- United Kingdom

- /

- Semiconductors

- /

- LSE:AWE

Uncovering 3 UK Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, notably from China's slower-than-expected recovery impacting the FTSE indices, investors are increasingly looking for resilient opportunities amid uncertainty. In this environment, growth companies with high insider ownership can offer a unique appeal; their alignment of interests often signals confidence in long-term prospects and stability even when broader market conditions are volatile.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 24.3% | 91.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 18.2% | 20.8% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 85.7% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| Energean (LSE:ENOG) | 10% | 39.1% |

| Brave Bison Group (AIM:BBSN) | 30.1% | 115.0% |

| ASA International Group (LSE:ASAI) | 18.4% | 23.3% |

| ActiveOps (AIM:AOM) | 21.6% | 43.3% |

Let's uncover some gems from our specialized screener.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £243.81 million.

Operations: The company's revenue is derived from three main segments: Research & Fintech (£25.40 million), Distribution Channels (£23.80 million), and Intermediary Services (£29.10 million).

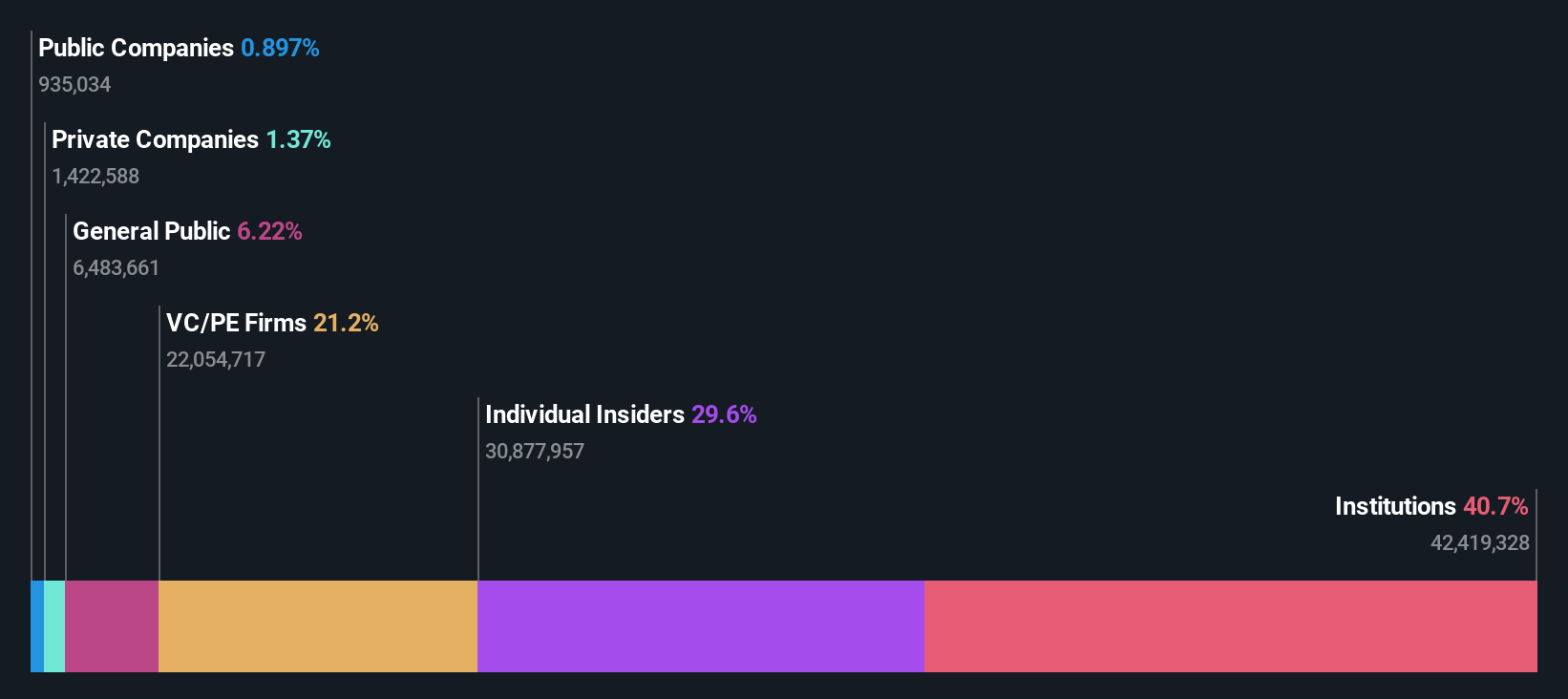

Insider Ownership: 29.6%

Fintel Plc is trading at a significant discount, approximately 40.3% below its estimated fair value, with analysts expecting a potential price increase of 45.3%. Despite slower revenue growth forecasts of 5.8% annually, earnings are projected to grow significantly at 28.8%, surpassing the UK market average. Recent board changes include the appointment of Ian Pickford as an independent non-executive director, expected to bolster strategic development and align with company objectives in wealth management.

