- United Kingdom

- /

- Capital Markets

- /

- LSE:LWDB

Discovering Undiscovered Gems in the United Kingdom August 2024

Reviewed by Simply Wall St

The United Kingdom's market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices both closing lower amid concerns over weak trade data from China and its impact on global demand. Despite these challenges, there remain opportunities to uncover promising small-cap stocks that can thrive even in uncertain economic conditions. In this article, we will explore three undiscovered gems in the UK market that exhibit strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Goodwin | 59.96% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the UK, Europe, Canada, and globally, with a market cap of £1.07 billion.

Operations: Alpha Group International plc generates revenue primarily from its Alpha Pay (£64.30 million) and Institutional (£61.29 million) segments, with additional contributions from Corporate London (£45.42 million), Corporate Amsterdam (£8.70 million), and Corporate Toronto (£4.23 million).

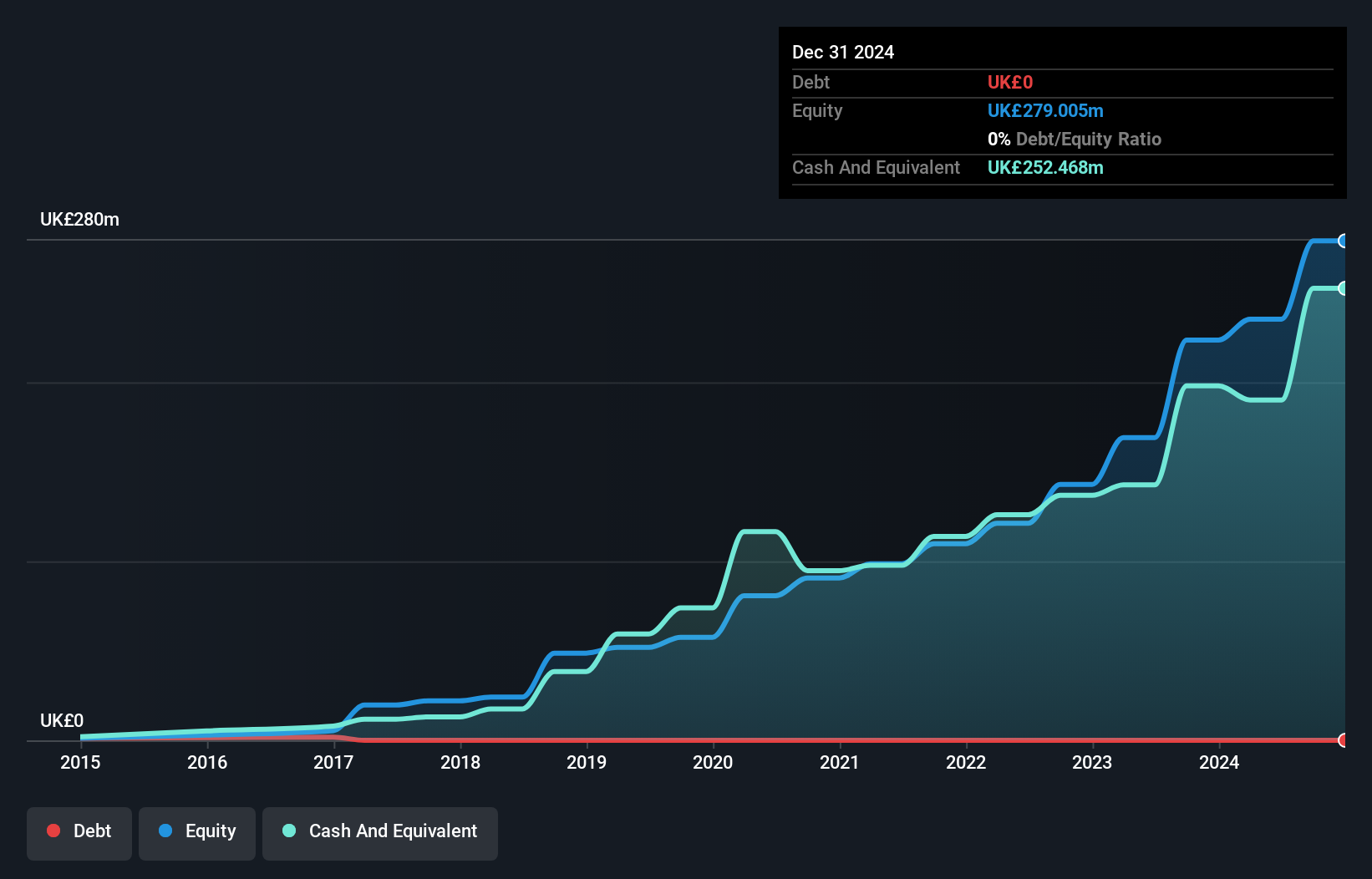

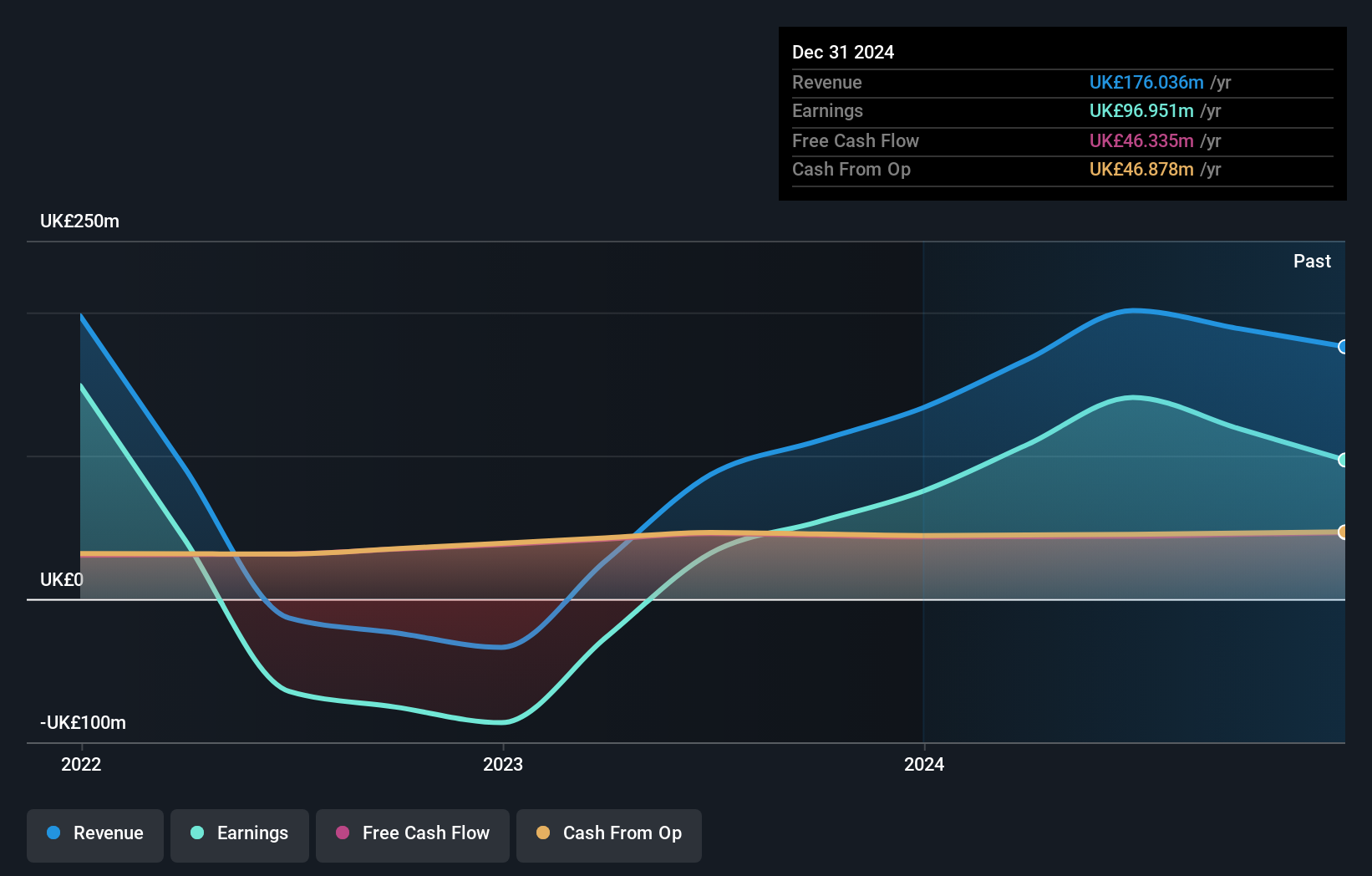

Alpha Group International, a promising player in the UK market, boasts a Price-To-Earnings ratio of 12x, lower than the UK's 16.6x average. With no debt and an impressive earnings growth of 130% over the past year, it stands out among its peers. Recent developments include share repurchases authorized up to 4.32 million shares and its addition to multiple FTSE indices in June 2024, reflecting strong investor confidence and potential for further growth.

- Unlock comprehensive insights into our analysis of Alpha Group International stock in this health report.

Learn about Alpha Group International's historical performance.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Law Debenture Corporation p.l.c., an investment trust, offers independent professional services to a global clientele and has a market cap of £1.19 billion.

Operations: Revenue for Law Debenture is primarily derived from two segments: Investment Portfolio (£35.62 million) and Independent Professional Services (£61.55 million).

