- United Kingdom

- /

- Commercial Services

- /

- LSE:DLAR

De La Rue's(LON:DLAR) Share Price Is Down 73% Over The Past Three Years.

De La Rue plc (LON:DLAR) shareholders should be happy to see the share price up 20% in the last quarter. But the last three years have seen a terrible decline. In that time the share price has melted like a snowball in the desert, down 73%. So it sure is nice to see a bit of an improvement. The thing to think about is whether the business has really turned around.

View our latest analysis for De La Rue

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

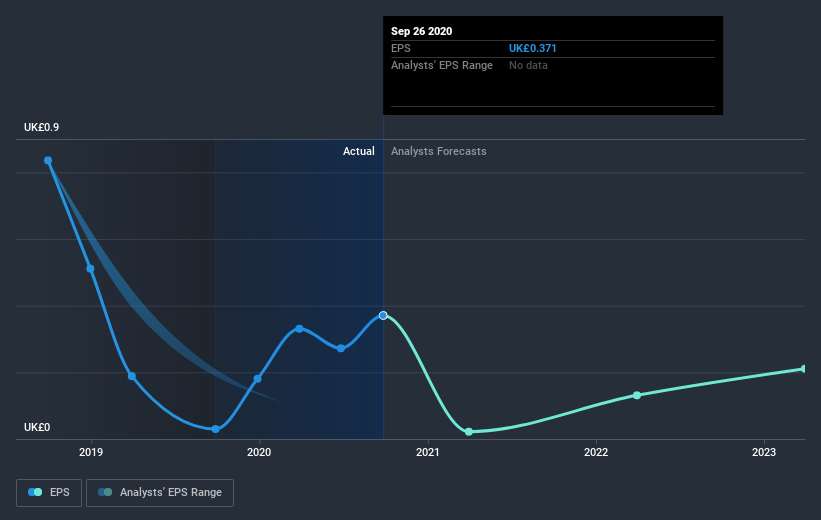

During the three years that the share price fell, De La Rue's earnings per share (EPS) dropped by 8.7% each year. The share price decline of 36% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 4.56.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between De La Rue's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for De La Rue shareholders, and that cash payout explains why its total shareholder loss of 70%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

It's nice to see that De La Rue shareholders have received a total shareholder return of 25% over the last year. That certainly beats the loss of about 9% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for De La Rue (1 is concerning) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading De La Rue or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:DLAR

De La Rue

Provides secure physical and digital tools for government and commercial organization in the United Kingdom, the Middle East, Africa, Asia, the United States, Rest of Europe, and internationally.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives