- United Kingdom

- /

- Professional Services

- /

- LSE:ITRK

Quite a few insiders invested in Intertek Group plc (LON:ITRK) last year which is positive news for shareholders

Generally, when a single insider buys stock, it is usually not a big deal. However, when several insiders are buying, like in the case of Intertek Group plc (LON:ITRK), it sends a favourable message to the company's shareholders.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

However if you'd rather see where the opportunities and risks are within ITRK's industry, you can check out our analysis on the GB Professional Services industry.

The Last 12 Months Of Insider Transactions At Intertek Group

The Senior Independent Non-Executive Director Graham Allan made the biggest insider purchase in the last 12 months. That single transaction was for UK£85k worth of shares at a price of UK£42.50 each. So it's clear an insider wanted to buy, even at a higher price than the current share price (being UK£37.78). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. To us, it's very important to consider the price insiders pay for shares. Generally speaking, it catches our eye when insiders have purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price.

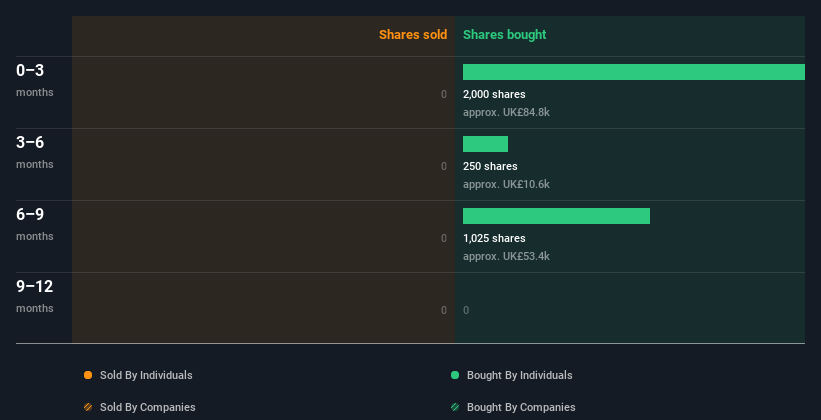

In the last twelve months Intertek Group insiders were buying shares, but not selling. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Intertek Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Intertek Group Insiders Bought Stock Recently

Over the last three months, we've seen significant insider buying at Intertek Group. Specifically, Senior Independent Non-Executive Director Graham Allan bought UK£85k worth of shares in that time, and we didn't record any sales whatsoever. This makes one think the business has some good points.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Intertek Group insiders own about UK£19m worth of shares. That equates to 0.3% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The Intertek Group Insider Transactions Indicate?

It is good to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. When combined with notable insider ownership, these factors suggest Intertek Group insiders are well aligned, and that they may think the share price is too low. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Case in point: We've spotted 1 warning sign for Intertek Group you should be aware of.

But note: Intertek Group may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ITRK

Intertek Group

Provides quality assurance solutions to various industries in the United Kingdom, the United States, China, Australia, and internationally.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success