- United Kingdom

- /

- Professional Services

- /

- LSE:HAS

Investors Don't See Light At End Of Hays plc's (LON:HAS) Tunnel

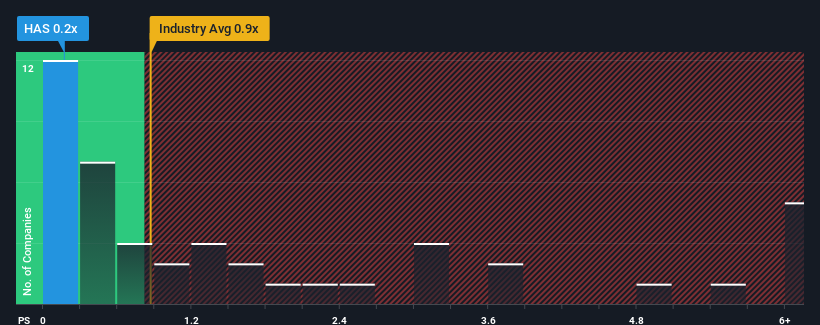

With a price-to-sales (or "P/S") ratio of 0.2x Hays plc (LON:HAS) may be sending bullish signals at the moment, given that almost half of all the Professional Services companies in the United Kingdom have P/S ratios greater than 0.9x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hays

How Has Hays Performed Recently?

Hays could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Hays will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Hays?

Hays' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.9%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 9.1% as estimated by the nine analysts watching the company. Meanwhile, the broader industry is forecast to expand by 6.0%, which paints a poor picture.

With this in consideration, we find it intriguing that Hays' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Hays maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you settle on your opinion, we've discovered 1 warning sign for Hays that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HAS

Hays

Engages in the provision of recruitment services in Australia, New Zealand, Germany, the United Kingdom, Ireland, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives