- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2411

Global Undervalued Small Caps With Insider Action October 2025

Reviewed by Simply Wall St

In October 2025, global markets are navigating a complex landscape with U.S. stocks advancing despite volatile trade headlines and rising oil prices, while small-cap indices like the Russell 2000 and S&P MidCap 400 have notably outperformed their large-cap peers. Amidst this backdrop of shifting economic indicators and market sentiment, identifying promising small-cap stocks involves looking for companies that can leverage current market conditions such as lower-than-expected inflation rates or improved business activity to drive growth and resilience.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 16.3x | 4.0x | 21.75% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 29.03% | ★★★★★☆ |

| Senior | 24.8x | 0.8x | 25.67% | ★★★★☆☆ |

| GDI Integrated Facility Services | 18.9x | 0.3x | 0.53% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.35% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.5x | 1.7x | 22.52% | ★★★★☆☆ |

| Sagicor Financial | 7.0x | 0.4x | -67.46% | ★★★★☆☆ |

| Bumitama Agri | 11.4x | 1.6x | 44.36% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.6x | 0.4x | -433.63% | ★★★☆☆☆ |

| Chinasoft International | 24.9x | 0.8x | -1379.71% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

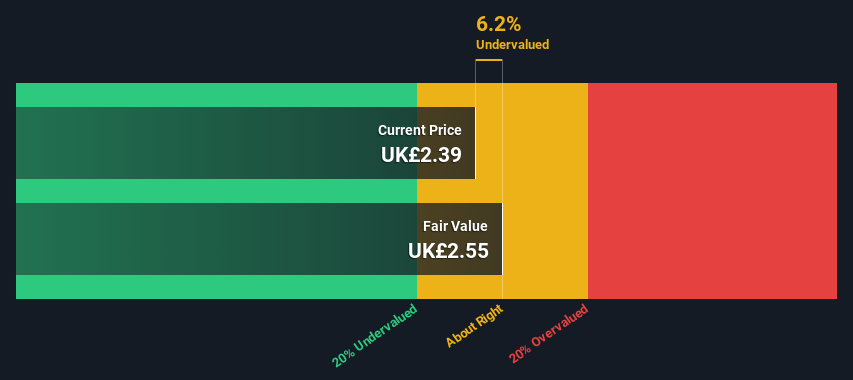

SThree (LSE:STEM)

Simply Wall St Value Rating: ★★★★★☆

Overview: SThree is a specialist staffing company that focuses on providing recruitment services across various sectors, with significant operations in the USA, DACH region, and other parts of Europe; it has a market capitalization of approximately £1.26 billion.

Operations: SThree's revenue primarily comes from its operations in DACH, the Netherlands (including Spain), and the Rest of Europe. Over recent periods, there has been a noticeable decline in gross profit margin from 26.73% to 24.62%. Operating expenses have consistently accounted for a significant portion of total costs, with general and administrative expenses being a major component.

PE: 7.1x

SThree, recognized for its niche in STEM recruitment, has faced challenges with a dip in net fees to £81.5 million for Q3 2025 from £92.7 million the previous year and a reduced net profit margin of 2.1%. Despite these hurdles, insider confidence remains evident through recent share purchases over the past six months. The company maintains its interim dividend at 5.1 pence per share, signaling stability amidst volatility and external borrowing risks that define its funding structure.

- Dive into the specifics of SThree here with our thorough valuation report.

Assess SThree's past performance with our detailed historical performance reports.

