- United Kingdom

- /

- Specialty Stores

- /

- LSE:PETS

UK Undervalued Small Caps With Insider Actions To Watch In February 2025

Reviewed by Simply Wall St

As the UK market grapples with the ripple effects of sluggish trade data from China, both the FTSE 100 and FTSE 250 have experienced declines, reflecting broader concerns about global economic recovery and its impact on commodity-dependent sectors. Amidst this backdrop, investors may find potential opportunities in small-cap stocks that demonstrate resilience through strategic insider actions and sound fundamentals.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 21.5x | 5.5x | 26.86% | ★★★★★★ |

| Stelrad Group | 11.8x | 0.6x | 22.44% | ★★★★★★ |

| Speedy Hire | NA | 0.3x | 25.65% | ★★★★★☆ |

| Gamma Communications | 22.7x | 2.3x | 37.87% | ★★★★☆☆ |

| iomart Group | 23.3x | 0.6x | 31.47% | ★★★★☆☆ |

| CVS Group | 26.8x | 1.1x | 45.74% | ★★★★☆☆ |

| Franchise Brands | 37.5x | 1.9x | 31.69% | ★★★★☆☆ |

| Telecom Plus | 17.6x | 0.7x | 31.89% | ★★★☆☆☆ |

| Warpaint London | 24.0x | 4.2x | 2.41% | ★★★☆☆☆ |

| Eagle Eye Solutions Group | 18.7x | 2.3x | 21.76% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

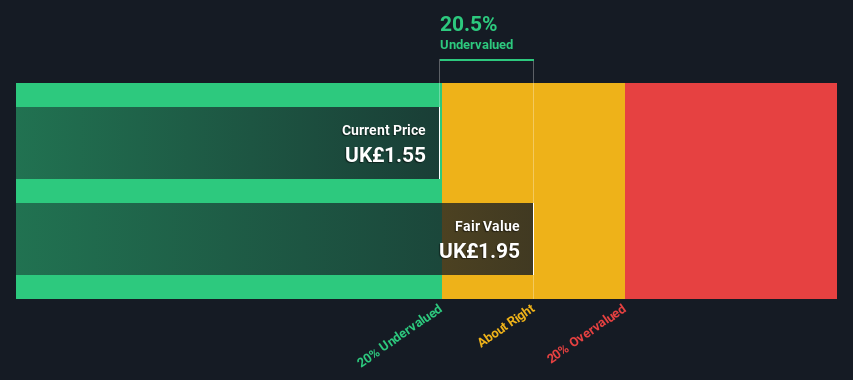

Franchise Brands (AIM:FRAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Franchise Brands is a multi-brand franchisor that operates across various sectors, including Azura, Pirtek, B2C Division, Filta International, and Water & Waste Services, with a market capitalization of approximately £0.31 billion.

Operations: Franchise Brands generates revenue primarily from Pirtek (£60.78M), Water & Waste Services (£49.17M), and Filta International (£25.64M). The company's gross profit margin has shown variability, reaching 66.47% in September 2023 and standing at 61.66% by June 2024, indicating changes in cost efficiency or pricing strategies over time.

PE: 37.5x

Franchise Brands, a UK-based company with a small market presence, is drawing attention for its growth potential despite relying entirely on external borrowing. Revenue is projected to increase by 7.89% annually, highlighting its growth trajectory. Recent board changes include the addition of Louise George as an independent Non-Executive Director and Chair of the Audit Committee, bringing extensive franchising and financial expertise. This strategic move could enhance governance and support future expansion efforts within the franchise sector.

- Dive into the specifics of Franchise Brands here with our thorough valuation report.

Review our historical performance report to gain insights into Franchise Brands''s past performance.

Mears Group (LSE:MER)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mears Group is a UK-based company specializing in providing management and maintenance services, with a market capitalization of approximately £0.34 billion.

Operations: The company generates revenue primarily from management (£591.63 million) and maintenance (£551.73 million) activities. Over the recent periods, its gross profit margin has shown an upward trend, reaching 21.68% by mid-2024. Operating expenses are a significant portion of costs, with general and administrative expenses consistently being a major component within this category.

PE: 7.7x

Mears Group, recognized for its small company stature, recently saw insider confidence with Andrew C. Smith acquiring 25,000 shares valued at £91,100. This purchase highlights potential belief in the company's future despite an anticipated earnings decline of 13.8% annually over the next three years. Financially reliant on external borrowing without customer deposits, Mears faces higher funding risks. Recent leadership changes include Angela Lockwood stepping in as Senior Independent Director following Dame Julia Unwin's retirement on January 2, 2025.

- Click here to discover the nuances of Mears Group with our detailed analytical valuation report.

Evaluate Mears Group's historical performance by accessing our past performance report.

