- United Kingdom

- /

- Commercial Services

- /

- LSE:DLAR

Here's Why De La Rue (LON:DLAR) Has A Meaningful Debt Burden

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies De La Rue plc (LON:DLAR) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for De La Rue

What Is De La Rue's Debt?

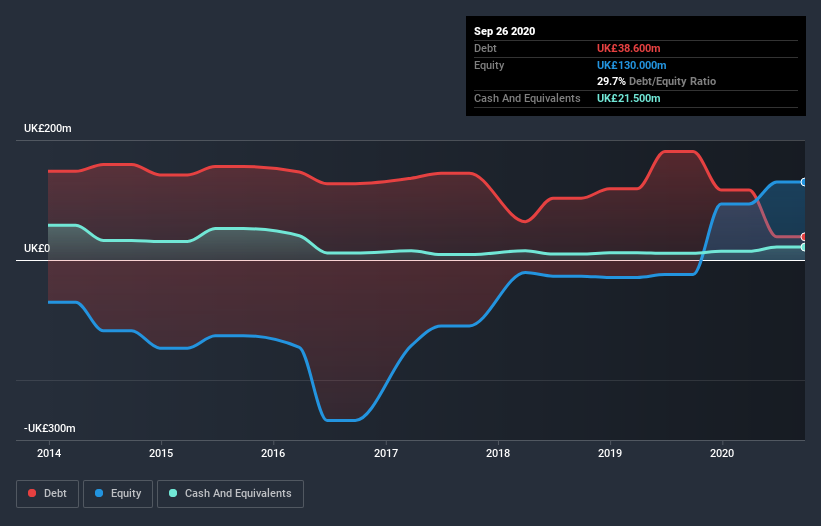

You can click the graphic below for the historical numbers, but it shows that De La Rue had UK£38.6m of debt in September 2020, down from UK£180.9m, one year before. On the flip side, it has UK£21.5m in cash leading to net debt of about UK£17.1m.

How Strong Is De La Rue's Balance Sheet?

The latest balance sheet data shows that De La Rue had liabilities of UK£163.6m due within a year, and liabilities of UK£55.4m falling due after that. On the other hand, it had cash of UK£21.5m and UK£86.7m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£110.8m.

While this might seem like a lot, it is not so bad since De La Rue has a market capitalization of UK£295.3m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While De La Rue's low debt to EBITDA ratio of 0.33 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 6.1 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. On the other hand, De La Rue's EBIT dived 16%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if De La Rue can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Considering the last three years, De La Rue actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

To be frank both De La Rue's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that De La Rue's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for De La Rue (1 is concerning) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading De La Rue or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:DLAR

De La Rue

Provides secure physical and digital tools for government and commercial organization in the United Kingdom, the Middle East, Africa, Asia, the United States, Rest of Europe, and internationally.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives