- Canada

- /

- Residential REITs

- /

- TSX:HOM.UN

Undervalued Small Caps With Insider Action In Global April 2025

Reviewed by Simply Wall St

In the midst of a mixed performance across major stock indexes, smaller-cap indices like the S&P MidCap 400 and Russell 2000 have shown resilience, posting gains despite broader market challenges. This environment highlights the potential opportunities within small-cap stocks, especially those experiencing insider activity which may signal confidence in their underlying value amidst global economic uncertainties.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.4x | 0.5x | 44.10% | ★★★★★★ |

| Nexus Industrial REIT | 5.2x | 2.7x | 24.84% | ★★★★★★ |

| Tristel | 26.0x | 3.7x | 31.17% | ★★★★★☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 41.57% | ★★★★☆☆ |

| Saturn Oil & Gas | 5.6x | 0.4x | 8.78% | ★★★★☆☆ |

| Norcros | 24.2x | 0.6x | 28.45% | ★★★☆☆☆ |

| FRP Advisory Group | 12.6x | 2.2x | 9.02% | ★★★☆☆☆ |

| Arendals Fossekompani | 20.6x | 1.6x | 48.72% | ★★★☆☆☆ |

| Westshore Terminals Investment | 13.3x | 3.8x | 38.38% | ★★★☆☆☆ |

| Calfrac Well Services | 34.8x | 0.2x | 26.31% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

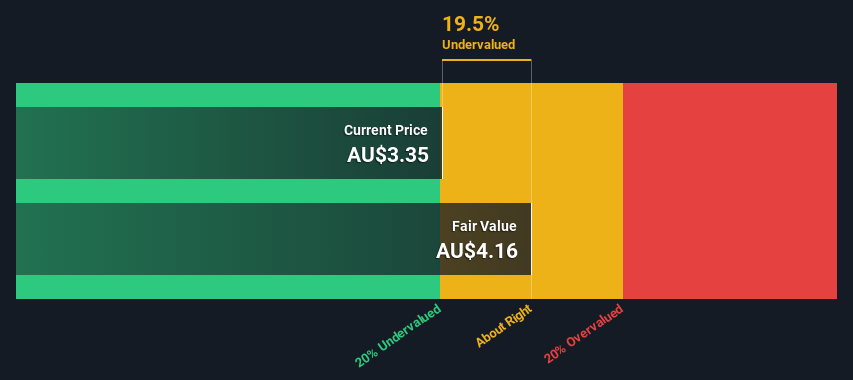

Charter Hall Retail REIT (ASX:CQR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Charter Hall Retail REIT focuses on investing in convenience-based retail properties, with a market cap of A$2.13 billion.

Operations: Convenience Shopping Centre Retail is the primary revenue stream, generating A$223.6 million, while Convenience Net Lease Retail contributes A$52 million. The net income margin showed a notable fluctuation over the years, reaching a peak of 1.33 in June 2022 before declining to -0.58 by December 2023, indicating significant variations in profitability during that period.

PE: 12.9x

Charter Hall Retail REIT, a smaller player in the real estate investment trust sector, is currently seen as undervalued. Despite an expected slight decline in earnings by 0.1% annually over the next three years, insider confidence is evident with David Harrison purchasing over 100,000 shares worth A$353,423. The company recently reaffirmed its fiscal year 2025 distribution and earnings guidance at 24.7 cents and approximately 25.4 cents per unit respectively, indicating stability amidst challenging market conditions.

- Delve into the full analysis valuation report here for a deeper understanding of Charter Hall Retail REIT.

Assess Charter Hall Retail REIT's past performance with our detailed historical performance reports.

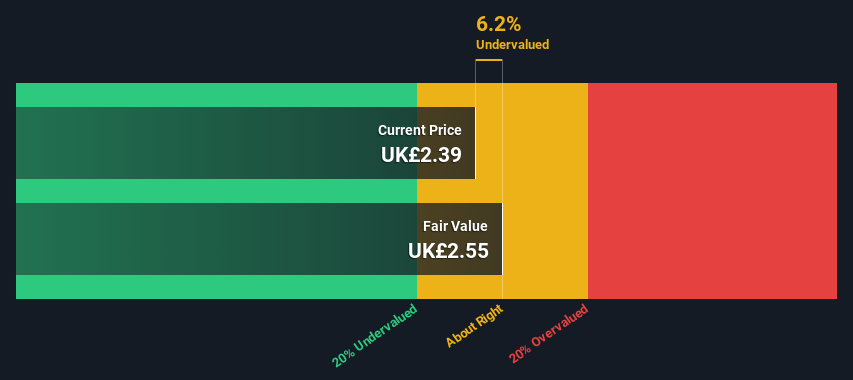

SThree (LSE:STEM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SThree is a global staffing company specializing in the recruitment of professionals across various sectors, with a market cap of £0.81 billion.

Operations: Revenue streams are primarily derived from the DACH region, Netherlands (including Spain), and the USA. The company experienced a decline in gross profit margin from 30.21% to 24.72% over the observed periods, indicating changes in cost management or pricing strategies. Operating expenses have been consistently significant, with general and administrative expenses forming a substantial part of these costs.

PE: 6.2x

SThree, a smaller company in the staffing industry, recently saw insider confidence as insiders purchased shares between January and March 2025. Despite being dropped from several indices on March 22, 2025, SThree remains attractive due to its low valuation. However, challenges include declining earnings projections at an average rate of 18.2% annually over the next three years and reliance on external borrowing for funding. The proposed final dividend decreased to £12.2 million, reflecting cautious financial management amid these hurdles.

- Click here to discover the nuances of SThree with our detailed analytical valuation report.

Review our historical performance report to gain insights into SThree's's past performance.

BSR Real Estate Investment Trust (TSX:HOM.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BSR Real Estate Investment Trust is a Canadian-based company focused on owning and managing residential real estate properties, with a market capitalization of approximately $1.06 billion.

Operations: The primary revenue stream for BSR Real Estate Investment Trust is derived from its residential real estate operations, with the latest reported figure at $168.67 million. The company experienced fluctuations in its net income margin, which notably reached a peak of 2.80% but also recorded negative margins in recent periods, such as -1.26%. Gross profit margin showed variability over time, reaching up to 60.28% before settling around 54-56% in recent quarters. Operating expenses have consistently been a factor affecting profitability, with general and administrative expenses being a significant component within this category.

PE: -10.1x

BSR Real Estate Investment Trust, a smaller player in the real estate sector, has been attracting attention due to its insider confidence. Independent Trustee Graham Senst recently purchased 10,000 shares for approximately US$182,061 in April 2025. Despite earnings declining by 27.7% annually over five years and relying on external borrowing for funding, BSR's consistent monthly cash distribution of US$0.0467 per unit suggests steady income potential for investors seeking regular dividends amidst financial restructuring efforts with new CFO Tom Cirbus at the helm.

Where To Now?

- Explore the 155 names from our Undervalued Global Small Caps With Insider Buying screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BSR Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HOM.UN

BSR Real Estate Investment Trust

An internally managed, unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario.

Moderate growth potential second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)