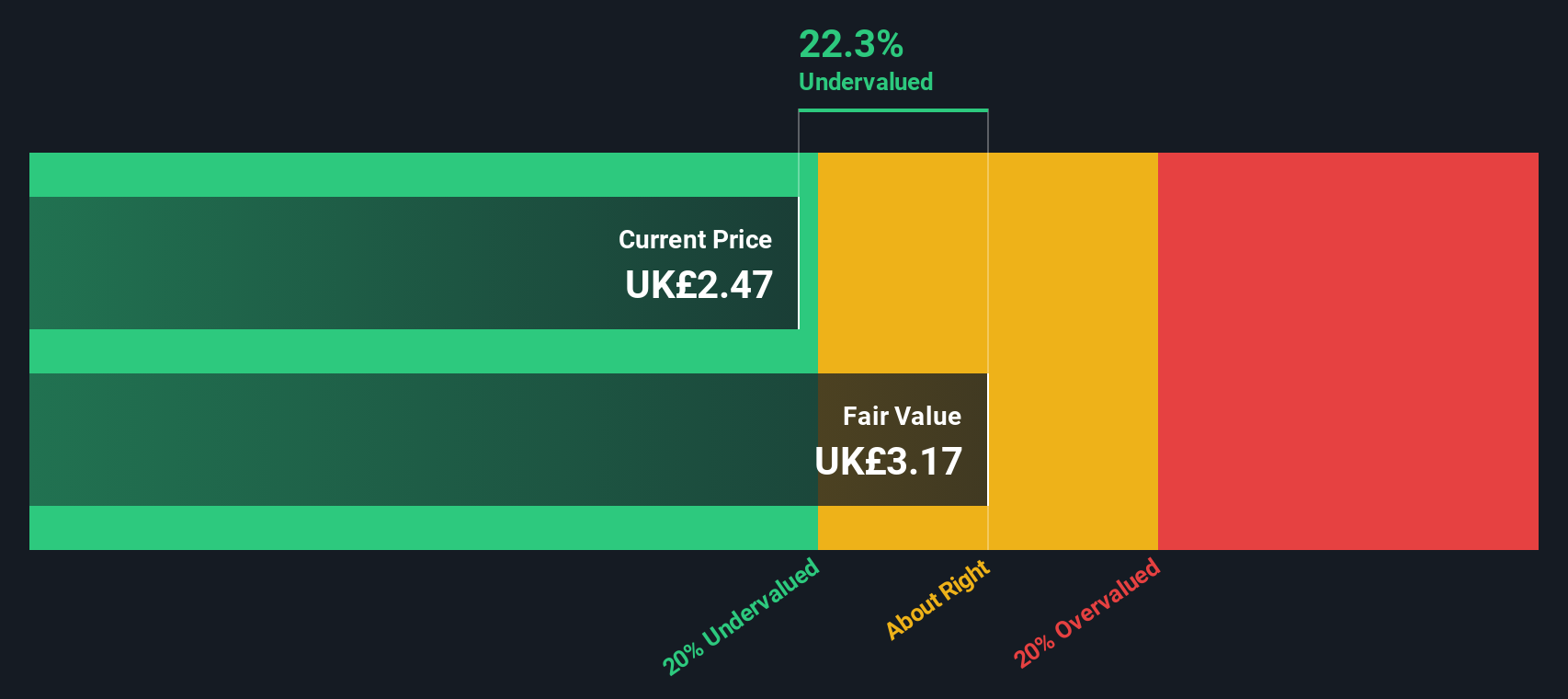

Pets at Home Group (LSE:PETS)

Simply Wall St Value Rating: ★★★★★★

Overview: Pets at Home Group operates as a leading UK pet care business, providing a range of products and services through its retail and veterinary segments, with a market cap of £1.34 billion.

Operations: PETS generates revenue primarily from its Retail and Vet Group segments, with the Retail segment contributing significantly more. The company has experienced fluctuations in net income margin, which was 6.13% as of February 2025. Operating expenses, particularly sales and marketing costs, are a major component of its cost structure.

PE: 11.2x

Pets at Home Group, a UK-based company, showcases potential for growth with earnings projected to rise by 11.06% annually. Despite relying solely on external borrowing for funding, which carries higher risk, the company reported strong financial performance in H1 2025 with sales reaching £789.1 million and net income of £37.6 million. Insider confidence is evident as insiders have increased their share purchases recently, signaling belief in future prospects despite recent board changes and reliance on external funding sources.

- Get an in-depth perspective on Pets at Home Group's performance by reading our valuation report here.

Gain insights into Pets at Home Group's past trends and performance with our Past report.

Seize The Opportunity

- Navigate through the entire inventory of 40 Undervalued UK Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PETS

Pets at Home Group

Engages in the omnichannel retailing of pet food, pet related products, and pet accessories in the United Kingdom.

6 star dividend payer with solid track record.

Market Insights

Community Narratives