- United Kingdom

- /

- Professional Services

- /

- AIM:DATA

GlobalData (LON:DATA) Will Pay A Larger Dividend Than Last Year At UK£0.13

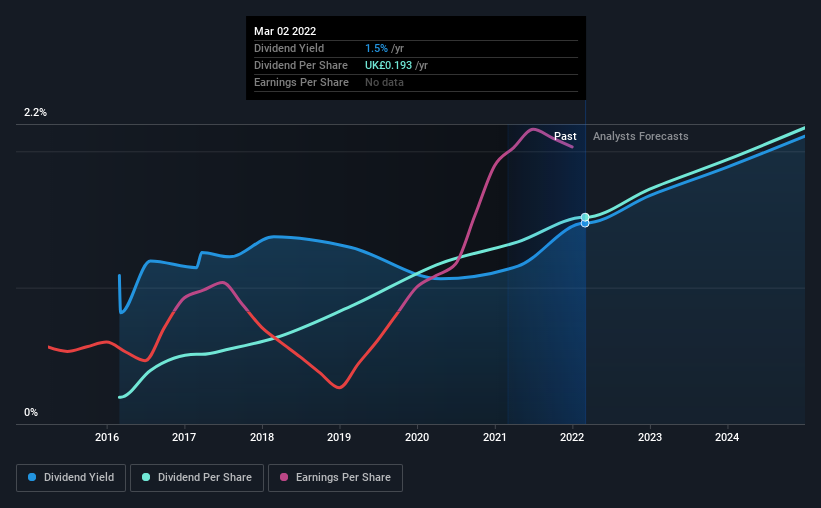

GlobalData Plc's (LON:DATA) dividend will be increasing to UK£0.13 on 29th of April. This makes the dividend yield about the same as the industry average at 1.5%.

View our latest analysis for GlobalData

GlobalData's Payment Has Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before this announcement, GlobalData was paying out 88% of earnings, but a comparatively small 44% of free cash flows. This leaves plenty of cash for reinvestment into the business.

EPS is set to grow by 23.9% over the next year. If recent patterns in the dividend continues, the payout ratio in 12 months could be 92% which is a bit high but can definitely be sustainable.

GlobalData Is Still Building Its Track Record

GlobalData's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2016, the dividend has gone from UK£0.025 to UK£0.19. This means that it has been growing its distributions at 41% per annum over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

Dividend Growth Could Be Constrained

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see GlobalData has been growing its earnings per share at 64% a year over the past five years. Fast growing earnings are great, but this can rarely be sustained without some reinvestment into the business, which GlobalData hasn't been doing.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think GlobalData's payments are rock solid. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 2 warning signs for GlobalData that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:DATA

GlobalData

Operates as a data, insight, and technology company in Europe, North America, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.