Tandem Group plc's (LON:TND) dividend will be increasing to UK£0.066 on 30th of June. This takes the dividend yield from 2.8% to 2.8%, which shareholders will be pleased with.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Tandem Group's stock price has reduced by 31% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

View our latest analysis for Tandem Group

Tandem Group's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, Tandem Group was earning enough to cover the dividend, but free cash flows weren't positive. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

Over the next year, EPS is forecast to fall by 30.3%. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 23%, which is comfortable for the company to continue in the future.

Dividend Volatility

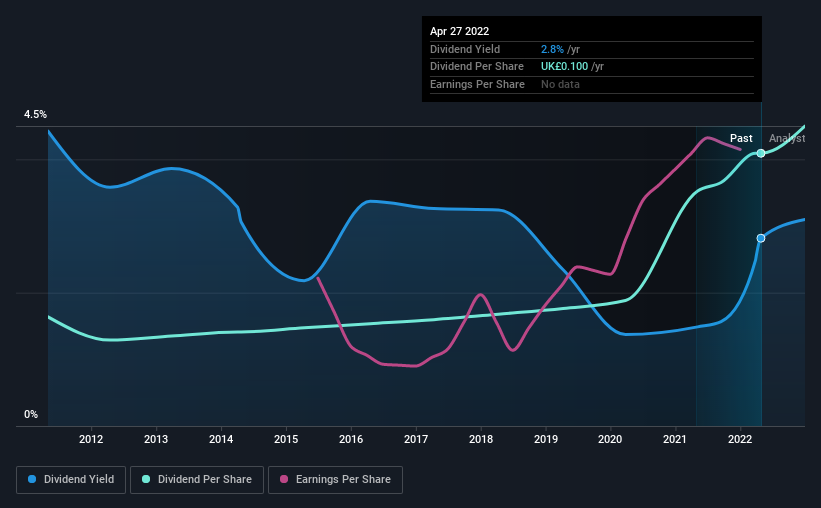

The company has a long dividend track record, but it doesn't look great with cuts in the past. The first annual payment during the last 10 years was UK£0.04 in 2012, and the most recent fiscal year payment was UK£0.10. This works out to be a compound annual growth rate (CAGR) of approximately 9.6% a year over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's encouraging to see Tandem Group has been growing its earnings per share at 35% a year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Tandem Group will make a great income stock. While Tandem Group is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 4 warning signs for Tandem Group (1 is a bit unpleasant!) that you should be aware of before investing. Is Tandem Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Tandem Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TND

Tandem Group

Designs, develops, distributes, and retails of sports, leisure, and mobility products in the United Kingdom.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.