- United Kingdom

- /

- Commercial Services

- /

- AIM:GYG

Did Changing Sentiment Drive GYG's (LON:GYG) Share Price Down A Worrying 52%?

It is a pleasure to report that the GYG plc (LON:GYG) is up 41% in the last quarter. But that's not enough to compensate for the decline over the last twelve months. During that time the share price has sank like a stone, descending 52%. The share price recovery is not so impressive when you consider the fall. Arguably, the fall was overdone.

View our latest analysis for GYG

We don't think that GYG's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, companies that are not judged on their (small) profits should be growing revenue quickly. As you can imagine, it's easy to imagine a fast growing company becoming (potentially very) profitable, but when revenue growth slows, then the potential upside often seems less impressive.

GYG's revenue didn't grow at all in the last year. In fact, it fell 22%. That looks pretty grim, at a glance. The share price drop of 52% is understandable given the company doesn't have profits to boast of. Having said that, if growth is coming in the future now may be the low ebb for the company. We have a natural aversion to companies that are losing money, not growing revenue, and losing favour with the market. But perhaps we shouldn't.

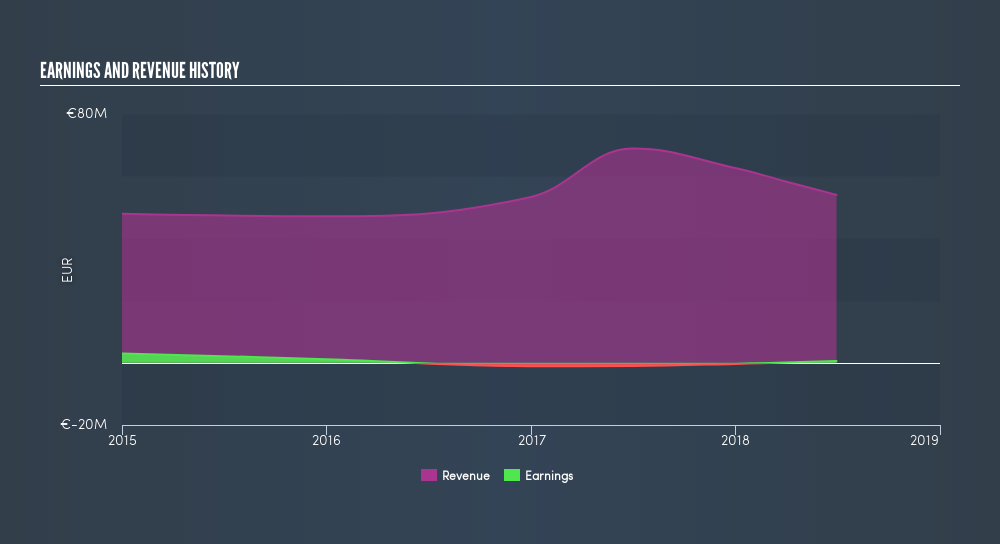

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think GYG will earn in the future (free profit forecasts)

A Different Perspective

While GYG shareholders are down 51% for the year (even including dividends), the market itself is up 2.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 41% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of GYG by clicking this link.

GYG is not the only stock that insiders are buying. For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:GYG

GYG

GYG plc operates as a superyacht painting, supply, and maintenance company worldwide.

Slightly overvalued with worrying balance sheet.

Market Insights

Community Narratives