- United Kingdom

- /

- Leisure

- /

- AIM:HRN

Shareholders have faith in loss-making Hornby (LON:HRN) as stock climbs 12% in past week, taking one-year gain to 60%

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Hornby PLC (LON:HRN) share price is 60% higher than it was a year ago, much better than the market return of around 5.5% (not including dividends) in the same period. So that should have shareholders smiling. Unfortunately the longer term returns are not so good, with the stock falling 41% in the last three years.

Since it's been a strong week for Hornby shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Hornby

Hornby isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Hornby saw its revenue grow by 2.1%. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 60%. That's not a standout result, but it is solid - much like the level of revenue growth. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

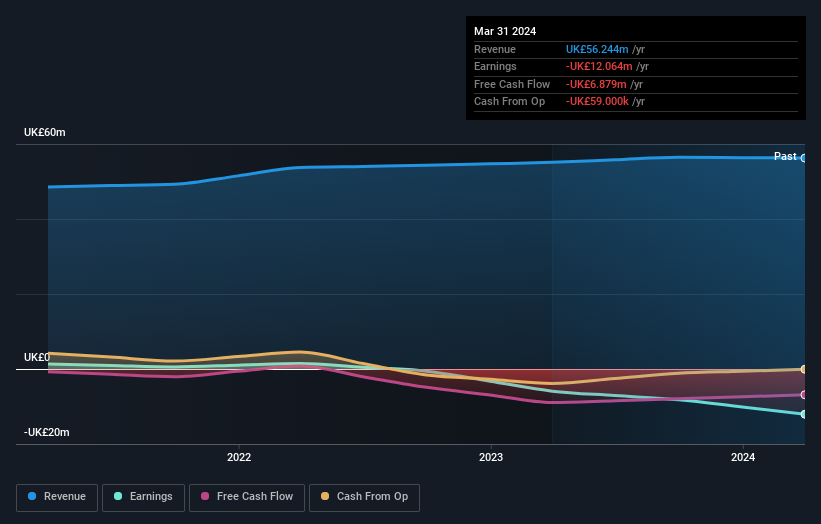

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Hornby shareholders have received a total shareholder return of 60% over one year. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Hornby has 4 warning signs (and 2 which are significant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hornby might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HRN

Hornby

Through its subsidiaries, designs, develops, sources, and distributes hobby and interactive products in the United Kingdom, the United States, Spain, Italy, and rest of Europe.

Slight and slightly overvalued.