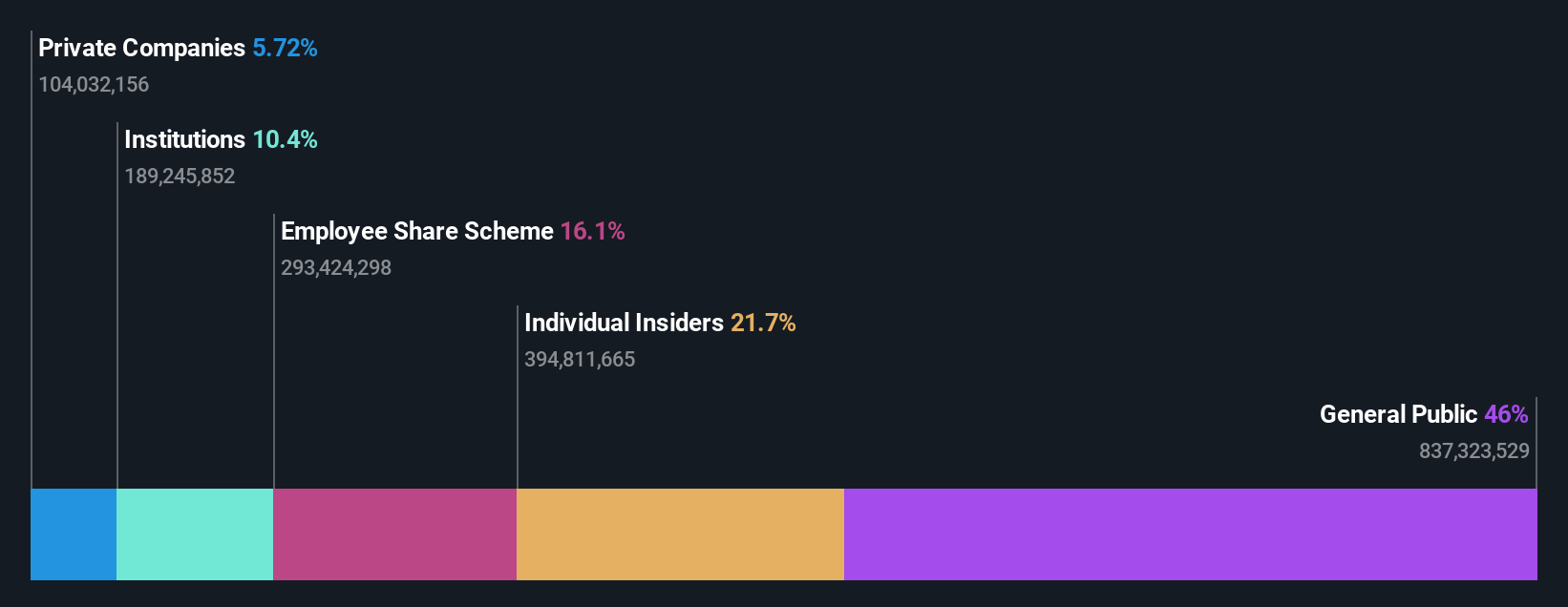

Shenzhen Pagoda Industrial (Group) (SEHK:2411)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Shenzhen Pagoda Industrial (Group) operates primarily in the trading and franchising sectors, with a focus on fruit retailing, and has a market cap of CN¥11.24 billion.

Operations: The company's primary revenue streams are derived from franchising and trading, with franchising contributing significantly more. Over recent periods, the net income margin has shown a declining trend, reaching -9.02% by mid-2025. Operating expenses, including substantial sales and marketing costs, have consistently impacted profitability.

PE: -4.4x

Shenzhen Pagoda Industrial (Group) has seen insider confidence with Yue Jiao acquiring 930,000 shares, reflecting a 13.6% change in their holdings. Despite recent challenges, including a net loss of CNY 342 million for the first half of 2025 and volatile share prices, the company remains focused on strategic transformation. Their proactive store network optimization reduced locations from 6,025 to 4,386 by June 2025. Future growth is anticipated through product diversification and enhancing store profitability amidst ongoing financial restructuring efforts.

