- United Kingdom

- /

- Commercial Services

- /

- LSE:DLAR

Optimistic Investors Push De La Rue plc (LON:DLAR) Shares Up 27% But Growth Is Lacking

De La Rue plc (LON:DLAR) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.0% over the last year.

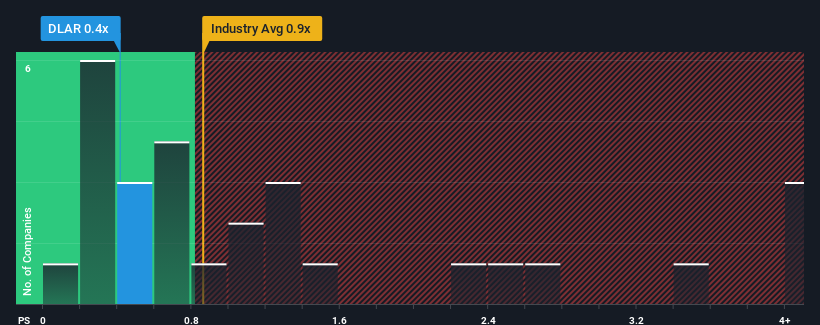

Even after such a large jump in price, there still wouldn't be many who think De La Rue's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in the United Kingdom's Commercial Services industry is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for De La Rue

What Does De La Rue's Recent Performance Look Like?

While the industry has experienced revenue growth lately, De La Rue's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think De La Rue's future stacks up against the industry? In that case, our free report is a great place to start.How Is De La Rue's Revenue Growth Trending?

In order to justify its P/S ratio, De La Rue would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 6.8% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 26% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 2.3% per year as estimated by the dual analysts watching the company. With the industry predicted to deliver 8.1% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that De La Rue is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

De La Rue appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that De La Rue's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for De La Rue you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DLAR

De La Rue

Provides secure physical and digital tools for government and commercial organization in the United Kingdom, the Middle East, Africa, Asia, the United States, Rest of Europe, and internationally.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives