- United Kingdom

- /

- Capital Markets

- /

- LSE:JTC

JTC (LON:JTC) Shareholders Have Enjoyed A 16% Share Price Gain

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. To wit, the JTC PLC (LON:JTC) share price is 16% higher than it was a year ago, much better than the market return of around 8.1% (not including dividends) in the same period. That's a solid performance by our standards! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View 2 warning signs we detected for JTC

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year JTC grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We doubt the modest 1.0% dividend yield is doing much to support the share price. However the year on year revenue growth of 32% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

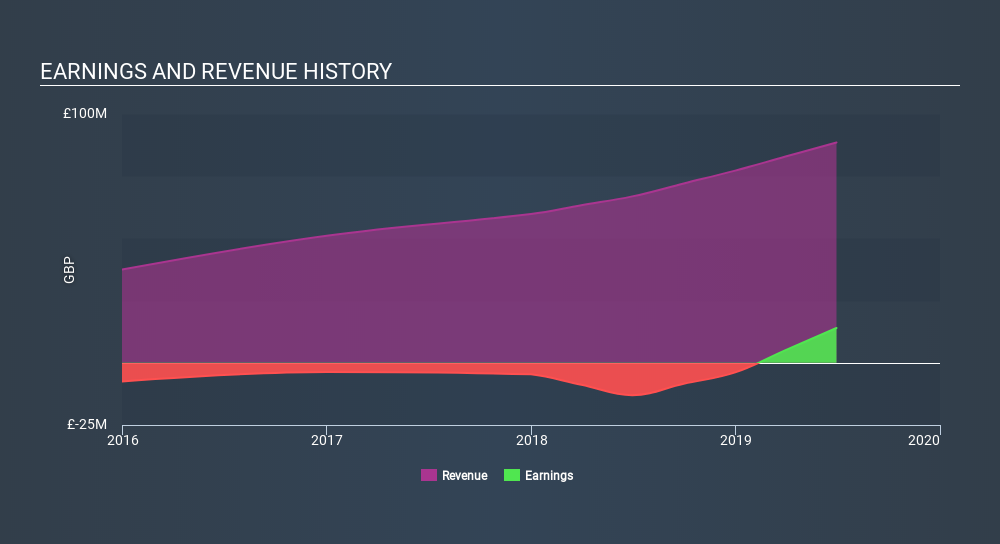

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that JTC has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that JTC shareholders have gained 17% over the last year , including dividends . Unfortunately the share price is down 2.5% over the last quarter. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for JTC which any shareholder or potential investor should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:JTC

JTC

Provides fund, corporate, and private wealth services to institutional and private clients.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives