- United Kingdom

- /

- Capital Markets

- /

- LSE:FSG

3 High Growth UK Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

The London markets have recently faced turbulence, with the FTSE 100 and FTSE 250 indices both closing lower amid weak trade data from China, highlighting ongoing economic challenges. In such uncertain times, identifying growth companies with strong insider ownership can be particularly appealing to investors as it often signals confidence in the company's future prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 33.5% |

| Plant Health Care (AIM:PHC) | 34.2% | 121.3% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| Belluscura (AIM:BELL) | 39.5% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.6% | 173.3% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 27.1% |

| Hochschild Mining (LSE:HOC) | 38.4% | 53.8% |

Here's a peek at a few of the choices from the screener.

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

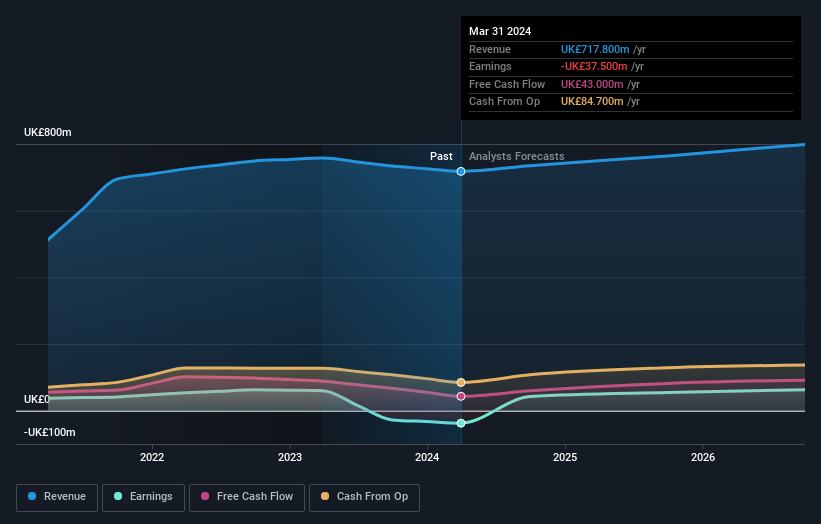

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property (IP) services and has a market cap of £699.03 million.

Operations: RWS Holdings plc generates revenue through four primary segments: IP Services (£105.10 million), Language Services (£325.40 million), Regulated Industry (£149.40 million), and Language & Content Technology (L&CT) (£137.90 million).

Insider Ownership: 24.6%

Earnings Growth Forecast: 67.4% p.a.

RWS Holdings, a growth company with significant insider ownership, recently launched Trados Studio 2024 and Tridion Docs 15.1, both featuring advanced AI capabilities. Despite a decline in half-year earnings to £11.1 million and sales to £350.3 million, RWS continues to innovate with new products like the HAI platform. The stock is trading at 68.8% below fair value estimates, although it has shown high volatility recently and its dividend sustainability is questionable given current earnings coverage.

- Click here and access our complete growth analysis report to understand the dynamics of RWS Holdings.

- According our valuation report, there's an indication that RWS Holdings' share price might be on the cheaper side.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★★☆

