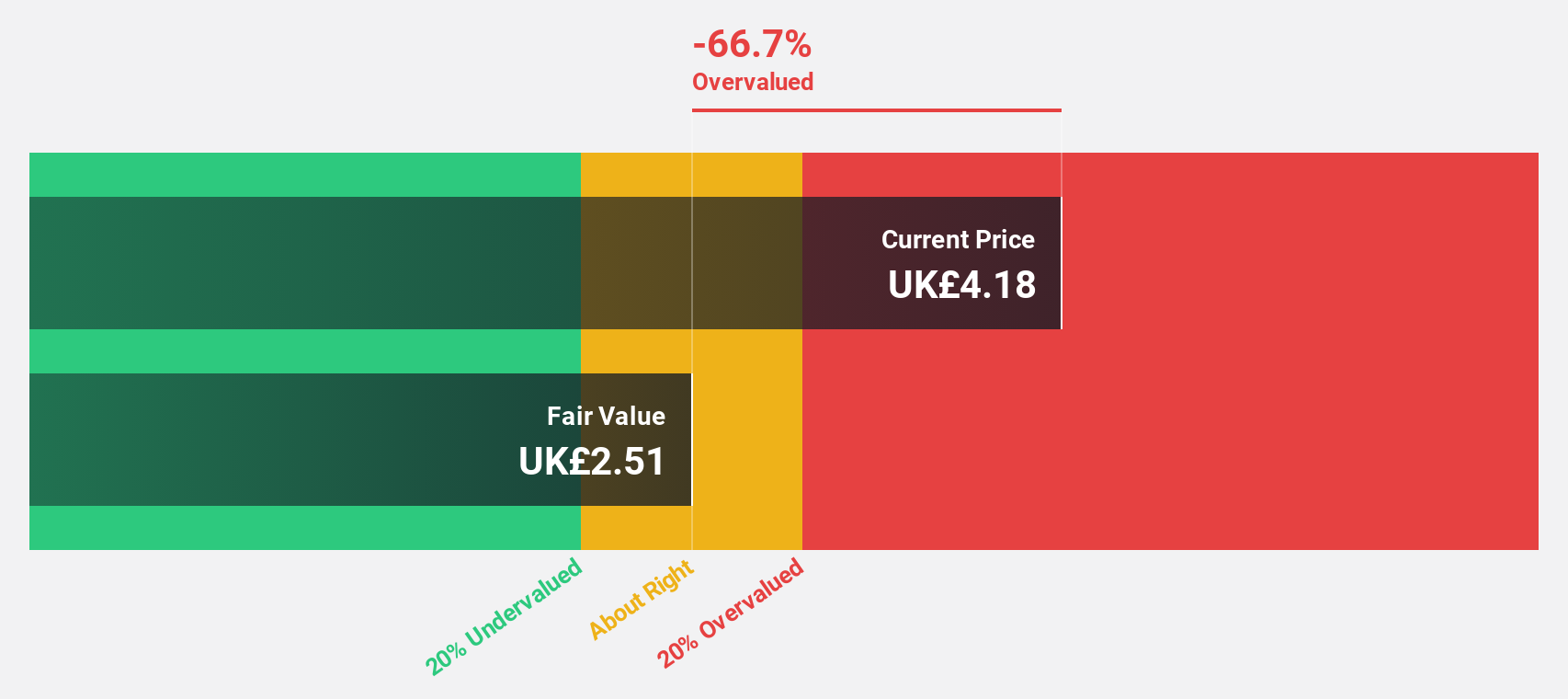

Estimated Discount To Fair Value: 26.7%

Barratt Redrow, trading at £4.33, is undervalued with a fair value estimate of £5.91, offering potential upside. Despite recent shareholder dilution and reduced profit margins from 10% to 2.7%, the company is expected to see significant earnings growth of 42.7% annually over the next three years, outpacing the UK market average of 14.8%. However, its dividend yield of 3.74% isn't well covered by earnings or cash flows, raising sustainability concerns.

- Our comprehensive growth report raises the possibility that Barratt Redrow is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Barratt Redrow's balance sheet health report.

Turning Ideas Into Actions

- Discover the full array of 55 Undervalued UK Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barratt Redrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BTRW

Barratt Redrow

Engages in the housebuilding business in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives