- United Kingdom

- /

- Professional Services

- /

- LSE:CPI

Capita plc's (LON:CPI) Price Is Right But Growth Is Lacking After Shares Rocket 44%

Capita plc (LON:CPI) shareholders have had their patience rewarded with a 44% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

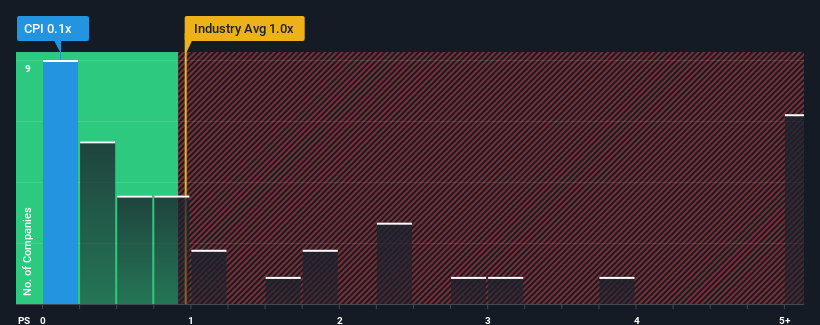

Even after such a large jump in price, Capita's price-to-sales (or "P/S") ratio of 0.1x might still make it look like a buy right now compared to the Professional Services industry in the United Kingdom, where around half of the companies have P/S ratios above 1x and even P/S above 3x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Capita

How Capita Has Been Performing

While the industry has experienced revenue growth lately, Capita's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Capita.Do Revenue Forecasts Match The Low P/S Ratio?

Capita's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.6%. The last three years don't look nice either as the company has shrunk revenue by 15% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 0.05% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially lower than the 6.4% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why Capita's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Capita's P/S Mean For Investors?

Capita's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Capita's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Capita has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CPI

Capita

Operates an outsourcer that supports clients across the public and private sectors in the United Kingdom and rest of Europe.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives