- United Kingdom

- /

- Professional Services

- /

- LSE:CPI

High Growth Tech Stocks To Watch In The United Kingdom September 2024

Reviewed by Simply Wall St

The market has been flat over the last week but is up 6.7% over the past year, with earnings forecast to grow by 15% annually. In this environment, identifying high growth tech stocks that can outperform becomes crucial for investors looking to capitalize on robust earnings potential and market momentum.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Oxford Biomedica | 20.98% | 106.13% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

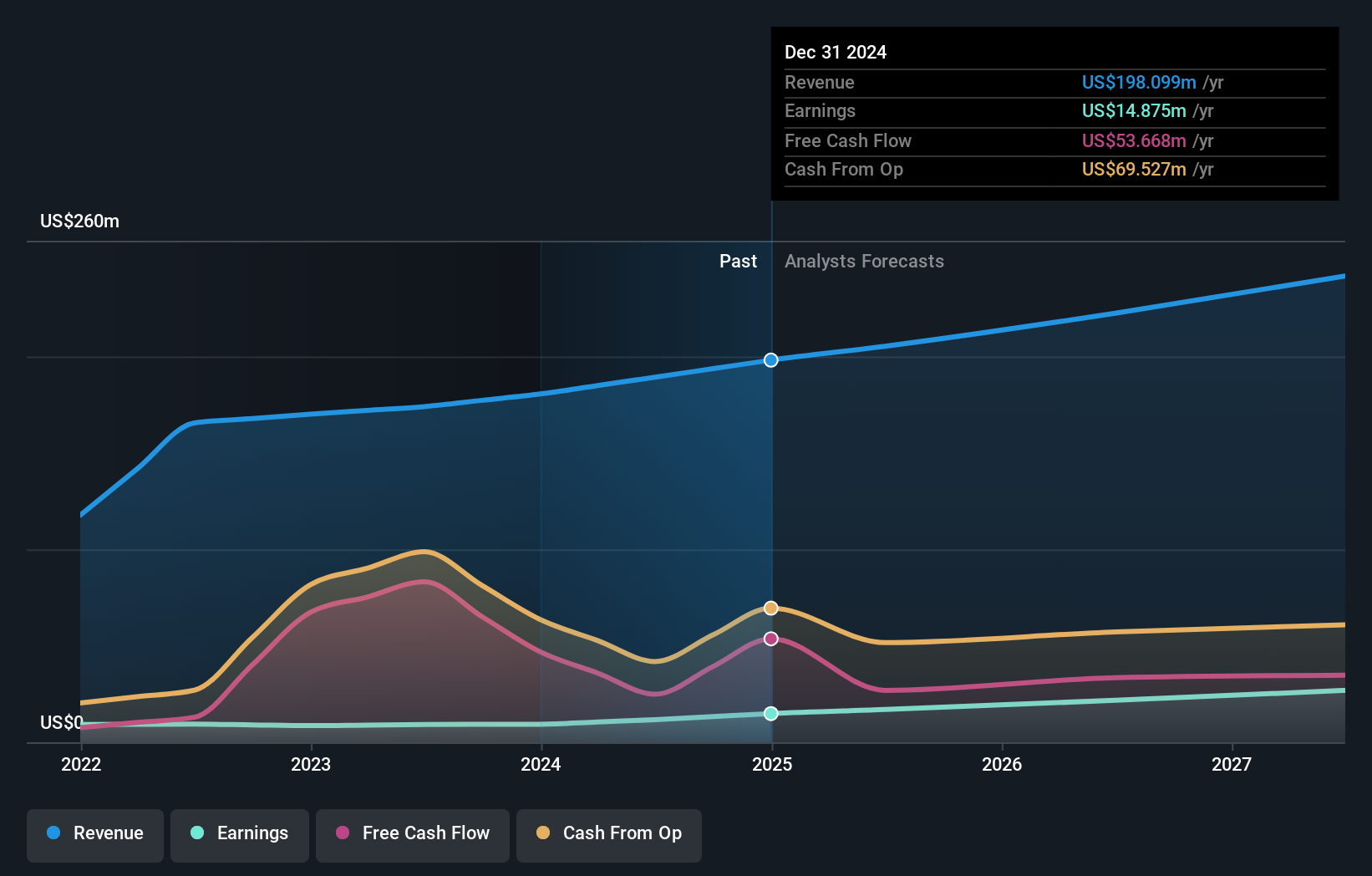

Overview: Craneware plc, with a market cap of £803.93 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc generates revenue primarily from its healthcare software segment, which reported $189.27 million. The company's gross profit margin stands at 70%.