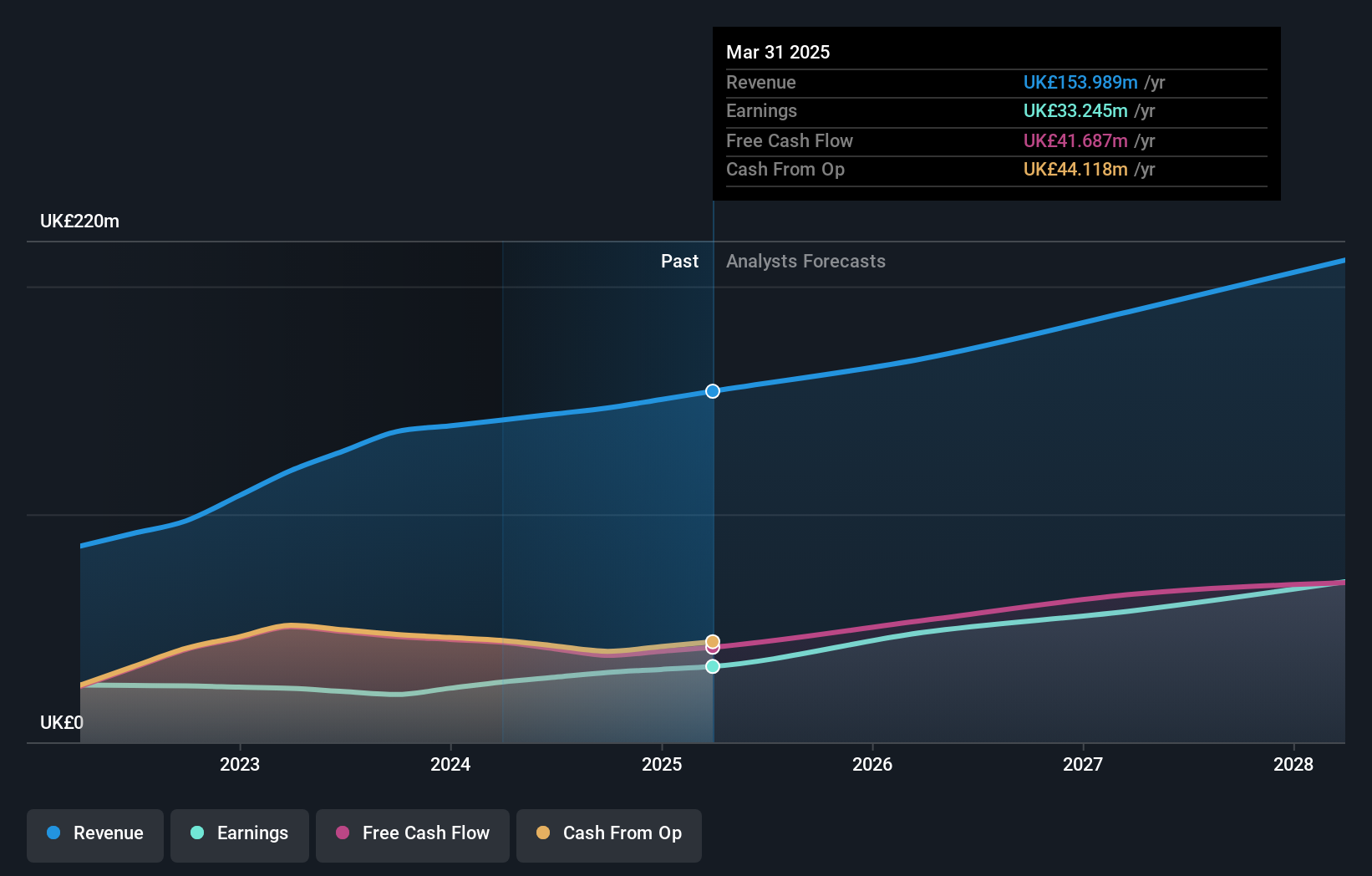

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £608.24 million.

Operations: The company's revenue segments are comprised of £84.17 million from Infrastructure, £47.35 million from Private Equity, and £9.80 million from Foresight Capital Management.

Insider Ownership: 31.9%

Earnings Growth Forecast: 27.9% p.a.

Foresight Group Holdings, with substantial insider ownership, reported a revenue increase to £141.33 million and net income of £26.43 million for the year ending March 31, 2024. Earnings are forecasted to grow significantly at 27.88% annually over the next three years, outpacing the UK market average. Despite trading at nearly 30% below fair value estimates, its dividend yield of 4.2% is not well-covered by earnings. The company has also completed a share buyback program worth £0.97 million.

- Navigate through the intricacies of Foresight Group Holdings with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Foresight Group Holdings shares in the market.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