- Click here and access our complete growth analysis report to understand the dynamics of Fintel.

- Upon reviewing our latest valuation report, Fintel's share price might be too pessimistic.

Nichols (AIM:NICL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nichols plc, with a market cap of £409.58 million, operates in the supply of soft drinks to the retail, wholesale, catering, licensed, and leisure industries across the United Kingdom and internationally including regions such as the Middle East and Africa.

Operations: The company's revenue is primarily derived from its Packaged segment, which generated £133.97 million, and its Out of Home segment, contributing £40.35 million.

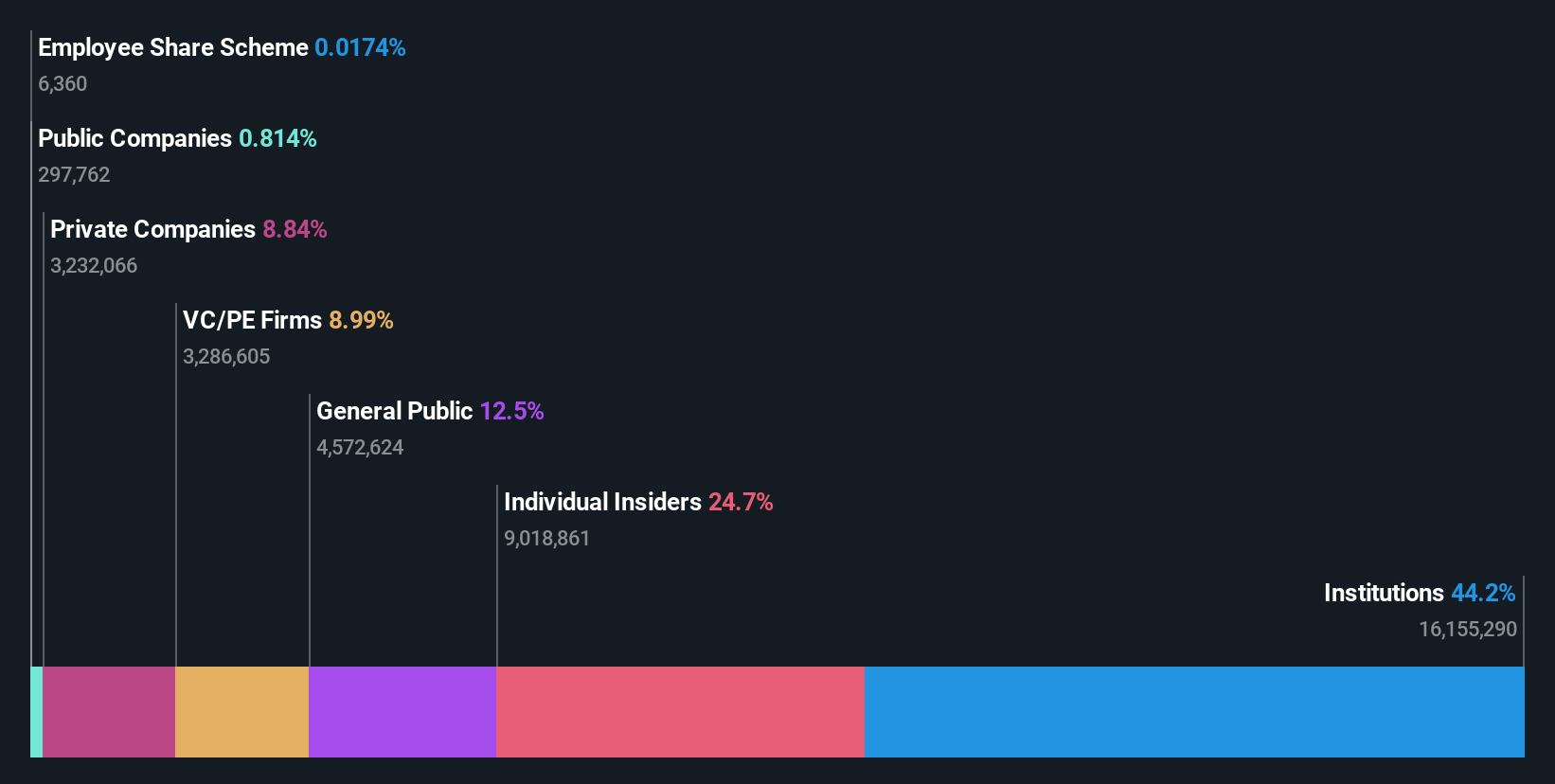

Insider Ownership: 24.7%

Nichols plc is trading at a substantial discount, approximately 40% below its estimated fair value, with analysts anticipating a potential price increase of 30.6%. Earnings are forecast to grow at 16.4% annually, outpacing the UK market average, while revenue growth remains modest at 4.4%. Recent earnings showed slight declines in net income compared to last year. Insider activity indicates more shares bought than sold recently but not in significant volumes.

- Delve into the full analysis future growth report here for a deeper understanding of Nichols.

