- United Kingdom

- /

- Commercial Services

- /

- AIM:FIH

We Ran A Stock Scan For Earnings Growth And FIH group (LON:FIH) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like FIH group (LON:FIH), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for FIH group

How Fast Is FIH group Growing Its Earnings Per Share?

Over the last three years, FIH group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, FIH group's EPS grew from UK£0.12 to UK£0.25, over the previous 12 months. It's not often a company can achieve year-on-year growth of 110%. The best case scenario? That the business has hit a true inflection point.

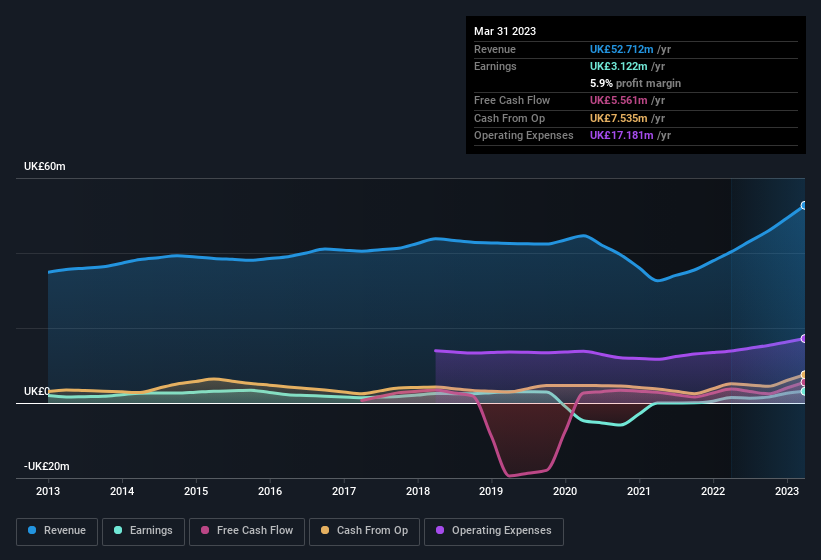

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. FIH group maintained stable EBIT margins over the last year, all while growing revenue 31% to UK£53m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since FIH group is no giant, with a market capitalisation of UK£34m, you should definitely check its cash and debt before getting too excited about its prospects.

Are FIH group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in FIH group in the previous 12 months. With that in mind, it's heartening that Robert Johnston, the Independent Non-Executive Director of the company, paid UK£6.1k for shares at around UK£2.42 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in FIH group.

And the insider buying isn't the only sign of alignment between shareholders and the board, since FIH group insiders own more than a third of the company. In fact, they own 40% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. With that sort of holding, insiders have about UK£13m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is FIH group Worth Keeping An Eye On?

FIH group's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bunch of shares, and one has been buying more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest FIH group belongs near the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with FIH group (at least 1 which is significant) , and understanding these should be part of your investment process.

The good news is that FIH group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FIH

FIH group

Through its subsidiaries, provides retailing, property, automotive, insurance, tourism shipping, and fishing agency services in the Falkland Islands and the United Kingdom.

Excellent balance sheet with low risk.

Market Insights

Community Narratives