Craneware, amid a strategic expansion, is leveraging its partnership with Microsoft to enhance its Trisus Platform through advanced AI and cloud technologies. This collaboration not only boosts Craneware's technological capabilities but also expands its market reach through the Azure Marketplace. Financially, the company has demonstrated robust growth with a 26.8% increase in earnings this past year, outpacing the industry average of 9.3%. Looking ahead, earnings are projected to grow by 25.6% annually, significantly above the UK market forecast of 14.5%. Additionally, Craneware is actively pursuing acquisitions that align with their growth strategy to further cement their foothold in healthcare technology solutions.

- Click here and access our complete health analysis report to understand the dynamics of Craneware.

Evaluate Craneware's historical performance by accessing our past performance report.

Nexxen International (AIM:NEXN)

Simply Wall St Growth Rating: ★★★★☆☆

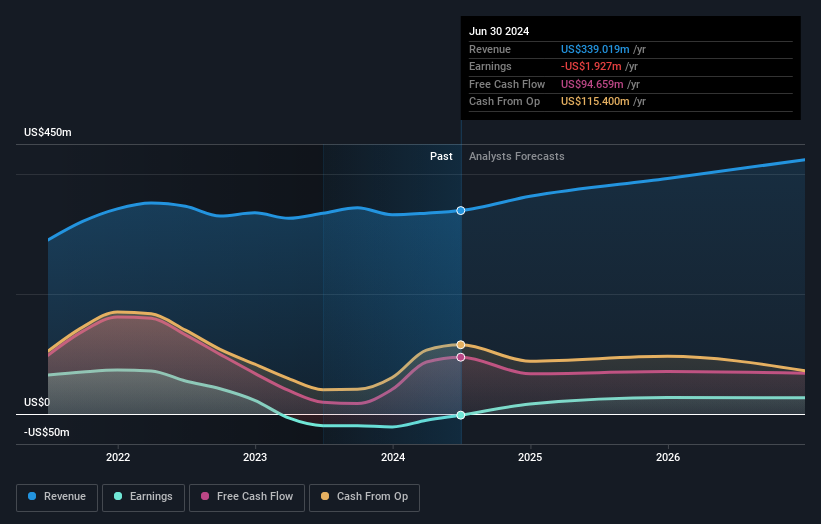

Overview: Nexxen International Ltd. offers a comprehensive software platform for advertisers to connect with publishers in Israel and has a market cap of £415.13 million.

Operations: Nexxen International Ltd. generates revenue primarily through its marketing services, amounting to $339.02 million. The company operates an end-to-end software platform that facilitates connections between advertisers and publishers in Israel.

Nexxen International, amidst a transformative year, has shown significant strides in its financial and operational fronts. With a robust revenue growth of 8.8% annually, it outpaces the UK market average of 3.8%. The company's recent pivot towards profitability is underscored by an impressive earnings forecast growth of 71.9% per year. In a strategic move to enhance shareholder value, Nexxen repurchased shares worth $3.7 million between May and June 2024, reflecting confidence in its future prospects. Additionally, the firm's partnership with The Trade Desk to provide exclusive ACR data segments marks a pivotal advancement in cross-device advertising technologies, setting a new standard for media investments on the open internet.

Capita (LSE:CPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capita plc offers consulting, digital, and software products and services to clients in both private and public sectors in the UK and internationally, with a market cap of £343.10 million.

Operations: Capita plc generates revenue through two main segments: Capita Experience (£1.12 billion) and Capita Public Service (£1.49 billion). The company serves both private and public sectors in the UK and internationally, focusing on consulting, digital, and software solutions.

Capita, navigating a challenging landscape, has demonstrated resilience with a turnaround from a net loss of GBP 84.4 million to a net income of GBP 53 million in the first half of 2024. Despite revenue contraction to GBP 1.24 billion from GBP 1.48 billion the previous year, the company’s earnings per share improved significantly, reflecting enhanced operational efficiency and cost management strategies. Moreover, Capita's commitment to innovation is evident in its renewed GBP 48 million contract for administering the Royal Mail Statutory Pension Scheme, which integrates advanced digital solutions like Microsoft Dynamics to streamline services. This strategic focus on technology-driven service delivery positions Capita to potentially capitalize on emerging opportunities within the professional services sector despite its current revenue growth forecast at a modest 1.5% annually and an expected significant earnings growth rate of approximately 52% per year.

- Dive into the specifics of Capita here with our thorough health report.

Assess Capita's past performance with our detailed historical performance reports.

Where To Now?

- Discover the full array of 47 UK High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CPI

Capita

Provides consulting, digital, and software products and services to clients in the private and public sectors in the United Kingdom and internationally.

Undervalued with reasonable growth potential.