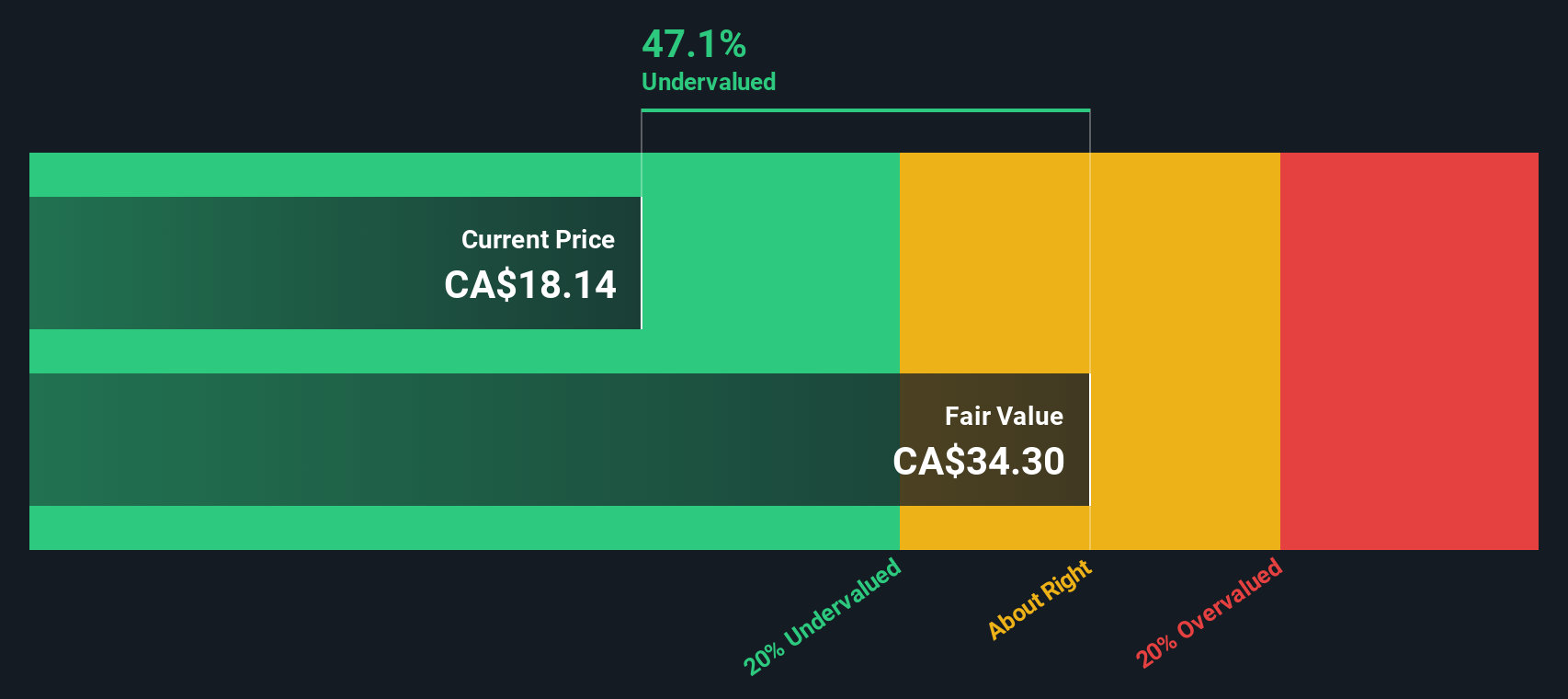

Neo Performance Materials (TSX:NEO)

Simply Wall St Value Rating: ★★★★★★

Overview: Neo Performance Materials specializes in advanced industrial materials, focusing on segments like Magnequench, Rare Metals, and Chemicals & Oxides, with a market capitalization of approximately $0.5 billion.

Operations: The company's revenue is primarily derived from segments such as Magnequench, Rare Metals, and Chemicals & Oxides. Its gross profit margin has shown variability, most recently recorded at 29.95% in the quarter ending June 2025. Operating expenses and non-operating expenses have been significant factors affecting net income across periods.

PE: -54.6x

Neo Performance Materials, a key player in the rare earth magnet industry, is gaining traction with its recent strategic moves. The opening of a new facility in Estonia and a partnership with Bosch positions them to capitalize on growing demand in electric vehicles and renewable energy sectors. Their earnings for Q2 2025 showed sales of US$114.7 million, up from US$107.55 million the previous year, reflecting solid financial performance. Insider confidence is evident as they repurchased shares worth C$4.97 million between June and August 2025, signaling potential value perception at current levels.

- Delve into the full analysis valuation report here for a deeper understanding of Neo Performance Materials.

Gain insights into Neo Performance Materials' past trends and performance with our Past report.

Make It Happen

- Dive into all 118 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2411

Shenzhen Pagoda Industrial (Group)

Operates as a fruit retailer in China, Indonesia, Singapore, Hong Kong, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives