- United Kingdom

- /

- Commercial Services

- /

- AIM:RST

Dividend Investors: Don't Be Too Quick To Buy Restore plc (LON:RST) For Its Upcoming Dividend

It looks like Restore plc (LON:RST) is about to go ex-dividend in the next 4 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Meaning, you will need to purchase Restore's shares before the 6th of June to receive the dividend, which will be paid on the 9th of July.

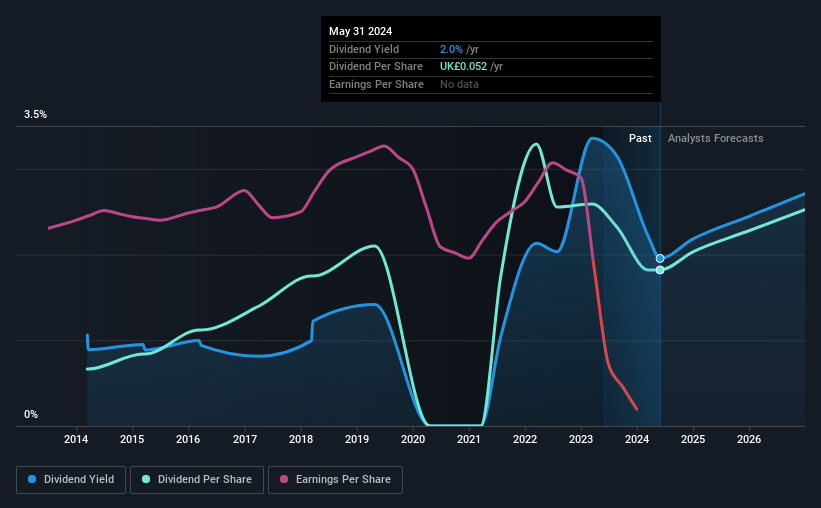

The company's upcoming dividend is UK£0.0335 a share, following on from the last 12 months, when the company distributed a total of UK£0.052 per share to shareholders. Based on the last year's worth of payments, Restore stock has a trailing yield of around 2.0% on the current share price of UK£2.66. If you buy this business for its dividend, you should have an idea of whether Restore's dividend is reliable and sustainable. So we need to investigate whether Restore can afford its dividend, and if the dividend could grow.

View our latest analysis for Restore

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Restore reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If Restore didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. It paid out 24% of its free cash flow as dividends last year, which is conservatively low.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Restore was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Restore has delivered 11% dividend growth per year on average over the past 10 years.

Get our latest analysis on Restore's balance sheet health here.

Final Takeaway

Is Restore an attractive dividend stock, or better left on the shelf? First, it's not great to see the company paying a dividend despite being loss-making over the last year. On the plus side, the dividend was covered by free cash flow." With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Restore.

So if you're still interested in Restore despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Case in point: We've spotted 1 warning sign for Restore you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:RST

Restore

Provides services to offices and workplaces in the public and private sectors primarily in the United Kingdom.

Reasonable growth potential and fair value.