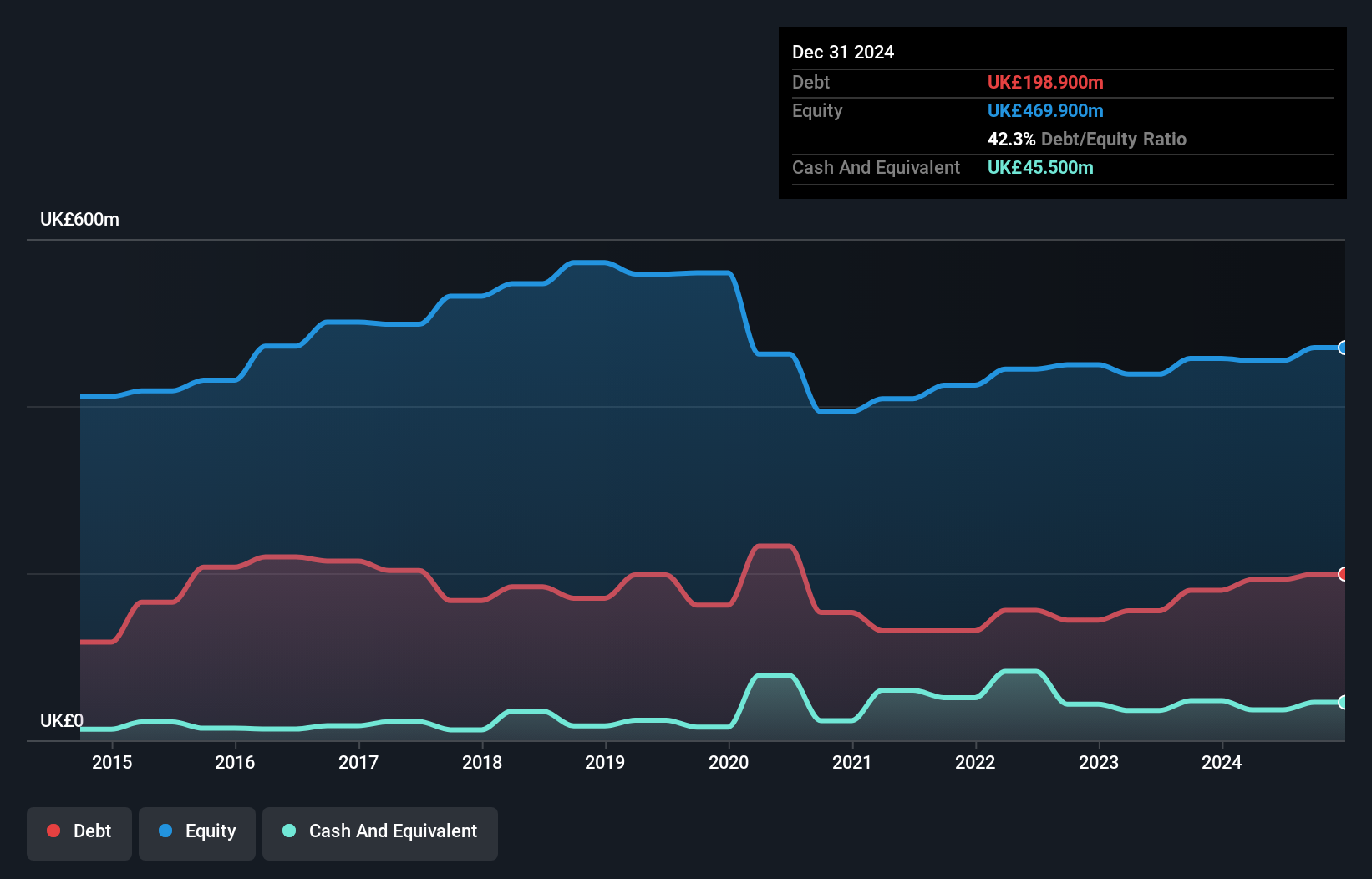

Law Debenture's recent performance highlights its strong earnings growth, with net income surging to £82 million for the half year ended June 30, 2024, compared to £16.54 million a year ago. The company's earnings per share also saw a significant increase from £0.13 to £0.63. Its price-to-earnings ratio of 8.5x is notably below the UK market average of 16.6x, indicating potential undervaluation. Additionally, Law Debenture's debt levels are well-managed with a net debt to equity ratio of 15%, and its interest payments are comfortably covered by EBIT at a multiple of 21.9x.

- Navigate through the intricacies of Law Debenture with our comprehensive health report here.

Review our historical performance report to gain insights into Law Debenture's's past performance.

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets globally, with a market cap of approximately £691.70 million.

Operations: Senior plc generates revenue primarily from its Aerospace segment (£651.10 million) and Flexonics segment (£333 million), with a minor deduction for central costs (-£1.50 million).

Senior plc, a notable player in the Aerospace & Defense sector, has been making significant strides. Over the past year, earnings grew by 40.1%, outpacing the industry’s 14.8%. The company trades at 67.2% below its estimated fair value and has a satisfactory net debt to equity ratio of 34.4%. Recent contracts with Deutsche Aircraft GmbH and Rolls-Royce highlight its growing influence, while an interim dividend increase of 25% underscores financial confidence.

- Click to explore a detailed breakdown of our findings in Senior's health report.

Gain insights into Senior's historical performance by reviewing our past performance report.

Make It Happen

- Reveal the 79 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LWDB

Law Debenture

An investment trust, provides independent professional services to companies, agencies, organizations, and individuals worldwide.

Solid track record with adequate balance sheet and pays a dividend.