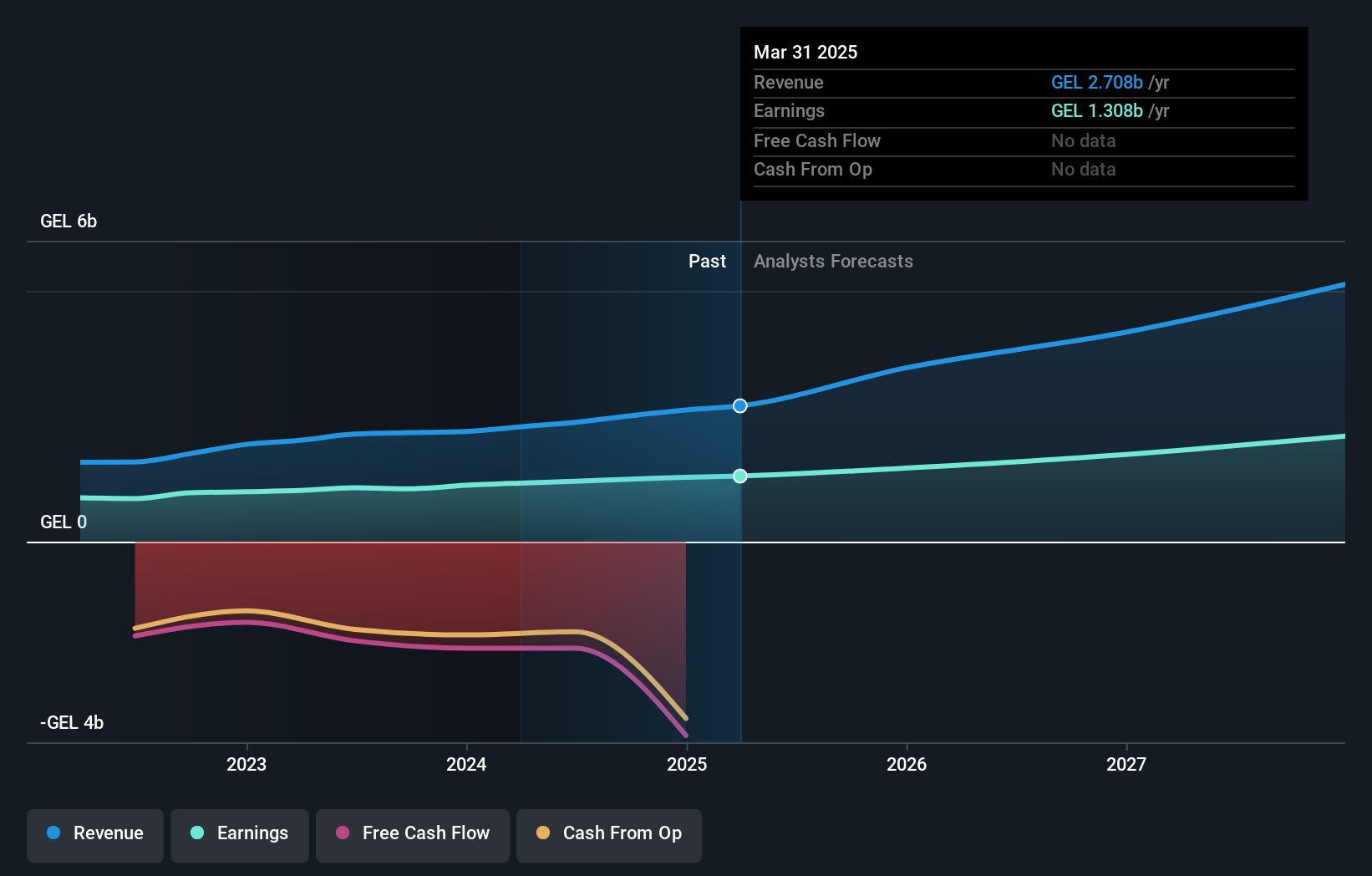

Overview: TBC Bank Group PLC operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan with a market cap of £1.69 billion.

Operations: Revenue Segments (in millions of GEL): Segment Adjustment: 2132.38, Uzbekistan Operations: 236.42

Insider Ownership: 17.8%

Earnings Growth Forecast: 15.3% p.a.

TBC Bank Group, with high insider ownership, reported a net interest income of GEL 862.2 million and net income of GEL 617.4 million for the half year ended June 30, 2024. Earnings per share increased to GEL 11.33 from GEL 9.9 a year ago. Forecasted earnings growth is at 15.27% annually, outpacing the UK market average of 14.3%. Despite an unstable dividend track record, it trades at good value compared to peers and industry estimates.

- Unlock comprehensive insights into our analysis of TBC Bank Group stock in this growth report.

- Our valuation report here indicates TBC Bank Group may be undervalued.

Taking Advantage

- Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 67 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FSG

Foresight Group Holdings

Operates as an infrastructure and private equity manager in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia.

High growth potential with excellent balance sheet.