- United Kingdom

- /

- Consumer Durables

- /

- AIM:NTBR

Northern Bear PLC (LON:NTBR) Surges 30% Yet Its Low P/E Is No Reason For Excitement

The Northern Bear PLC (LON:NTBR) share price has done very well over the last month, posting an excellent gain of 30%. The last month tops off a massive increase of 112% in the last year.

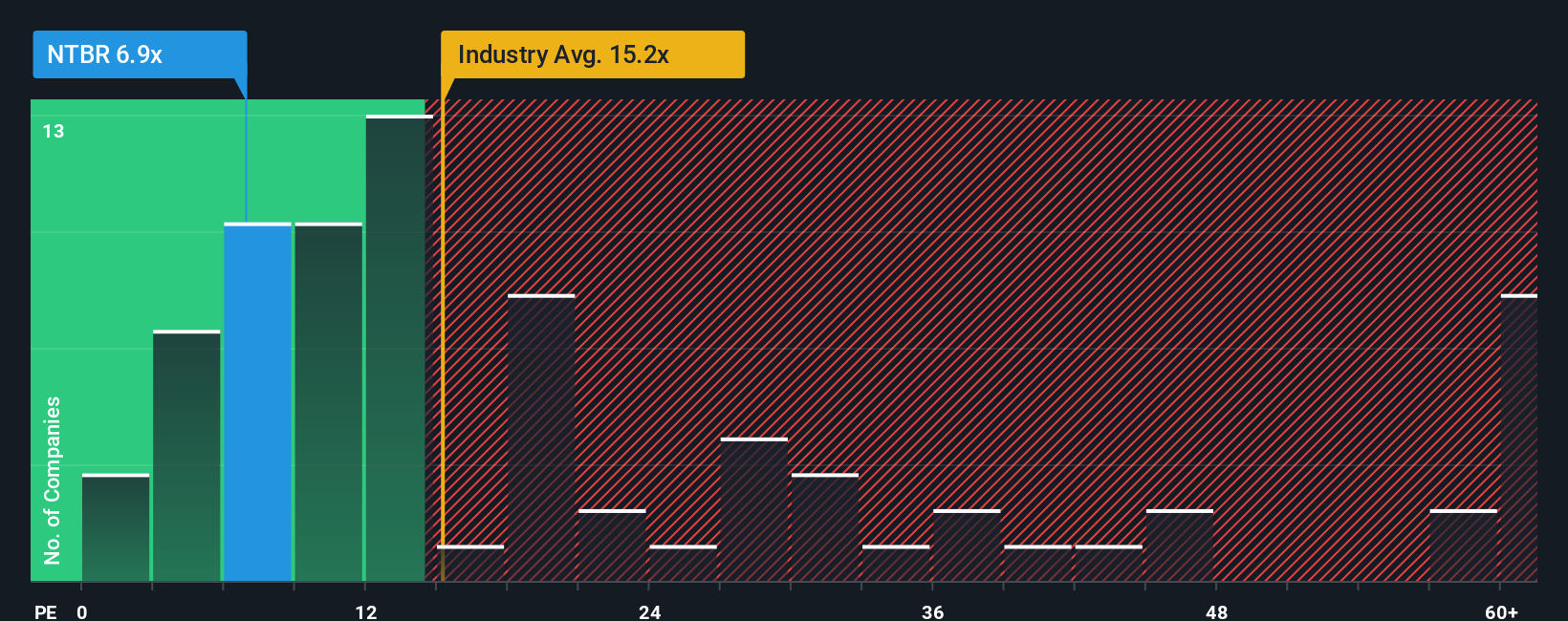

In spite of the firm bounce in price, Northern Bear may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.9x, since almost half of all companies in the United Kingdom have P/E ratios greater than 17x and even P/E's higher than 31x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Northern Bear certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Northern Bear

Is There Any Growth For Northern Bear?

Northern Bear's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 77% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 4.4% during the coming year according to the one analyst following the company. That's shaping up to be materially lower than the 22% growth forecast for the broader market.

With this information, we can see why Northern Bear is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Northern Bear's recent share price jump still sees its P/E sitting firmly flat on the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Northern Bear maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Northern Bear that you need to be mindful of.

If you're unsure about the strength of Northern Bear's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Northern Bear might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:NTBR

Northern Bear

Provides building and support services to local authorities, housing associations, NHS trusts, universities, construction companies, and national house builders in Northern England and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives