Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that RWS Holdings plc (LON:RWS) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for RWS Holdings

What Is RWS Holdings's Net Debt?

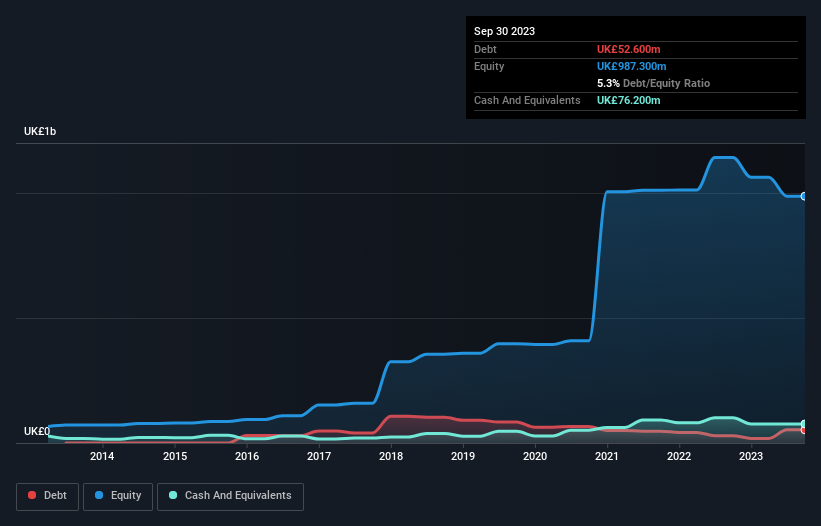

As you can see below, at the end of September 2023, RWS Holdings had UK£52.6m of debt, up from UK£29.3m a year ago. Click the image for more detail. However, its balance sheet shows it holds UK£76.2m in cash, so it actually has UK£23.6m net cash.

How Healthy Is RWS Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that RWS Holdings had liabilities of UK£182.6m due within 12 months and liabilities of UK£145.9m due beyond that. Offsetting this, it had UK£76.2m in cash and UK£199.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£53.3m.

Given RWS Holdings has a market capitalization of UK£786.0m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, RWS Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

But the bad news is that RWS Holdings has seen its EBIT plunge 18% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine RWS Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While RWS Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, RWS Holdings recorded free cash flow worth a fulsome 94% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Summing Up

We could understand if investors are concerned about RWS Holdings's liabilities, but we can be reassured by the fact it has has net cash of UK£23.6m. And it impressed us with free cash flow of UK£67m, being 94% of its EBIT. So we are not troubled with RWS Holdings's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for RWS Holdings you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:RWS

RWS Holdings

Provides technology-enabled language, content, and intellectual property (IP) services in the United Kingdom, Continental Europe, the United States, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026