- United Kingdom

- /

- Commercial Services

- /

- AIM:CPP

CPPGroup Plc's (LON:CPP) Intrinsic Value Is Potentially 65% Above Its Share Price

In this article we are going to estimate the intrinsic value of CPPGroup Plc (LON:CPP) by projecting its future cash flows and then discounting them to today's value. The Discounted Cash Flow (DCF) model is the tool we will apply to do this. Believe it or not, it's not too difficult to follow, as you'll see from our example!

We would caution that there are many ways of valuing a company and, like the DCF, each technique has advantages and disadvantages in certain scenarios. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you.

See our latest analysis for CPPGroup

The model

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To begin with, we have to get estimates of the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

A DCF is all about the idea that a dollar in the future is less valuable than a dollar today, and so the sum of these future cash flows is then discounted to today's value:

10-year free cash flow (FCF) estimate

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

| Levered FCF (£, Millions) | -UK£2.05m | UK£847.1k | UK£1.29m | UK£1.76m | UK£2.22m | UK£2.64m | UK£2.99m | UK£3.27m | UK£3.50m | UK£3.68m |

| Growth Rate Estimate Source | Analyst x2 | Analyst x2 | Est @ 52.16% | Est @ 36.82% | Est @ 26.07% | Est @ 18.55% | Est @ 13.28% | Est @ 9.6% | Est @ 7.02% | Est @ 5.21% |

| Present Value (£, Millions) Discounted @ 7.1% | -UK£1.9 | UK£0.7 | UK£1.0 | UK£1.3 | UK£1.6 | UK£1.7 | UK£1.8 | UK£1.9 | UK£1.9 | UK£1.9 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = UK£12m

The second stage is also known as Terminal Value, this is the business's cash flow after the first stage. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (1.0%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 7.1%.

Terminal Value (TV)= FCF2030 × (1 + g) ÷ (r – g) = UK£3.7m× (1 + 1.0%) ÷ (7.1%– 1.0%) = UK£61m

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= UK£61m÷ ( 1 + 7.1%)10= UK£31m

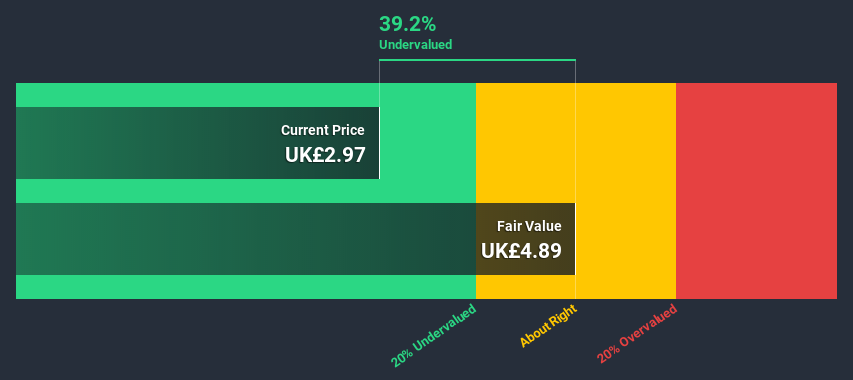

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is UK£43m. To get the intrinsic value per share, we divide this by the total number of shares outstanding. Relative to the current share price of UK£3.0, the company appears quite undervalued at a 39% discount to where the stock price trades currently. Remember though, that this is just an approximate valuation, and like any complex formula - garbage in, garbage out.

The assumptions

The calculation above is very dependent on two assumptions. The first is the discount rate and the other is the cash flows. Part of investing is coming up with your own evaluation of a company's future performance, so try the calculation yourself and check your own assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at CPPGroup as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 7.1%, which is based on a levered beta of 1.024. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

Next Steps:

Although the valuation of a company is important, it ideally won't be the sole piece of analysis you scrutinize for a company. It's not possible to obtain a foolproof valuation with a DCF model. Instead the best use for a DCF model is to test certain assumptions and theories to see if they would lead to the company being undervalued or overvalued. For example, changes in the company's cost of equity or the risk free rate can significantly impact the valuation. Why is the intrinsic value higher than the current share price? For CPPGroup, we've compiled three important elements you should further examine:

- Risks: To that end, you should be aware of the 2 warning signs we've spotted with CPPGroup .

- Future Earnings: How does CPP's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

PS. Simply Wall St updates its DCF calculation for every British stock every day, so if you want to find the intrinsic value of any other stock just search here.

When trading CPPGroup or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:CPP

CPPGroup

Engages in creating embedded and ancillary real-time assistance products and resolution service in the India, Turkey, and internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

MPAA often has inventory and core-related timing issues. While this quarter’s problems may ease, similar issues have recurred historically and can persist for several quarters. It's not a one-off, it's a structural part of their business. Core returns are simply estimates: How many customers will actually return the original part; how quickly they'll do so; how many are useable; what they're worth, etc. MPAA predicts X sales in a quarter and Y core returns and its reserves, inventory values, etc. are based on that. If they expect a 90% core return rate and only 80% come back it doesn't change cash but they have to write down inventory and increase cost of goods sold which impacts EPS. They've also cited inventory buildup at key customers multiple times in the past. The assumption the latest backlog will all shift into future quarters this year with no impact on pricing, etc. seems more like wishful thinking. Retailer X was slated to buy $10m in parts this quarter but finds they have a lot more inventory on hand than they anticipated so they pushed the order. Realistically there are likely to be SKU cuts, reduction in safety stock on others, etc. Assuming that all $10m will come in this year plus the regular replenishment seems pretty unrealistic. MPAA also has a shaky track record when it comes to new lines and the supposed impact on business. If you look at the EV testing solutions hype back around 2020 that was supposed to diversify them beyond traditional reman and be a higher margin business that would grow with EV adoption. But it has never turned into a material contributor. The debt reduction and stock buy backs are meaningful but IMHO this narrative takes a very optimistic view of things.