- According our valuation report, there's an indication that Nichols' share price might be on the cheaper side.

Alphawave IP Group (LSE:AWE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphawave IP Group plc develops and sells wired connectivity solutions across multiple regions including North America, China, and Europe, with a market cap of £1.45 billion.

Operations: The company's revenue from Communications Equipment is $307.59 million.

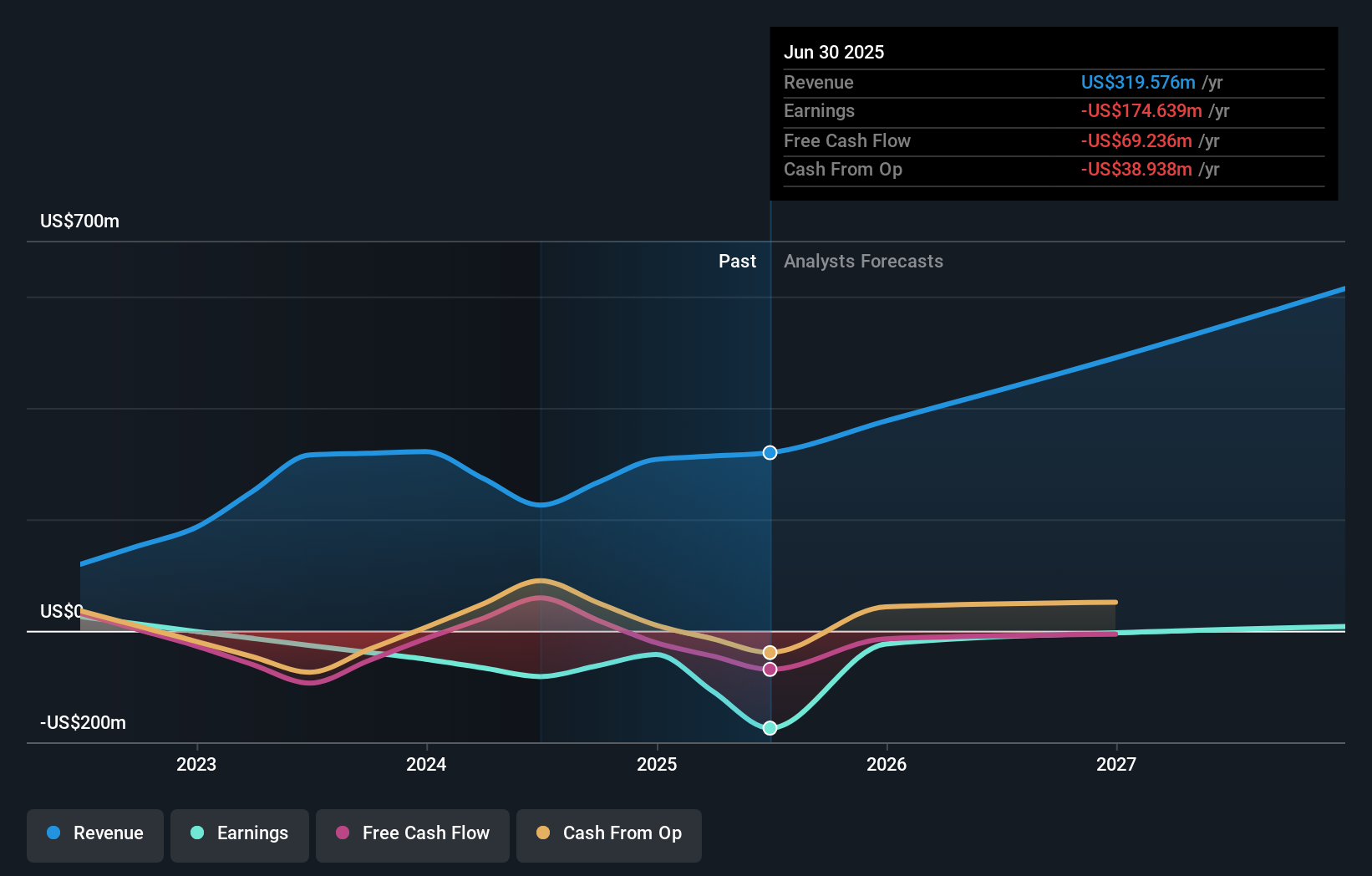

Insider Ownership: 34.1%

Alphawave IP Group is poised for substantial growth, with revenue expected to increase by 23.1% annually, surpassing the UK market average. Despite a low forecasted return on equity of 1.5%, earnings are anticipated to grow significantly at 91% per year, becoming profitable within three years. The company is undergoing a transition due to an acquisition by Aqua Acquisition Sub LLC, which will result in delisting and re-registration as a private entity in early 2026.

- Navigate through the intricacies of Alphawave IP Group with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Alphawave IP Group's share price might be too optimistic.

Next Steps

- Gain an insight into the universe of 67 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AWE

Alphawave IP Group

Develops and sells wired connectivity solutions in North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives