- United Kingdom

- /

- Professional Services

- /

- AIM:GATC

Returns On Capital Signal Difficult Times Ahead For Gattaca (LON:GATC)

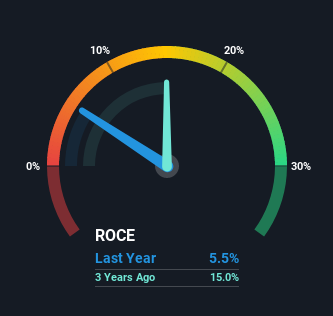

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This indicates the company is producing less profit from its investments and its total assets are decreasing. And from a first read, things don't look too good at Gattaca (LON:GATC), so let's see why.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Gattaca is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.055 = UK£2.6m ÷ (UK£115m - UK£68m) (Based on the trailing twelve months to July 2021).

Thus, Gattaca has an ROCE of 5.5%. Ultimately, that's a low return and it under-performs the Professional Services industry average of 12%.

Check out our latest analysis for Gattaca

In the above chart we have measured Gattaca's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Gattaca here for free.

So How Is Gattaca's ROCE Trending?

In terms of Gattaca's historical ROCE trend, it isn't fantastic. Unfortunately, returns have declined substantially over the last five years to the 5.5% we see today. On top of that, the business is utilizing 53% less capital within its operations. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. If these underlying trends continue, we wouldn't be too optimistic going forward.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 59%, which has impacted the ROCE. Without this increase, it's likely that ROCE would be even lower than 5.5%. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

Our Take On Gattaca's ROCE

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. Investors haven't taken kindly to these developments, since the stock has declined 38% from where it was five years ago. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

One more thing: We've identified 4 warning signs with Gattaca (at least 2 which are a bit unpleasant) , and understanding these would certainly be useful.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:GATC

Gattaca

A human capital resources company, provides contract and permanent recruitment services in the private and public sectors.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives