- United Kingdom

- /

- Professional Services

- /

- AIM:GATC

Gattaca (LON:GATC) Will Be Hoping To Turn Its Returns On Capital Around

Ignoring the stock price of a company, what are the underlying trends that tell us a business is past the growth phase? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. Trends like this ultimately mean the business is reducing its investments and also earning less on what it has invested. So after we looked into Gattaca (LON:GATC), the trends above didn't look too great.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Gattaca:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

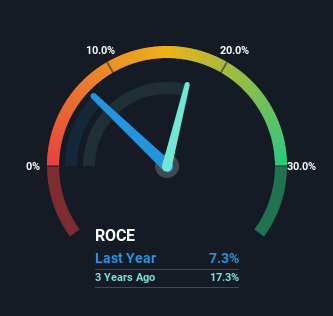

0.073 = UK£2.6m ÷ (UK£90m - UK£54m) (Based on the trailing twelve months to January 2022).

Therefore, Gattaca has an ROCE of 7.3%. In absolute terms, that's a low return and it also under-performs the Professional Services industry average of 13%.

Check out our latest analysis for Gattaca

In the above chart we have measured Gattaca's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Gattaca here for free.

What Does the ROCE Trend For Gattaca Tell Us?

The trend of returns that Gattaca is generating are raising some concerns. Unfortunately, returns have declined substantially over the last five years to the 7.3% we see today. On top of that, the business is utilizing 63% less capital within its operations. The fact that both are shrinking is an indication that the business is going through some tough times. If these underlying trends continue, we wouldn't be too optimistic going forward.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 60%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. And with current liabilities at these levels, suppliers or short-term creditors are effectively funding a large part of the business, which can introduce some risks.

The Key Takeaway

In summary, it's unfortunate that Gattaca is shrinking its capital base and also generating lower returns. This could explain why the stock has sunk a total of 74% in the last five years. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

Gattaca does come with some risks though, we found 3 warning signs in our investment analysis, and 1 of those is concerning...

While Gattaca may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:GATC

Gattaca

A human capital resources company, provides contract and permanent recruitment services in the private and public sectors.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives